Surge (XRP) is experiencing a rise in favorable belief in advance of the upcoming launch of the Grayscale Count on for the cryptocurrency. As exhilaration expands, market individuals are placing themselves for possible gains.

This growth has actually stimulated conjecture regarding a feasible XRP Exchange Traded Fund (ETF) in the United States. Below’s exactly how the altcoin’s cost might respond as this belief remains to unravel.

Surge ETF Rumors Spread

On September 12, Grayscale, among the biggest electronic possession financial investment supervisors internationally, revealed the launch of its XRP Rely On the United States. Adhering to the statement, XRP’s cost swiftly rose from $0.53 to $0.58.

Although the cost has actually given that worked out to $0.56, on-chain information from Santiment exposes a substantial spike in Weighted View, reaching its highest degree in over a month. Heavy View tracks social quantity to assess whether the marketplace is leaning favorable or bearish on a job.

A rise in this statistics shows a high quantity of favorable remarks, blog posts, or messages, while a decrease recommends expanding pessimism. The current spike symbolizes that formerly careful individuals are currently progressively positive regarding XRP’s future potential customers.

Find Out More: XRP ETF Clarified: What It Is and Just How It Functions

In crypto terms, this is referred to as the Worry of Objective Out (FOMO)– potentially on the following crypto ETF. Concerning this growth, Medical professional Crypto, an expert on X, said that the XRP ETF could come earlier than anticipated.

” Today Grayscale revealed the initial XRP trust fund. Probably, in 4-8 months, you will certainly see the initial XRP ETF,” Medical Professional Revenue said.

Historically, incredibly high favorable belief frequently causes a temporary cost decrease. If this fad proceeds, XRP might encounter a possible cost decrease in the future.

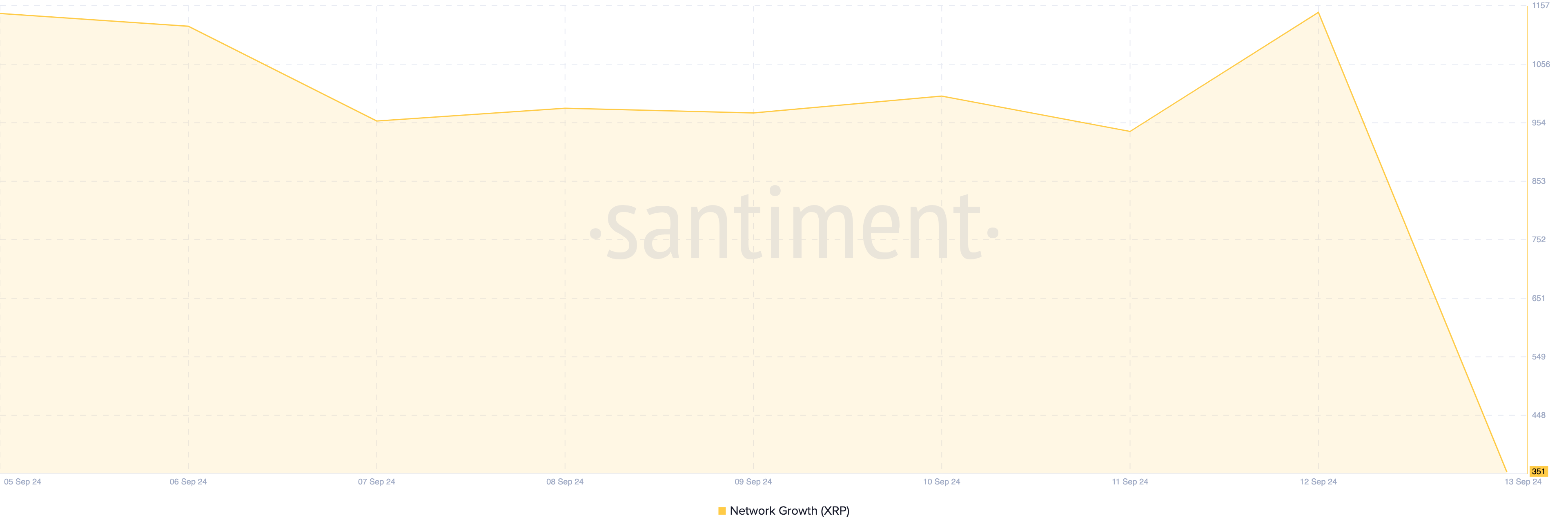

Sustaining this overview, the Network Development statistics aligns with this bearish predisposition. Adhering to Grayscale’s statement, the variety of brand-new addresses going into the XRP Journal (XRPL) rose, suggesting expanding need for XRP.

Yet, the variety of brand-new addresses with effective purchases has actually given that lowered, recommending XRP’s cost could get rid of even more of its current gains.

XRP Rate Forecast: Bearish Turnaround Brewing

XRP’s cost boost over the previous 24-hour permitted it to outshine various other leading 10 cryptocurrencies. In spite of this, the Chaikin Cash Circulation (CMF) on the everyday graph continues to be in the adverse area.

This adverse CMF analysis recommends that XRP’s circulation still goes beyond build-up, suggesting a possible cost decrease. In a similar way, the Awesome Oscillator (AO) is additionally in the adverse area, although it reveals eco-friendly pie chart bars.

The AO steps energy, and while a favorable analysis signals favorable energy, the existing adverse analysis suggests that bulls do not have the stamina to endure or magnify the cost boost. Provided these problems, XRP’s cost might go down to $0.52 in the coming days.

Find Out More: Surge (XRP) Rate Forecast 2024/2025/2030

On the other side, XRP might resist the bearish fad. If this takes place, the uptrend might proceed, possibly pressing the cryptocurrency’s worth to $0.60.

Please Note

According to the Count on Job standards, this cost evaluation post is for informative objectives just and must not be thought about monetary or financial investment suggestions. BeInCrypto is dedicated to exact, honest coverage, however market problems undergo transform without notification. Constantly perform your very own research study and talk to a specialist prior to making any type of monetary choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.