Pendle, a decentralized financing (DeFi) return trading method, has actually made a considerable jump by increasing right into Bitcoin (BTC) return alternatives.

This brand-new advancement allows Bitcoin owners to check out distinct return approaches, widening their alternatives within the DeFi community.

BTC Staking Fulfills Versatility: Pendle’s Multi-Phase Return Approach

The intro of BTC swimming pools is the initial phase in Pendle’s multi-phase strategy, which they call the Bitcoin Arc. This strategy intends to boost BTC generate possibilities via partnerships with 3 DeFi giants– Corn, Lombard Financing, and Babylon Labs.

The collaboration enables customers to down payment Lombard’s liquid-staked BTC (LBTC) on Corn, a Layer 2 (L2) Ethereum method, and get involved throughout the ecological communities of Lombard, Corn, and Babylon. Via this effort, individuals can get gain from Corn Bit multipliers, Lombard Information, and Babylon Information, producing a detailed and interconnected return community.

Learn More: Leading 8 High-Yield Fluid Betting Systems To View in 2024

Pendle will certainly offer Bitcoin owners 2 main return approaches via its BTC swimming pools. The PT-LBTC choice, which provides a dealt with return on BTC, enables customers to secure steady, foreseeable returns. This technique is optimal for those looking for to prevent the threats of return volatility and rather go with regular, surefire returns.

At The Same Time, the YT-LBTC choice provides leveraged direct exposure to Bitcoin returns. Individuals can take advantage of multipliers– approximately 3x via Corn Bit and Lombard Information– with extra Babylon Information improving return capacity. This technique satisfies those seeking to make best use of returns by taking computed threats to go after greater returns.

Planning for Bitcoin’s Expanding Duty in Decentralized Financing

Pendle’s most recent effort lines up with the expanding energy of Bitcoin in DeFi (BTCFi). As Bitcoin’s visibility in DeFi broadens, Pendle’s BTC return swimming pools place the system to profit from this pattern.

Daniel Anthony, Pendle’s Head of Development, clarified that integrating Bitcoin return alternatives lines up with a more comprehensive technique to adjust to vital growths in the DeFi market. He mentioned that the surge of BTC betting was expected previously this year as equity capital started to move right into the room. Pendle was gotten ready for this change, guaranteeing its system might fit Bitcoin possessions.

” RWA was hyped since individuals claimed we can take advantage of this trillion-dollar liquidity in TradFi and bring that entire point to DeFi. However I assume what individuals have actually been missing out on is that the following closest next-door neighbor to us that we have not actually used the DeFi is BTC. I assume Bitcoin has a really deep liquidity in crypto. I imply, consider central exchanges. The quantity of liquidity that they have and Bitcoin is exceptionally deep. Which hasn’t been used DeFi in all,” Anthony clarified to BeInCrypto in a current unique meeting.

Looking in advance, Anthony predicts Bitcoin’s increasing function in DeFi, anticipating constant advancement for BTCFi along with facilities improvements. He stressed that Pendle’s calculated concentrate on Bitcoin settings it to remain pertinent as the sector progresses, especially as need for liquidity and return possibilities in BTC boosts.

Past straightening with present market fads, Pendle’s growth right into Bitcoin return alternatives additionally gets ready for the method’s upcoming V3 upgrade. The V3 version will certainly concentrate on enhancing liquidity and scalability, resolving present restrictions in taking care of bigger deals.

In addition, Anthony highlighted that V3 will certainly allow the method to fit bigger financial investments. This ability will certainly make it much more eye-catching to institutional financiers and massive DeFi individuals.

” For instance, presently, we are not able to take advantage of deals that are 6, 7 numbers, and above even if of liquidity restrictions of Pendle V2. So, to deal with this, we are constructing Pendle V3. […] I assume it mainly functions as an upgrade to what Pendle V2 can refrain and functions as a huge enhance to what Pendle V2 is today. Ideally, we can obtain it out by very early following year,” he clarified.

Learn More: 9 Cryptocurrencies Providing the Greatest Betting Returns (APY) in 2024

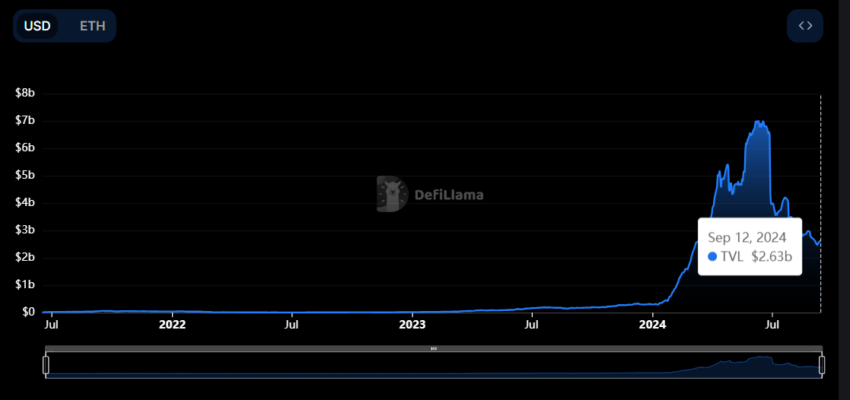

Presently, Pendle rates as the biggest return method by complete worth secured (TVL). DefiLlama information reveals that it has a TVL of $2.63 billion at the time of composing.

Please Note

In adherence to the Count on Task standards, BeInCrypto is dedicated to impartial, clear coverage. This newspaper article intends to offer precise, prompt details. Nonetheless, visitors are encouraged to validate realities separately and speak with a specialist prior to making any kind of choices based upon this web content. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.