A version of this article first appeared on TKer.co

(AI) is today. are favorable on the pledge of taking hills of information, refining it, and creating cost-efficient items and solutions that are what can be made by people.

And the is anticipated to and drive earnings development for firms, which is great information for the stock exchange.

However all this talk primarily concentrates on monetary advantages, and it invokes pictures of a where the human touch is pursued its abstract worth has actually been considered provided.

The bright side is that background claims arising modern technologies do not indicate completion of whatever they were indicated to improve.

” As the universality of modern technology boosts and people boost their dependence on modern technology as they interact using networks, the worth they put on ‘credibility’ and human connection– which can stimulate a classic photo of an easier, pre-digital life– is most likely to expand,” Goldman Sachs’ Peter Oppenheimer composed. “This holds true throughout lots of item classifications, consisting of food.”

In a study record discovering AI, Oppenheimer highlights instances of handmade, low-tech, “retro” items and solutions that endured technical development. From his note:

… The development of synthetic immersive home entertainment might likewise increase need for experiences in the real life. This may show the expanding appeal of items and solutions that are viewed as ‘genuine’ or timeless. Retro ‘crafts’ are expanding in appeal, whether it be the development fact television programs where candidates complete in cooking, punctuation, sowing and even ballroom dance competitors.

These styles are spreading out right into retail. According to Grand Sight Study, as an example, the marketplace for supposed ‘artisanal’ pastry shop items was valued around the world at $95.13 billion in 2022 and is most likely to expand at a substance price of 5.7% from 2023 to 2030. The concentrate on sustainability and rate of interest in the previous with each other produce brand-new customer markets. According to study carried out by GlobalData for ThredUP, a United States pre-owned shop, the resale garments market is expanding at 15 times the price of conventional retail. According to a record by Statistica, since 2021, 42% of millennials and Gen Z participants mentioned that they were most likely to purchase pre-owned products.

You may think the wide uptake of the vast variety of ridesharing choices indicates need for settings of transportation that you have would certainly crumble. That’s not held true. From the note:

A comparable pattern has actually arised in transportation with the development in the ‘sharing’ economic situation and the development of cycle, mobility scooter and auto sharing. Couple of would certainly have anticipated the constant development in the bike market a years earlier; the international bike market was valued at over $64 billion in 2022 and is anticipated to expand at a substance price of 9.7% from 2023 to 2030. Possibly a lot more striking is just how the bike is outselling the auto. Evaluation of 30 European nations by the Confederation of the European Bike Market (CONEBI) and the European Cyclists Federation (ECF) recommends that, at the existing trajectory, 10 million even more bikes will certainly be marketed annually in Europe by 2030, standing for a surge of 47% compared to 2019. On this basis, the 30 million bikes marketed every year in Europe would certainly be greater than double the yearly sales of autos.

As the globe progresses, it interests think of the worth customers put on the past. From the note:

In the 21st century, in a very digitalised globe where practically every person is attached to the net and the reducing side of modern technology endangers to displace work and firms, it is significant that of the largest firms in Europe is LVMH. This is a firm that offers the worth of heritage in historical brand names. It was created in 1987 via the merging of 2 old firms: Louis Vuitton (established in 1854) and Moet Hennessey, which itself was a merging in 1971 in between Moet & & Chandon, the sparkling wine manufacturer (established in 1743) and Hennessey, manufacturer of brandy (established in 1765). According to its internet site, the firm creates the brand names that ‘completely envelop all that they have actually personified for our consumers for centuries.

Abstract worth is a type of worth. And individuals are locating it in items and solutions that have actually perhaps been improved.

It’s challenging to clarify why we value this things. However the factor is we do.

And we require this things.

And when sufficient individuals require something, there’ll be organizations to provide that point. It’s simply fundamental business economics and industrialism at the office.

Evaluating the macro crosscurrents

There were a couple of significant information factors and macroeconomic advancements from recently to take into consideration:

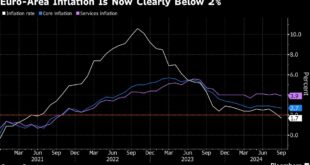

Rising cost of living cools down The (CPI) in August was up 2.5% from a year earlier, below the 2.9% price in July. This was the most affordable print considering that February 2021. Changed for food and power costs, core CPI was up 3.2%, unmodified from the previous month’s price.

On a month-over-month basis, CPI was up 0.2% as power costs dropped 0.8%%. Core CPI raised by 0.3%.

If you annualize the in the month-to-month numbers– a representation of the temporary pattern in costs– CPI increased 1.1% and core CPI climbed up 2.1%.

Rising cost of living prices have actually been floating near the Federal Get’s target price of 2%, which is why the reserve bank has actually been indicating that price cuts might be nearby.

Rising cost of living assumptions continue to be trendy From the New york city Fed’s September Study of Customer Assumptions: “Mean rising cost of living assumptions at the one- and five-year perspectives continued to be unmodified in August at 3.0% and 2.8%, specifically. Mean rising cost of living assumptions at the three-year perspective recoiled rather from the reduced July analysis, raising from 2.3% to 2.5%.”

