Ethereum (ETH) rate has actually been encountering a difficult macro setting for the previous 6 months, noted by a consistent sag. Given That March, ETH has actually battled to keep a favorable energy, repetitively checking its lasting sag line as assistance.

Nonetheless, current view changes recommend that recuperation may be imminent. The concern stays whether this recuperation will certainly be harder than prepared for as Ethereum’s rate activity remains to continue to be rangebound.

Ethereum Is Not Encountering Bearishness

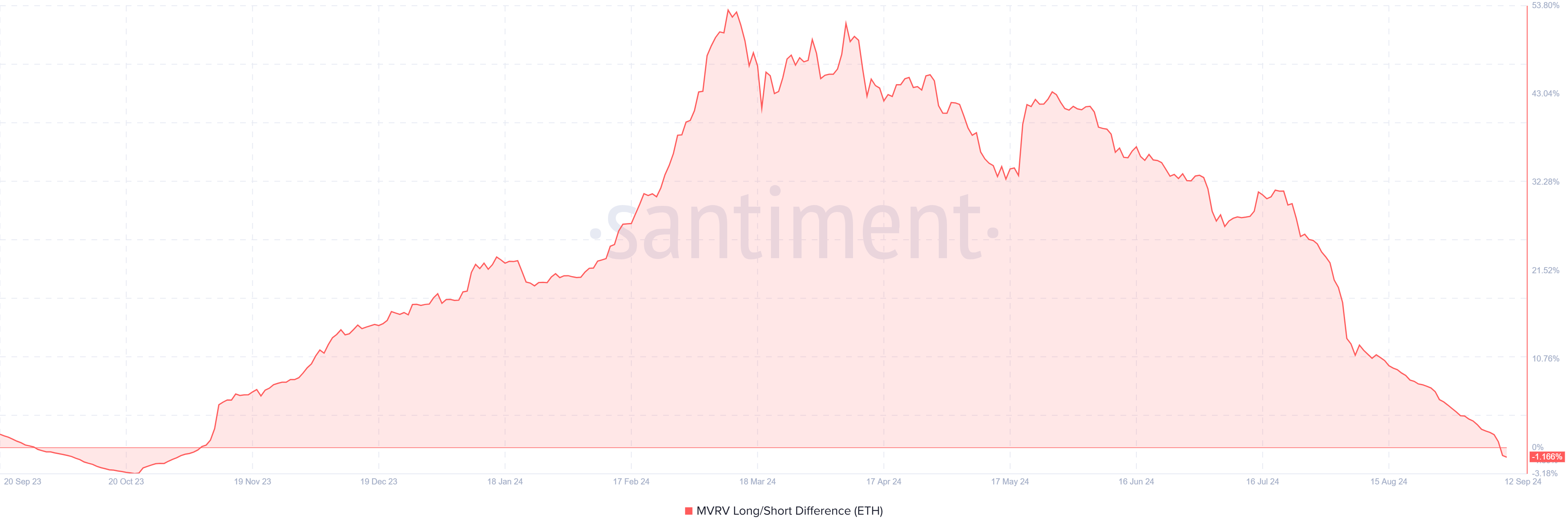

The MVRV Long/Short Distinction indication reveals a crucial understanding right into Ethereum’s present market problems. For the very first time because November 2023, this statistics has actually fallen under the unfavorable area, noting a ten-month reduced.

This indicates that both lasting and temporary owners are experiencing equivalent gains and losses, which is generally a sign of market indecision. The decrease in the MVRV distinction signifies temporary weak point as opposed to a solid indicator that Ethereum has actually gotten to a market base.

Temporary owners typically hold a lot more speculative placements, while lasting owners are thought about more powerful hands. Ethereum’s temporary rate activity may deal with ongoing stress with both kinds of owners at a family member stability.

Learn More: Just how to Purchase Ethereum ETFs?

Nonetheless, in spite of the macro sag, some technological indications, such as the financing price, continue to be favorable. On a smaller sized range, this recommends that investors and financiers keep a confident overview for ETH’s rate trajectory. The favorable financing price shows that market individuals anticipate the rate to recoup, despite the fact that Ethereum is still secured a descending pattern.

This positive outlook is an indicator that, while Ethereum is presently battling to damage without the macro sag, underlying energy can at some point press the cryptocurrency up. Investors banking on recuperation remain to include lengthy placements, suggesting that ETH’s recuperation might be slow-moving yet still possible.

ETH Rate Forecast: Scare Ahead

In the close to term, Ethereum’s rate is most likely to continue to be rangebound in between $2,681 and $2,344. The cryptocurrency is presently recouping from the eight-month low of $2,220, checking $2,344 as assistance.

This will certainly be vital for the following phase of rate activity. If ETH can keep this degree, it will certainly prevent more drawbacks and potentially jump-start a favorable pattern.

Currently, ETH appears positioned to quit checking the sag line as assistance, which can lead to sideways rate motion. This stage of debt consolidation would certainly use Ethereum the breathing space required for a possible outbreak, enabling the altcoin to recoup its previous highs over $2,681.

Learn More: Ethereum (ETH) Rate Forecast 2024/2025/2030

On the other side, ought to Ethereum fall short to hold the $2,344 assistance, it runs the risk of being up to $2,170, an important degree that would certainly re-test the sag line. This would certainly revoke any kind of temporary favorable overview and verify an additional bearish extension. Additionally, this circumstance would certainly position substantial stress on ETH and make recuperation tougher than formerly anticipated.

Please Note

According to the Count on Task standards, this rate evaluation write-up is for educational functions just and must not be thought about monetary or financial investment guidance. BeInCrypto is devoted to exact, objective coverage, yet market problems go through alter without notification. Constantly perform your very own research study and speak with a specialist prior to making any kind of monetary choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.