Central crypto exchange Sea serpent struck back versus the United States Stocks and Exchange Payment (SEC) by testing its safeties tag on electronic possessions.

The regulatory authority declared Sea serpent breached government safeties legislations when it used particular electronic possessions, which certify as non listed safeties.

Sea Serpent Despites SEC Allegations Versus Digital Properties

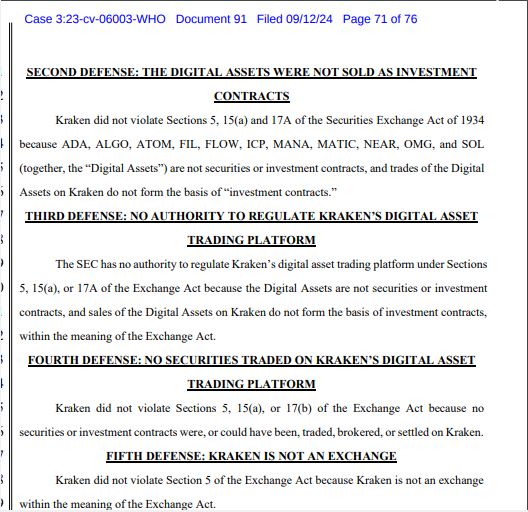

Sea serpent stated ADA, ALGO, SOL, and various other possessions do not fulfill the lawful meaning of safeties under United States regulation. The exchange likewise knocked the SEC for the absence of quality, calling it out for regulative overreach.

Learn More: Crypto Guideline: What Are the Conveniences and Drawbacks?

In its protection, Sea serpent points out the Howey judgment, a landmark High court instance that functions as a referral indicate identify what makes up a financial investment agreement. With this referral, the exchange obstacles that the SEC fell short to show that the called symbols fulfill the requirements detailed in the Howey structure and, consequently, do not drop under the SEC’s territory.

” The SEC has no authority to manage Sea serpent’s electronic property trading system […] since the Digital Properties are not safeties or financial investment agreements,” the declaring read.

Sea serpent is, for that reason, promoting a court test, stating the SEC is obstructing its initiatives to sign up or comply. It says that the regulatory authority regularly “stonewalls” it utilizing irregular judgments and support.

Some neighborhood participants have actually slammed the Howey examination, suggesting that it’s as well wide and does not make up the intricacies of contemporary financial investment frameworks or modern technologies. Because of this, the examination might not constantly precisely identify particular sorts of deals in today’s progressively complicated monetary landscape.

” The issue is actually that the Howey examination is much as well common. The fact is that several cryptocurrencies do not pass that details examination. However that does not absorb the subtlety of what safeties were suggested to be,” one X customer commented.

This isn’t the very first time the SEC has actually run the gauntlet for identifying electronic possessions as safeties. In June 2023, the regulatory authority affirmed that numerous crypto possessions traded on Binance, Coinbase, and Robinhood certified as safeties, an insurance claim that was rapidly tested by crypto execs.

Learn More: That Is Gary Gensler? Every little thing To Understand About the SEC Chairman

Just Recently, the SEC changed its placement by amending its complaint pertaining to “3rd party Crypto Possession Stocks.” The regulatory authority made clear that the term describes agreements connected to the sale of crypto possessions, not the possessions themselves. This upgrade originated from the phrasing utilized in Afterthought 6 of its modified issue versus Binance.

Please Note

In adherence to the Count on Task standards, BeInCrypto is devoted to impartial, clear coverage. This newspaper article intends to supply precise, prompt details. Nonetheless, viewers are encouraged to confirm truths individually and seek advice from a specialist prior to making any type of choices based upon this web content. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.