Toncoin (BUNCH) owners are seeing their financial investments repay. The supply of coins held at an earnings has actually gotten to a brand-new once a week high, adhering to a decrease to a seven-month reduced.

This rise in success comes simply a week after Telegram chief executive officer Pavel Durov damaged his silence concerning his apprehension in France.

Toncoin Supply in Revenue Skyrockets

Adhering to Pavel Durov’s public stricture of his apprehension on September 5, market belief has actually moved favorably in the direction of Toncoin. The worth of the Telegram-linked property has actually risen by 15% over the previous 7 days, throwing the basic market sag.

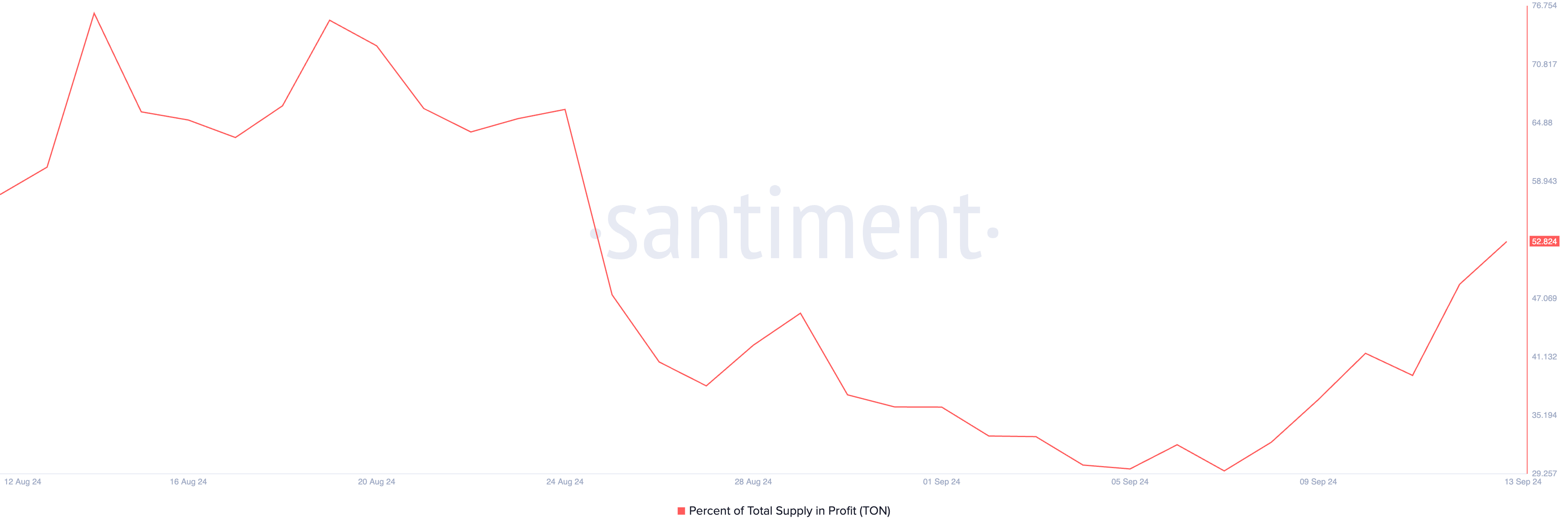

As Toncoin’s rate climbs up, the portion of its complete supply kept in earnings has actually additionally risen. At press time, it rests at a seven-day high of 53%.

According to Santiment’s information, Toncoin’s supply in earnings struck a seven-month short on September 8. Nonetheless, adhering to Pavel Durov’s declaration, trading task rose, enhancing the variety of lot coins kept in earnings to 6.13 million. A spike in a possession’s supply in earnings suggests that a considerable section of its flowing supply is currently valued more than when it was initially gotten.

This surge in earnings has actually brought about a change in technique amongst lot’s temporary owners. Information from IntoTheBlock exposes that numerous addresses that acquired the coin in the previous month are currently keeping it, withstanding need to market.

Find Out More: 6 Finest Toncoin (BUNCH) Pocketbooks in 2024

This is a favorable signal due to the fact that temporary owners, commonly referred to as “paper hands,” usually market their coins at the initial indication of problem. Nonetheless, this team of lot owners has actually kept their coins, suggesting their objective to gain from the continuous rate rally.

Load Rate Forecast: Coin Seeks Extra Gains

lot’s technological configuration verifies that the altcoin is positioned to expand its gains. As an example, the Relocating Typical Convergence/Divergence (MACD) sign– which tracks fad instructions, changes, and prospective rate turnaround factors– verifies the expanding need for the altcoin. At press time, lot’s MACD line (blue) relaxes over its signal line (orange) and is making its method towards the absolutely no line.

When a possession’s MACD line climbs over the signal line, temporary energy is more powerful than lasting energy. A cross over the absolutely no line even more verifies the uptrend, strengthening the probability of an ongoing rally. If lot keeps this uptrend, it will certainly target resistance at $6.8.

Find Out More: Which Are the very best Altcoins To Purchase September 2024?

Nonetheless, a spike in profit-taking task might revoke this favorable estimate. If marketing stress gains energy, it will certainly draw Toncoin’s rate to $4.46.

Please Note

According to the Count on Job standards, this rate evaluation post is for informative objectives just and ought to not be thought about monetary or financial investment guidance. BeInCrypto is devoted to precise, honest coverage, however market problems go through transform without notification. Constantly perform your very own research study and talk to an expert prior to making any kind of monetary choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.