” Year-ahead rising cost of living assumptions succumbed to the 4th straight month, can be found in at 2.7%. The existing analysis is the most affordable considering that December 2020 and is well within the 2.3-3.0% array seen in both years before the pandemic. Long-run rising cost of living assumptions were bit altered, bordering up from 3.0% last month to 3.1% this month. Long-run rising cost of living assumptions continue to be decently raised about the series of analyses seen in both years pre-pandemic.”

Customer feelings boost From the College of Michigan’s : “Customer belief increased to its highest possible analysis considering that Might 2024, raising for the 2nd successive month and raising regarding 2% over August. The gain was led by a renovation in acquiring problems for durables, driven by a lot more desirable costs as regarded by customers. Year-ahead assumptions for individual financial resources and the economic situation both boosted too, regardless of a small weakening because labor markets.”

Wage development is cooling down According to the , the average per hour pay in August was up 4.6% from the previous year, below the 4.7% price in July.

Oil costs drop Brent unrefined futures dropped listed below $70 a barrel for the very first time in greater than 2 years on Tuesday, shutting at its cheapest degree considering that December 2021. From : “Defeatist financial information from the United States and China– consisting of weak import numbers launched Tuesday– have actually mixed concerns regarding oil need in the leading 2 customers, including in problems that an excess will certainly arise following year and fueling document bearish positioning. That’s being worsened by rising result in creating countries outside the Company of Oil Exporting Countries.”

Gas costs drop From : “The nationwide standard for a gallon of gas maintained its sizzling speed of decrease, sinking 6 cents considering that recently to $3.24. The key perpetrators behind the dip are reduced need and dropping oil expenses.”

Actual revenues are up From the : “Actual average home revenue was $80,610 in 2023, a 4.0% rise from the 2022 price quote of $77,540. This is the initial statistically considerable yearly rise in actual average home revenue considering that 2019.”

At the same time, hardship ticked reduced. From the Demographics: “In 2023, the main hardship price dropped 0.4 percent indicate 11.1%. There were 36.8 million individuals in hardship in 2023, not statistically various from 2022.”

Card costs information is secure From Financial institution of America: “Financial institution of America aggregated credit score and debit card costs per home increased 0.9% year-over-year (YoY) in August, recoiling from the 0.4% YoY decrease in July. On a month-over-month (MOTHER) basis, costs in August reduced 0.2% after climbing 0.3% in July. In our sight, this mirrors a normalization of customer costs rather than a weakening. Within the overall, solutions investing energy continues to be more powerful than items.”

Joblessness asserts ticked greater increased to 230,000 throughout the week finishing September 7, up from 228,000 the week prior. This statistics remains to go to degrees traditionally related to financial development.

Home mortgage prices drop According to , the ordinary 30-year fixed-rate home mortgage was up to 6.2%, below 6.35% recently. From Freddie Mac: “Home mortgage prices have actually dropped majority a percent over the last 6 weeks and go to their cheapest degree considering that February 2023. Fees remain to soften as a result of inbound financial information that is a lot more calm. However regardless of the enhancing home mortgage price setting, potential purchasers continue to be on the sidelines, as they discuss a mix of high home costs and relentless supply lacks.”

There are in the united state, of which 86 million are and of which are Of those bring home mortgage financial obligation, mostly all have , and a lot of those home mortgages prior to prices rose from 2021 lows. Every one of this is to state: Many house owners are not specifically conscious activities in home costs or home mortgage prices.

Local business positive outlook wears away The in August dropped.

Significantly, the a lot more substantial “tough” parts of the index remain to stand up better than the a lot more sentiment-oriented “soft” parts.

Remember that throughout times of regarded anxiety, soft information has a tendency to be a lot more overstated than real tough information.

Near-term GDP development approximates continue to be favorable The sees actual GDP development climbing up at a 2.5% price in Q3.

Placing everything with each other

We remain to obtain proof that we are experiencing a where rising cost of living cools down to convenient degrees .

This comes as the Federal Get remains to utilize really limited financial plan in its Though, with rising cost of living prices having from their 2022 highs, the Fed has actually taken a much less hawkish tone in — also indicating that .

It would certainly take financial plan as hanging, which indicates we ought to be planned for reasonably limited monetary problems (e.g., greater rates of interest, tighter loaning criteria, and reduced supply appraisals) to stick around. All this indicates for the time being, and the threat the right into an economic downturn will certainly be reasonably raised.

At the exact same time, we likewise understand that supplies are marking down devices– suggesting that .

Additionally, it is very important to keep in mind that while economic crisis threats might rise, Unemployed individuals are , and those with work are obtaining elevates.

In A Similar Way, as lots of firms Also as the risk of greater financial obligation maintenance expenses impends, provide firms space to soak up greater expenses.

At this moment, any kind of considered that the .

And as constantly, ought to bear in mind that and are simply when you get in the stock exchange with the purpose of producing long-lasting returns. While , the long-run overview for supplies .

For a lot more on just how the macro tale is progressing, look into the

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.