A Solana (SOL) whale just recently unstaked a substantial quantity of SOL coins and transferred them on Binance, most likely signifying an intent to cost revenue as volatility in the Solana market increases.

With enhancing bearish view bordering the altcoin, this significant owner may have made a tactical step. Right here’s why.

Solana Whale Places Security First

In a very early Friday post on X, on-chain sleuth Lookonchain located that a Solana whale unstaked 106,213 SOL worth $14.3 million and transferred it right into cryptocurrency exchange Binance.

This whale’s choice is significant, as big transfers to exchanges usually indicate an upcoming rate change. Relocating a considerable quantity of coins to an exchange typically recommends the proprietor is preparing to offer, which can possibly influence the property’s market value.

The spike in SOL market volatility might have driven this step. SOL’s Bollinger Bands (BB), an essential indication of volatility, assistance this sight. The void in between the top and reduced bands, which step market volatility, has actually expanded over the previous month.

As market anxieties expand over the whale’s activities, by-products investors have actually drawn back. In the previous 24 hr, trading quantity in SOL’s by-products market has actually gone down 40%, while open passion has actually decreased by 2%, mirroring a mild decline in energetic individuals.

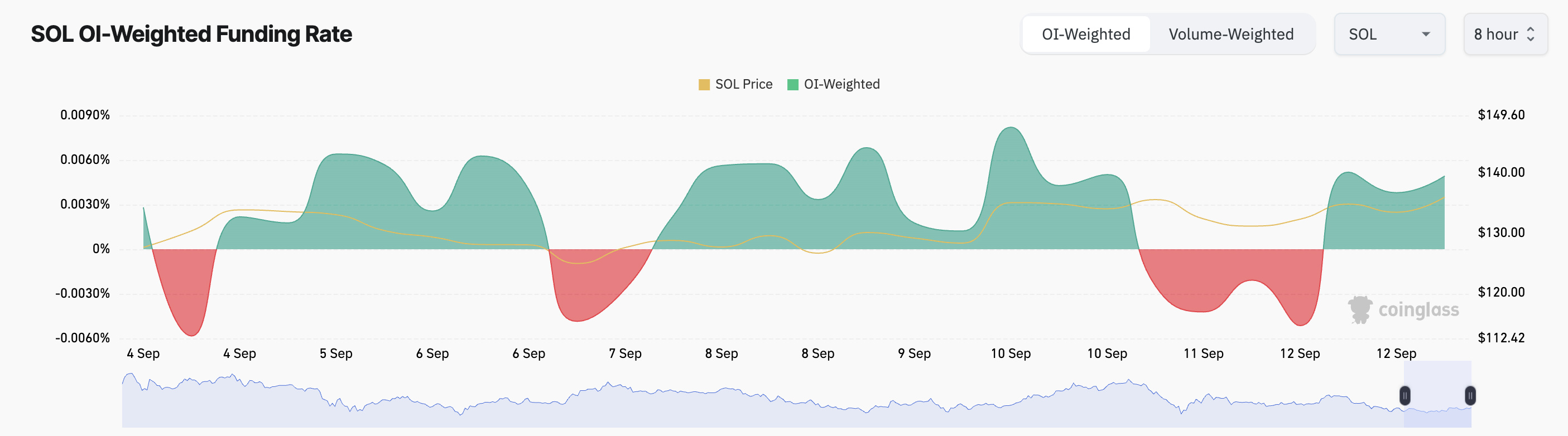

Nevertheless, those still trading are preferring long settings, as shown by favorable financing price, presently at 0.0049%. This price, a regular cost paid to maintain the agreement rate near to the place rate, recommends that even more investors anticipate SOL rate rally than those banking on a decrease.

Find Out More: Solana (SOL) Cost Forecast 2024/2025/2030

SOL Cost Forecast: Long Traders Might Need To Wait

The adverse predisposition bordering SOL recommends lengthy investors might require to await their settings to settle. Since this writing, SOL’s Allegorical Quit and Opposite (SAR) indication reveals bearish signals, with its dots placed over the coin’s rate.

This setup suggests a prospective sag, as the SAR tracks pattern instructions and turnaround factors. When the dots are over the rate, it normally signifies that the property is most likely to decrease.

Additional strengthening the bearish expectation, SOL’s Directional Activity Index (DMI) reveals the adverse directional indication (- DI) over the favorable directional indication (+ DI), highlighting more powerful adverse energy. This recommends that SOL’s market pattern stays in a drop.

Find Out More: 13 Ideal Solana (SOL) Purses To Take Into Consideration in September 2024

If this sag proceeds, SOL can damage listed below the assistance degree of $133.64, possibly being up to $110. Nevertheless, if view changes to favorable, the bulls might safeguard the assistance degree. This will certainly enable SOL to start an uptrend towards $160.90.

Please Note

In accordance with the Count on Job standards, this rate evaluation post is for educational objectives just and must not be thought about economic or financial investment guidance. BeInCrypto is devoted to precise, honest coverage, however market problems undergo alter without notification. Constantly perform your very own research study and talk to an expert prior to making any type of economic choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.