Coinbase has actually resolved current reports that it was releasing Bitcoin IOUs to BlackRock for its area exchange-traded fund (ETF) item.

These reports became TRON blockchain owner Justin Sunlight slammed the company’s covered Bitcoin item, cbBTC.

Coinbase Clears Up ETF Procedures In The Middle Of Bitcoin IOU Rumors

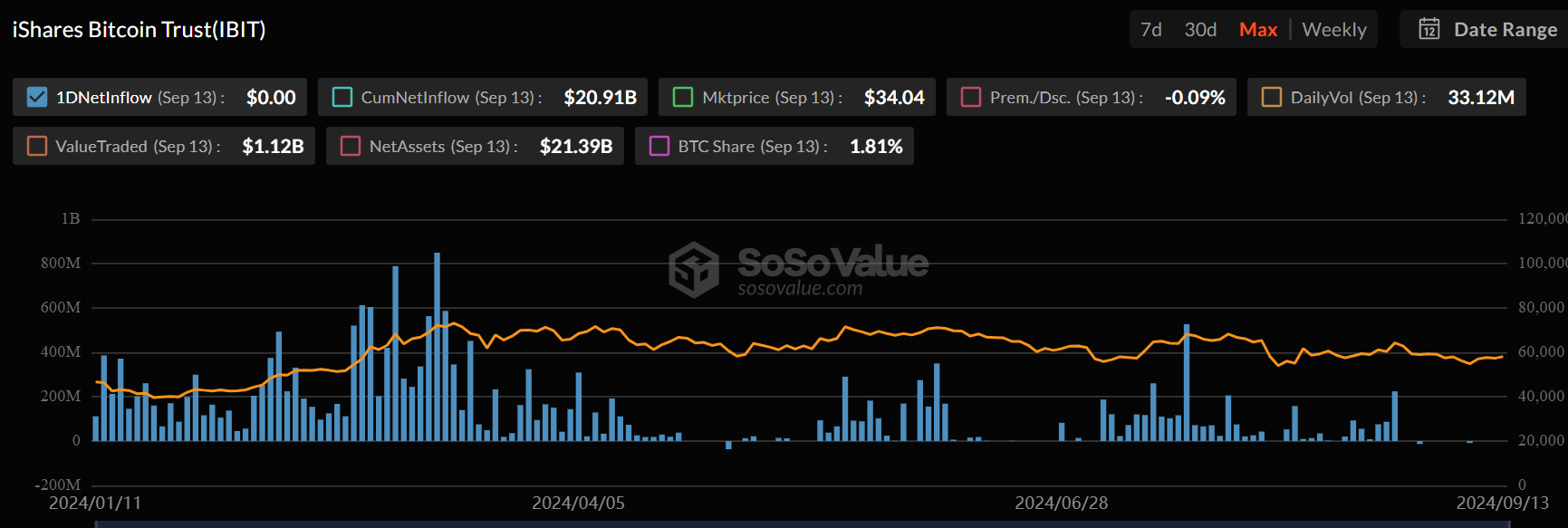

On September 14, crypto expert Tyler Durden suggested that Coinbase was releasing BTC IOUs to BlackRock. This would certainly indicate BlackRock might obtain Bitcoin to short it without showing they held a 1:1 proportion.

Durden referenced Cryptoquant information, insisting that Coinbase was the biggest purchaser and vendor at market low and high. He hypothesized that BlackRock could utilize its setting to adversely affect Bitcoin’s cost, either by covering it or triggering a significant pullback.

Learn More: Exactly how To Profession a Bitcoin ETF: A Step-by-Step Technique

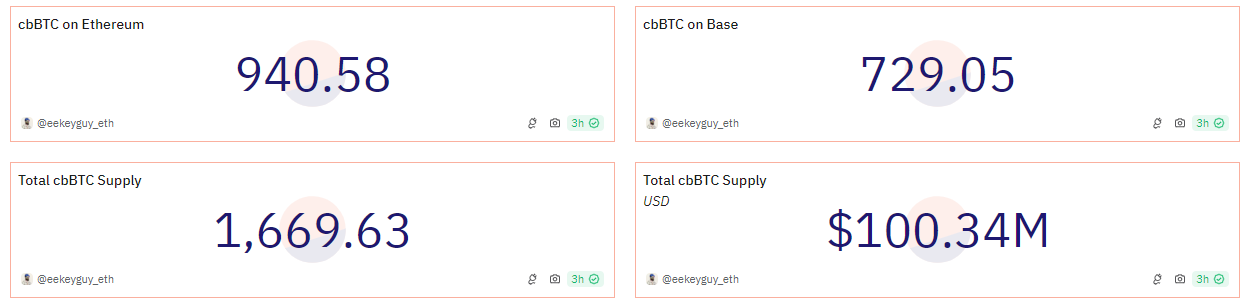

At the same time, Tron network owner Justin Sunlight even more had earlier stimulated debates over Coinbase’s brand-new covered Bitcoin item, cbBTC. Sunlight asserted cbBTC did not have Evidence of Book, had no audits, and might ice up equilibriums at any moment. He explained cbBTC as “believe me” Bitcoin, indicating that a United States federal government subpoena might confiscate all Bitcoin held with it.

” cbbtc= reserve bank btc. There disappears ludicrous mix on the planet than placing reserve banks and Bitcoin with each other. I envision this is a day Satoshi Nakamoto might never ever have actually imagined when developing Bitcoin,” Sunlight added.

