Despite The Fact That Ethereum (ETH) is encountering obstacles, its rate still has the prospective to climb up. Presently, ETH is trading at $2,411.

Just recently, worries have actually appeared that ETH might go into a bear cycle. While this is feasible, an on-chain evaluation recommends exactly how the cryptocurrency may prevent capitulation.

Ethereum Has Solid Assistance

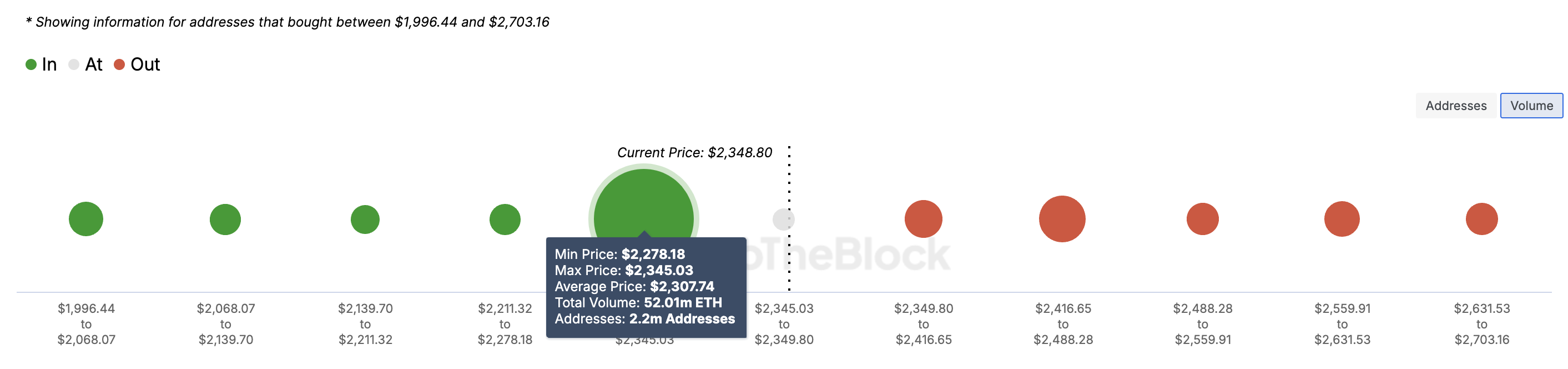

Based Upon the In/out of Cash Around Rate (IOMAP), a statistics that categorizes addresses right into those in earnings, in loss, and at breakeven factor, market individuals built up 52 million coins at a typical rate of $2,345,

This quantity is more than the quantity acquired in between $2,349 and $2,703. Normally, bigger quantities at particular rate degrees have a more powerful impact on rate motion. If even more quantity goes to a loss, ETH would certainly deal with resistance as owners might offer to recover cost.

On the various other hand, greater quantity in earnings shows solid assistance, as owners are much less most likely to cost a reduced rate. Based upon this, ETH has considerable assistance around $2,345, which might assist press the rate greater and possibly get to $2,800.

Learn More: How To Buy Ethereum (ETH) With a Credit Card: Complete Guide

One more indication enhancing this expectation is Ethereum’s Chaikin Cash Circulation (CMF), which gauges the equilibrium in between buildup and circulation.

When the CMF increases, it indicates that buildup is outmatching offering stress. Alternatively, a dropping CMF shows greater circulation. On the everyday graph, the CMF has actually relocated right into the favorable area, recommending that raised acquiring stress might assist Ethereum recoup from current losses and press its rate greater.

ETH Rate Forecast: Need Surges

On the everyday duration, Ethereum (ETH) has actually increased from $2,225 to $2,421, suggesting a stable higher pattern that recommends more rate rises might be on the perspective.

According to the graph below, a supply area exists around $2,700, which might serve as resistance. Nonetheless, the $2,400 area works as a solid need area for ETH, boosting the chance of the altcoin going beyond the resistance at $2,581.

In addition, the sell wall surface around $2,744 sustains the possibility for ETH to press greater. If ETH removes these barriers, its rate might get to $2,800 and perhaps $2,991.

Learn More: Ethereum (ETH) Price Prediction 2024/2025/2030

That claimed, investors ought to beware of prospective market volatility. If the more comprehensive market changes from favorable to bearish, this projection might no more hold. Because situation, ETH’s rate might go down to $2,114.

Please Note

According to the Count on Job standards, this rate evaluation post is for educational objectives just and ought to not be thought about monetary or financial investment recommendations. BeInCrypto is dedicated to exact, impartial coverage, yet market problems undergo alter without notification. Constantly perform your very own research study and speak with a specialist prior to making any type of monetary choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.