If you were lucky sufficient to acquire the normal united state home in June 2022, you most likely secured around $1,400 a month in home loan settlements. Due mainly to higher mortgage rates, that very same home today would certainly set you back regarding $2,175 a month. So it’s not a surprise that home sales over the last two-plus years have actually gone to a few of the lowest levels in modern-day background.

Yet regardless of this cost crisis, home costs have not decreased, other than in a few of the boomiest Zoomtowns of the pandemic.

In this week’s version of DataDigest, we’re mosting likely to assess what it would certainly consider home sales to rocket in the loss and winter season of 2024.

Home loan settlements are just component of the cost obstacle. Various other holding prices genuine estate consist of taxes andinsurance According to S&P Global, insurance coverage costs enhanced country wide by 34% in between 2017 and 2023, with a lot more boosts striking home owners in 2024.

The prices to acquire a home have actually drastically enhanced over the last few years.

The various other item of the cost challenge isincome Price is the price about a purchaser’s capability to pay. As the economic climate expands and revenues enhance, homes come to be a lot more economical gradually. By the 2nd fifty percent of 2024, with robustly expanding revenues, stable home prices, and rates of interest that have actually relieved down off their height, home purchasing cost has really been enhancing for months. Also still, the nation deals with a situation in home-buying cost– and property buyers have actually been sluggish to react.

That leads us to a pair cost inquiries to deal with:

-

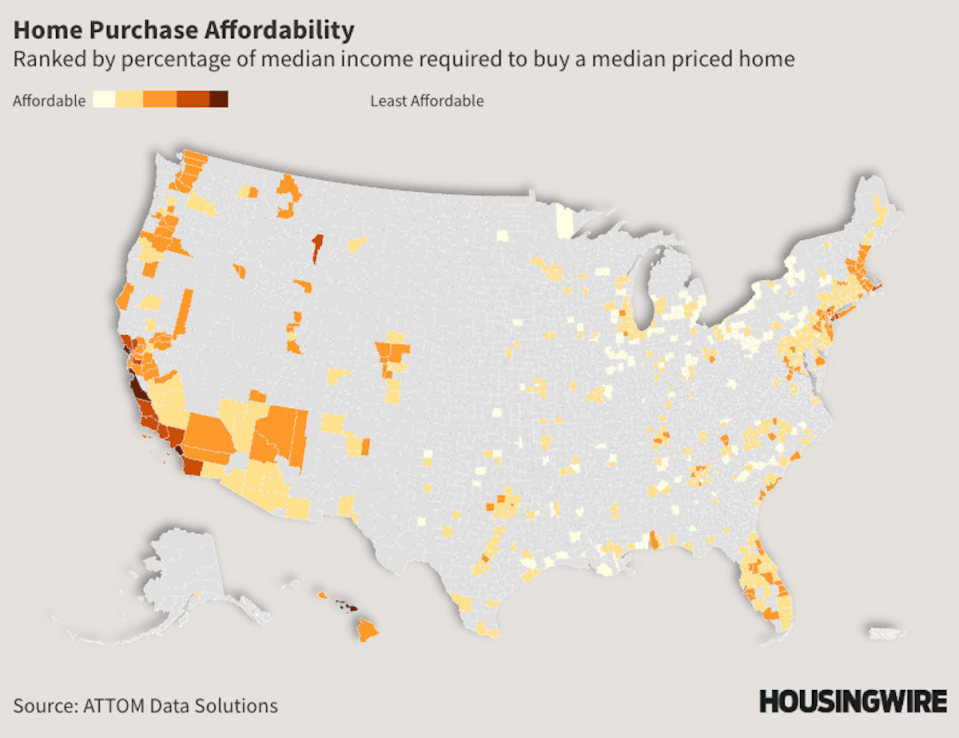

Which locations are one of the most and the very least affordable?

-

Just how much will require be buoyed by enhancing cost– also if home loan prices never ever go back to the pandemic lows?

Home loan prices came to a head in May 2024 and have slid over 100 basis factors ever since. Since Wednesday, several finance policemans were estimating in the reduced 6% variety for standard adhering home loans, and in the mid-to-high 5% variety for federal government finance items. Each dip in home loan prices boosts cost as settlements on a home acquisition decrease. Home loan settlements on the typical-price home are 7% less than in 2014 and are 13% less than the height in May 2024.

If home loan prices proceed their slide together with assumptions that the Federal Reserve will drop the short term interest rate at upcoming conferences, by the 4th quarter of 2024, home acquisition problems will certainly go to their ideal degree in 2 years.

In the graph listed below we’re computing a common home loan repayment for a home purchaser at any type of provided minute over the last 3 years. Home loan settlements are a feature of the rate of the home, minus the deposit, and the home loan rate of interest.

If property buyers are fortunate, home loan prices will certainly remain to move right into the 4th quarter 2024 and home costs will certainly tick down with seasonal patterns. Price will certainly remain to boost.