Coinbase chief executive officer Brian Armstrong reacted to these claims by making clear just how ETFs operate and attending to issues concerning cbBTC. He discussed that ETF mints and burns normally work out on-chain within one organization day. He additionally kept in mind that the company’s institutional customers utilize profession funding and OTC choices prior to clearing up professions on-chain.

Better, Armstrong specified that his company was not accredited to reveal institutional customer addresses, consisting of those of BlackRock.

” If you desire audits, Deloitte audits us each year, we’re a public firm. I question our institutional customers desire individuals cleaning all their addresses, and it’s not our location to share for them. This is what it appears like if you desire a lot of institutional cash to stream right into Bitcoin,” the Coinbase Chief Executive Officer emphasized.

Pertaining to cbBTC, Armstrong kept in mind that its customers rely on a central custodian to take care of the underlying Bitcoin, and Coinbase has actually never ever asserted or else.

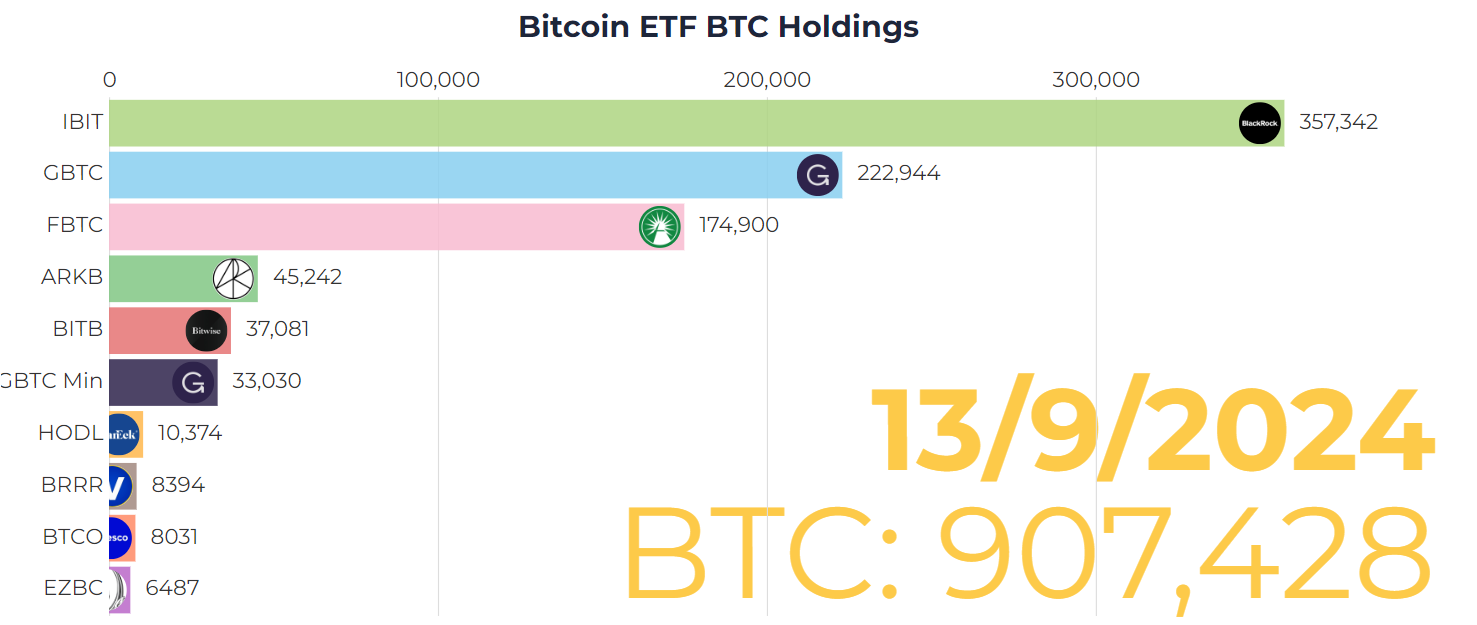

Especially, various other market specialists have actually additionally shot down the IOU insurance claims. Nate Geraci, head of state of The ETF Shop, rejected the reports, stressing that the ETFs completely have the possessions they declare.

” Whatever Coinbase is or isn’t doing, felt confident the ETFs 100% very own underlying BTC. It’s genuine. And it’s magnificent. That easy. Duration. End of tale. Listened to exact same point back then w/ physical gold ETFs. Any individual bolstering this things does not recognize just how ETFs function,” Geraci wrote.

Learn More: 7 Finest Crypto Exchanges in the U.S.A. for Bitcoin (BTC) Trading

At the same time, Bloomberg expert Eric Balchunas mentioned that individuals discover it difficult to approve that real market individuals, instead of ETFs, are in charge of Bitcoin’s current cost variations.

” I obtain why these concepts exist and individuals intend to scepegoat the ETFs. [Because] it is also unimaginable that the indigenous HODLers might be the vendors. However they are. The telephone call is originating from inside your house. All the ETFs and BlackRock have actually done is save BTC’s cost from the void repetitively,” Balhcunas stated.

Please Note

In adherence to the Trust fund Job standards, BeInCrypto is devoted to impartial, clear coverage. This newspaper article intends to give exact, prompt info. Nonetheless, viewers are suggested to confirm truths individually and talk to a specialist prior to making any kind of choices based upon this web content. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.