Surge is proactively advertising the XRP Journal (XRPL) as the optimal blockchain for tokenizing real-world properties (RWA) on an institutional range. Surge highlights protection, scalability, and interoperability, placing itself as a reliable system for decentralized financing (DeFi) and handling tokenized properties.

In a current special meeting with BeInCrypto, Ross Edwards, Elder Supervisor for Solutions and Shipment at Surge, uses understandings right into why the XRPL is distinctively placed to link conventional financing with DeFi.

Instantaneous Negotiation, Security, and Lower Threat: Why XRPL appropriates for Financial Institutions

When talking about the XRPL’s function in changing institutional financing, Ross Edwards was unquestionable concerning its fundamental benefits. He mentioned the special advantages that make the blockchain attract attention for establishments wanting to tokenize RWAs.

For Edwards, the trick to XRPL’s success hinges on its layout. As an example, he highlighted that the XRPL’s deal rate– clearing up in simply 3 to 5 secs at marginal expense– addresses the high expenses and hold-ups frequently connected with conventional monetary systems.

” The XRP Journal makes it possible for instantaneous negotiation of worth, along with openness and auditability that can truly alter the threat account of purchases,” he described.

Find Out More: What is The Influence of Real Life Property (RWA) Tokenization?

He additionally clarified that the XRPL utilizes a solid administration system. This permits the neighborhood to present changes to fulfill its requirements, consisting of those of banks.

In addition, it gets rid of the demand for personalized writing, releasing, and handling wise agreements, along with the connected audits. These capabilities inevitably will lower dangers, which is vital for banks.

” It was developed for producing worth and properties on-chain, for holding those firmly, for trading and moving those properties. So, it’s natively developed for this. The XRP Journal is a tried and tested modern technology. It’s been competing 11 to 12 years. It’s very secure. […] You just need to call the APIs of the XRP Journal to allow those usage instances,” Edwards suggests.

Furthermore, the Automated Market Manufacturer (AMM) is among Surge’s core advancements on the XRPL. This function, incorporated straight right into the procedure, permits establishments to involve with DeFi firmly without the demand for possibly undependable third-party wise agreements.

What establishes the XRPL’s AMM apart is its capability to accumulated liquidity throughout the procedure. Surge’s liquidity approach is especially created to fulfill the requirements of institutional individuals.

By integrating the AMM right into the XRPL’s decentralized exchange (DEX), the procedure for establishments to take part in DeFi is streamlined. Such a system guarantees both protection and performance for large procedures.

The XRPL’s AMM is additionally with the ability of settling liquidity from throughout the procedure. This system guarantees that establishments have accessibility to significant liquidity swimming pools and can implement purchases at one of the most beneficial rates. In addition, it successfully decreases slippage– a substantial issue for establishments implementing big purchases– and assurances continual liquidity for trading objectives.

In addition, the intro of the Multi-Purpose Symbol (MPT) criterion will certainly permit establishments to develop intricate token frameworks standing for numerous property courses. Establish for launch in Q3, MPT will certainly give better adaptability for establishments wanting to tokenize and take care of varied profiles of properties on the XRPL.

Surge is additionally wanting to increase using the XRPL for institutional DeFi with the upcoming launch of Surge USD (RLUSD), a fully-backed stablecoin fixed to the United States buck. Edwards sees this stablecoin as a substantial action towards boosting liquidity and cross-border purchases for establishments making use of the XRPL.

” If you’re mosting likely to operate in the real-world property tokenization room, stablecoins are an essential. It’s mosting likely to remain to expand in value, not simply value in the crypto globe however in fact value in the monetary globe. Which’s why Surge thinks that providing Surge USD will certainly include in the existing stablecoins around. They will certainly fit particular establishments and particular usage instances and truly assist gas or proceed the development of tokenization in general,” he claimed.

Leveraging DIDs and Tactical Collaborations for Expanding Influence in Tokenized Properties

Besides strong framework and modern technologies, protection and conformity are extremely important for establishments, specifically in tokenized properties. In a previous discussion with BeInCrypto, Surge’s Markus Infanger, Elder Vice Head Of State of RippleX, highlighted just how the XRPL leverages Decentralized Identifiers (DID) to attend to these worries successfully.

By incorporating DIDs, the XRPL makes it possible for establishments to firmly and verifiably take care of customer identifications, helping with conformity with Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements. This assimilation assists decrease the dangers of deceptive purchases by improving KYC/AML procedures. Because of this, it boosts both protection and regulative adherence for tokenized property purchases.

” The mix of these attributes, along with others suggested to sustain institutional DeFi on the XRPL, such as an indigenous Financing Method and Oracles, are making it simpler to incorporate tokenized real-world properties right into on-chain monetary framework. Inevitably, DeFi offers brand-new monetary rails for activities such as trading, collateralizing, spending, and loaning. Bringing real-world properties on-chain and subjecting them to these rails opens brand-new possibilities– which is the actual worth of tokenizing real-world properties,” Infanger clarified.

The enhancing use the XRPL in institutional financing stands apart with its collaborations with crucial market gamers. As an example, Surge’s collaboration with OpenEden brought about the intro of tokenized United States treasury costs (T-bills) on the XRPL.