Will it suffice to relocate the needle for property buyers?

Home sales quantities in 2024 have actually stayed at historical lows, with many actions of home sales securing the price of existing home sales at around 4 million for the year. Also as home loan prices have actually dropped in the 2nd fifty percent of the year, there is extremely little indicator of the sales price enhancing yet. It does not show up that home customers are specifically encouraged by settlements that are 14% less expensive currently than they remained in May.

This might be because of the truth that home loan prices remained greater– and home acquisitions much less economical– for longer than any individual expected at the beginning of 2024. Home loan prices really did not lastly decline till after the prime need component of the period. Late in the year, buyer need subsides. So it might be tough to identify any type of low need boosts till following springtime.

The standard technique for ranking cost is to contrast a location’s typical earnings to its typical home rate. Is a common home economical to a common household in the location?

In 2020, the typical valued home in Milwaukee called for simply 14% of the typical earnings to acquire. Today that proportion is 31%. Although Milwaukee is amongst one of the most economical real estate markets in the nation, homes there are economical to a great deal less individuals currently. The need side of a supply/demand formula is much weak in this setting.

HousingWire made use of information from a current ATTOM Information Solutions record on cost to show one of the most and the very least economical real estate areas in the nation.

Homeownership cost consists of greater than simply home loan settlements. Specifically, insurance coverage can be a considerable part of month-to-month settlements. As environment catastrophes have actually enhanced in strength and regularity, and as substitute prices for our homes have actually increased also, insurance coverage prices are increasing in several states.

Real estate tax are likewise a considerable element for cost for a home. Given that tax obligations are typically a set percent of the home’s worth, the price relocates straight with the rate of your home. Given that insurance coverage prices have actually been raising about the price of the home, we’re concentrating right here on including insurance coverage to the cost position, yet missing the tax obligation component.

Each state manages its insurance coverage markets in a different way. In states with less controls on insurance coverage prices, such as Oklahoma and Texas and Nebraska, house owner insurance coverage prices are drastically greater than in states which firmly regulate insurance coverage costs for customers. According to information from Bankrate and S&P Global, normal insurance coverage for a $300,000 home in Oklahoma is approximately $5,000 annually, approximately 45% even more in 2023 than in 2017. Insurance coverage for the very same home in Vermont is simply $806, a boost of just 6% in between 2017 and 2023.

From a regular monthly settlements viewpoint, while home loan settlements have actually included $800 to a regular monthly repayment in Oklahoma in the last 2 years, insurance coverage settlements have actually included $200 even more– a considerable influence to the expensive costs.

When we integrate the state’s ordinary insurance coverage prices to the neighborhood rate for real estate, it alters the idea of cost a little bit. Oklahoma City, which has a reasonably low-cost typical rate in the $240,000 variety, has reduced revenues and drastically greater insurance coverage prices than does a high home-price market such as Rose city, Oregon. After making up insurance coverage, cost in these 2 locations begins to assemble.

With these even more full prices in mind, we discover a great deal even more regarding home acquisition habits. A number of those very same sunbelt markets with high insurance coverage prices are likewise markets with the best supply development of unsold homes on the marketplace in 2024.

Eventually, rates of interest alleviate pull back. Gradually, revenues expand. Yet if these insurance coverage prices are expanding quicker than revenues, the high insurance coverage states will certainly encounter ongoing cost difficulties– also when the states that appear expensive since they have expensive homes really boost about their neighborhood purchaser capabilities.

Do expensive homes suggest costs must drop?

It’s not a surprise that the seaside The golden state markets are the least economical in the country; The golden state has actually been expensive for years. If a market is expensive to the majority of individuals that live there, why does not that suggest that home costs must decrease? Just how can home costs remain expensive for life?

The response depends on the marketplace characteristics of supply and need. If the supply of homes offered for acquisition is extremely reduced, these homes do not need to be economical to the typical earnings, they just require to be economical for the wealthiest couple of customers. The golden state has a persistent lack of supply contrasted to the populace. The golden state has 10 million even more individuals than Texas, yet has 60% less homes offered for customers. Limited supply in The golden state maintains homes constantly expensive.

Throughout the last years, American home owners were honored with ultra-low home loan prices. In the post-pandemic age, extremely couple of home owners want marketing. We have actually created thoroughly regarding themortgage rate lock-in effect Therefore, several components of the nation that never ever formerly dealt with supply lacks currently encounter California-style situations. Throughout the Midwest and Northeast, several cities have 75% less homes offered for customers than they did a years earlier.

In the coming year, if home loan prices simplicity, that can without a doubt incentivize property buyers that have actually been sidelined for 2 years. See these inventory-deprived markets, specifically in the Midwest and Northeast. As purchaser competitors warms up, that can highly likely drive home costs higher.

The cost situation isn’t one quickly fixed.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.