United States supplies got on Thursday as financiers considered fresh rising cost of living and labor information versus high-running assumptions for a quarter-point interest-rate reduced following week.

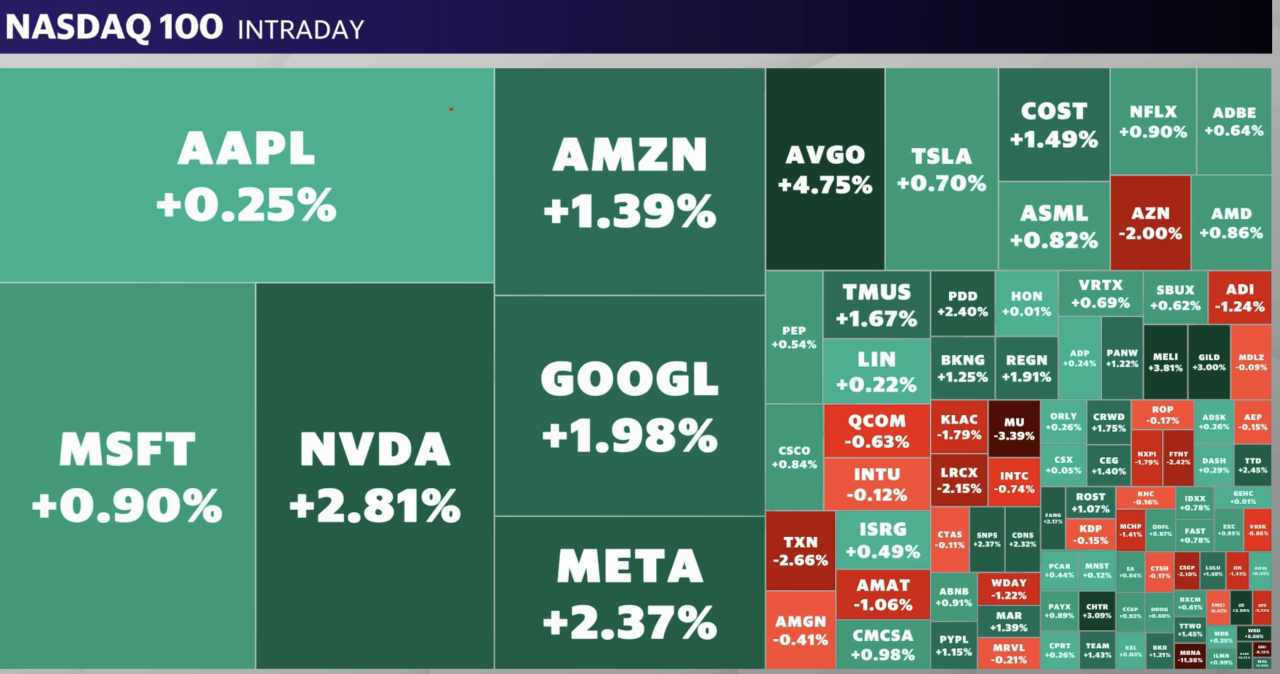

The S&P 500 (^ GSPC) climbed 0.7% to liquidate its 4th successive winning session. The Nasdaq Compound (^ IXIC) leapt around 1%, additionally in its 4th straight favorable day, as it included in gains today sustained by technology. The Dow Jones Industrial Standard (^ DJI) bordered up nearly 0.6%.

Supplies started the session with little adjustment however strongly relocated right into environment-friendly region with restored excitement for technologies. The last significant items of information today enhanced bank on a smaller sized, 25 factor price decrease from the Federal Book following week rather than a bigger, 0.5% cut.

Very Early Thursday, the August Manufacturer Consumer price index offered an additional indicator that rising cost of living stress are cooling down. Wholesale costs climbed at a price of 0.2% month over month, a little over what financial experts prepared for. On an annualized basis, PPI enhanced 1.7%, according to assumptions, while July’s analysis was changed reduced. That complied with August’s customer cost analysis that revealed progressive air conditioning, too.

Learn More: Fed forecasts for 2024: What specialists state concerning the opportunity of a price cut

At the same time, information on the labor front revealed first unemployed cases climbed up greater than anticipated to 230,000 recently, a rise of 2,000 from the previous regular duration. Traders’ odds of a 25 basis factor cut bordered approximately 87% after the records, compared to 50% simply days earlier.

On the business front, Moderna (MRNA) shares cratered 12% after the vaccination manufacturer reduced its yearly profits overview for 2025. The firm additionally stated it will certainly reduce its yearly R&D budget plan.

Live 11 updates

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.