Experts have actually increased Bitcoin’s rate target to $112,000 complying with a spike in exchange-traded fund (ETF) inflows.

This boosted task recommends favorable belief amongst institutional financiers, possibly driving the cryptocurrency to brand-new highs.

Bitcoin ETF Inflows to Trigger Cost Increase

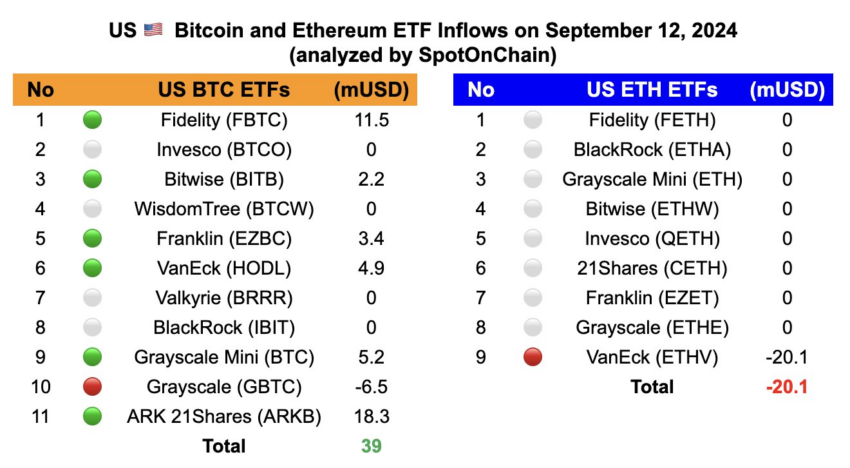

SpotOnChain experts reported substantial inflows right into Bitcoin ETFs. Bitcoin’s web circulation transformed favorable, with $39 million in inflows, turning around previous weak quantities.

On the other hand, Ethereum ETFs saw web discharges for the 2nd successive day, with Grayscale’s ETHE experiencing a $20 million discharge, while various other United States Ethereum ETFs had no web circulation.

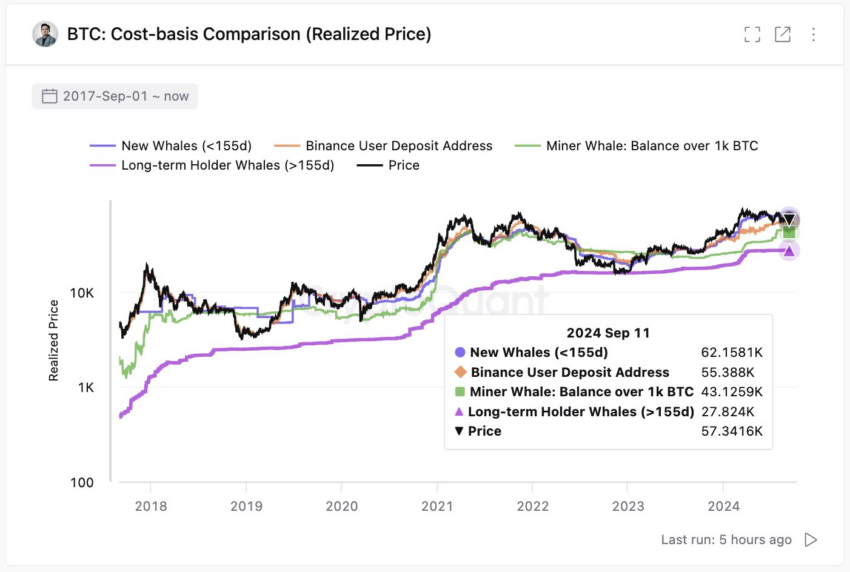

The favorable inflows happen when Bitcoin ETF financiers’ expense basis is more than Bitcoin’s rate. CryptoQuant Chief Executive Officer Ki Youthful Ju noted that the expense basis for “New Custodial Wallets/ETFs” is $62,000, while Bitcoin professions at around $57,000.

According to Ark Invest Study Partner David Puell, these market problems recommend that the ordinary ETF capitalist might go to a loss. Still, the historic point of view enhances the possibility for a substantial higher motion.

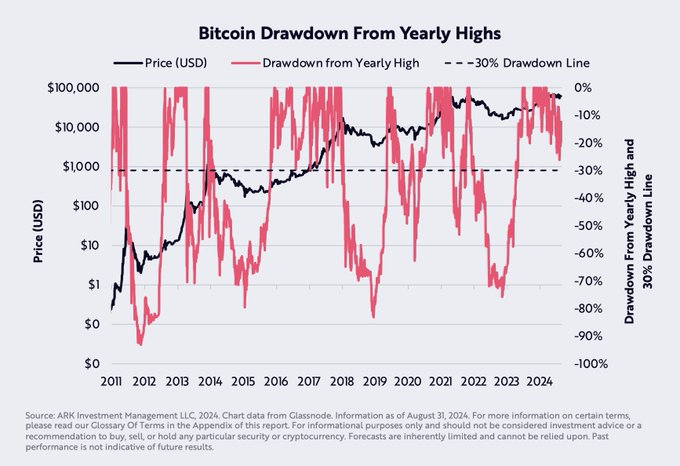

” When determined versus bitcoin’s rolling annual highs, the percent rate drawdown in 2024 still recommends the type of modification connected traditionally with bitcoin’s favorable key patterns, like those seen in 2016 and 2017, as an example,” Puellsaid

The merging of boosted ETF inflows, institutional buildup, and historic patterns adds to the agreement amongst experts that Bitcoin is positioned for a substantial rally.

Miky Bull, as an example, increased his Bitcoin rate target to $112,000, showing self-confidence in the cryptocurrency’s possibility to exceed previous highs.

” Bitcoin to a very first target of $112,000 this year. Background has actually without a doubt dominated. In 2016 and 2020 Q4 post-halving observed the start of an allegorical rally to a cycle top,” Bullaffirmed

Learn More: Bitcoin (BTC) Cost Forecast 2024/2025/2030

His evaluation indicate Bitcoin’s intermittent rate activities, particularly complying with cutting in half occasions that decrease mining benefits and come before considerable rate rises. The current spike in ETF inflows might function as a stimulant, affecting financial investment and fostering.

Please Note

In adherence to the Trust fund Task standards, BeInCrypto is dedicated to objective, clear coverage. This newspaper article intends to give exact, prompt details. Nevertheless, viewers are recommended to confirm realities individually and talk to an expert prior to making any kind of choices based upon this web content. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.