In A Similar Way, Surge has actually partnered with Archax, the UK’s initial controlled electronic property exchange, broker, and custodian. Archax intends to bring thousands of numerous bucks in tokenized RWAs onto the XRPL in the coming year.

Stabilizing Short-Term Gains and Long-Term Development in Tokenization

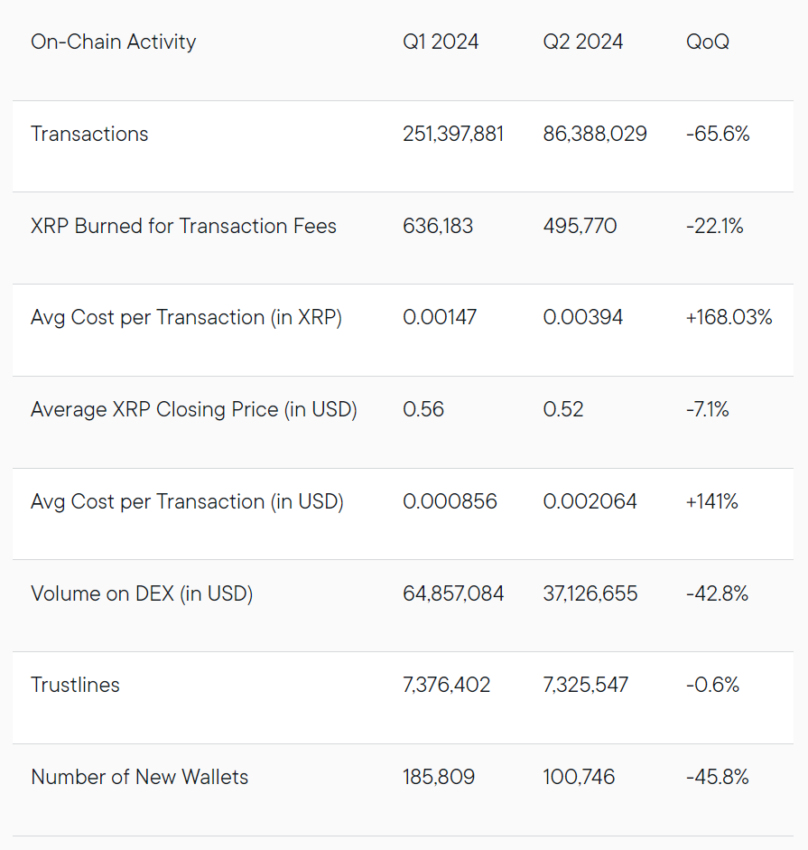

Regardless Of the XRP Journal’s solid structure for institutional fostering, it has actually dealt with some difficulties, specifically in on-chain task. A current record disclosed that in the 2nd quarter of 2024, the variety of purchases on the XRPL dropped by over 65% contrasted to the initial quarter. This reduction is additionally seen in deal quantities and total DEX interaction, where trading quantity dropped by virtually 43%.

The ordinary deal expense on the XRPL additionally raised considerably. In Q2, the expense of purchases greater than increased contrasted to Q1, increasing by 168%, which might add to the decrease in task. In addition, less brand-new budgets were produced on the network, with budget development lowering by 45.8%.

Additionally, Edwards mentioned that the difficulties of tokenization are past the XRPL itself. He recognized that of the greatest difficulties in tokenization is its long-lasting nature. According to him, this calls for persistence and steady community structure.

” Tokenization is not something that can be done immediately. It’s not depending on a person’s choice or capability to take a possession, compose an item of code, and shop it someplace, also if it’s a blockchain or whatever. That’s in fact a really basic procedure. It has to do with developing the community and linking with each other these worth chains,” he claimed.

Edwards stressed that banks require prompt, substantial returns. This implies each action in the tokenization procedure need to provide temporary worth while establishing the structure for long-lasting development.

He additionally kept in mind that this need is a fragile harmonizing act that Surge and the wider market need to browse thoroughly. Additionally, Edwards highlighted that banks need to play an essential function in obtaining this equilibrium right, as their involvement is crucial for the success of the tokenization community.

Find Out More: RWA Tokenization: A Consider Safety And Security and Count On

Nonetheless, in the close to term, Edwards thinks that enhancing need and recognizing the vehicle drivers behind tokenization will certainly be crucial. As the usage of tokenized properties expands– relocating past simply acquiring and holding to wider usage instances– the marketplace will certainly begin to increase quickly.

” We’re visiting, when that takes place and opens, when there’s even more usage of these tokenized properties, as opposed to simply acquisition and hold, we’re mosting likely to begin to see this location increase substantially. And it’s mosting likely to come to be crucial to the future of the monetary system,” he ended.

Please Note

Adhering To the Depend on Job standards, this function write-up provides point of views and point of views from market professionals or people. BeInCrypto is devoted to clear coverage, however the sights shared in this write-up do not always show those of BeInCrypto or its team. Viewers must validate info individually and speak with an expert prior to choosing based upon this material. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.