Pepe’s (PEPE) rate has actually risen by 956% over the previous 365 days. Nevertheless, regardless of striking a brand-new all-time high in Might, the meme coin might be positioned for additional losses.

At press time, PEPE’s market price rests at $0.0000073. As vendors start to take control, the coin’s favorable energy deals with major difficulties, indicating a possible recession in its rate pattern.

Pepe Currently at Make or Mar Placement

On the 4-hour graph, PEPE is trading near the 20 and 50-day Exponential Relocating Standards (EMA), essential technological indications made use of to analyze a cryptocurrency’s pattern.

Historically, PEPE’s rate has actually seen extensive rallies when it trades over these EMAs. As an example, on August 22, the 20-day EMA (blue) went across over the 50-day EMA (yellow), developing a gold cross– a favorable signal. During that time, PEPE was trading around $0.0000078, and within 3 days, the rate rose to $0.0000096.

Nevertheless, currently, both EMAs are merging, suggesting that PEPE’s temporary possibility goes to a critical time. This might either result in a brand-new rate rally or signal additional decrease relying on market energy.

Learn More: Just How To Acquire Pepe (PEPE) and Whatever You Required To Know

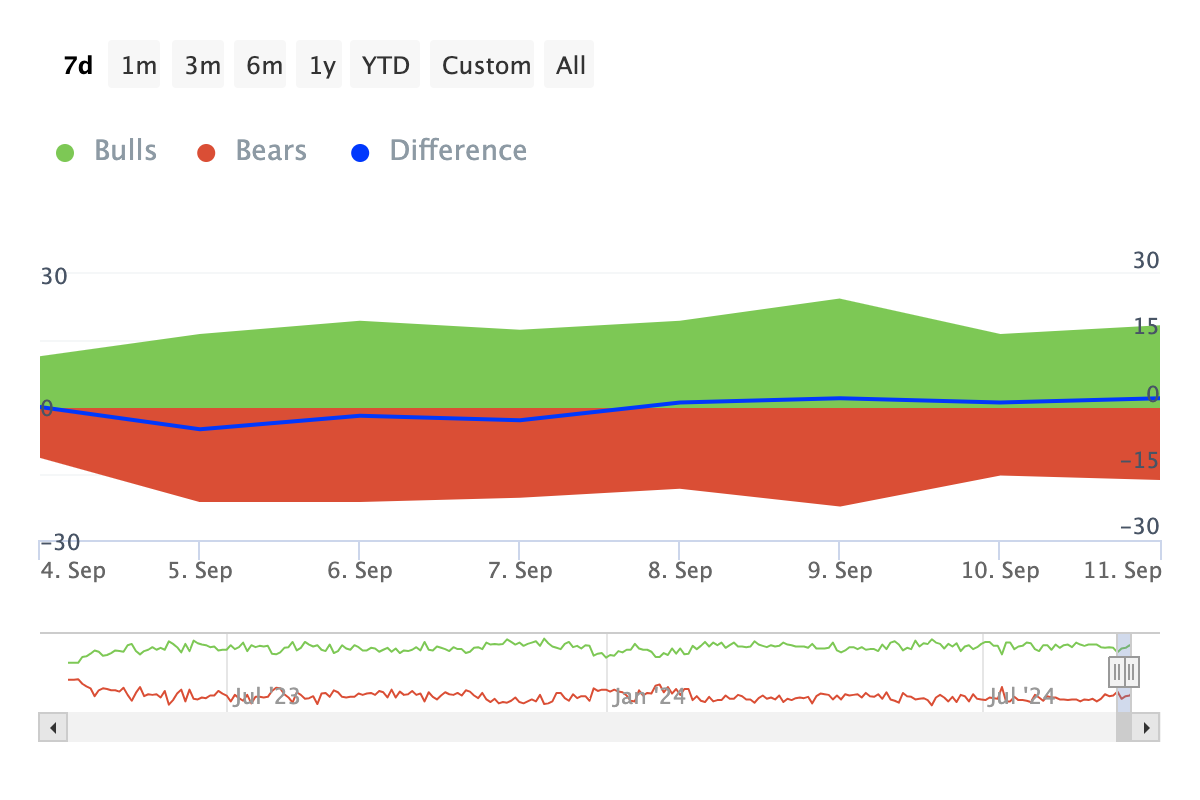

As the frog-themed cryptocurrency browses this crucial duration, on-chain information from IntoTheBlock recommends that bears might be acquiring control. BeInCrypto’s evaluation of the Bulls and Bears sign indicate this change.

For context, bulls stand for addresses that bought at the very least 1% of the overall trading quantity throughout a details duration, while bears are those that offered a comparable quantity. When there are extra bulls than bears, it usually indicates a possible rate rise.

Nevertheless, because there are presently even more bears than bulls, PEPE’s rate might deal with a substantial decrease.

PEPE Cost Forecast: Bulls in Problem

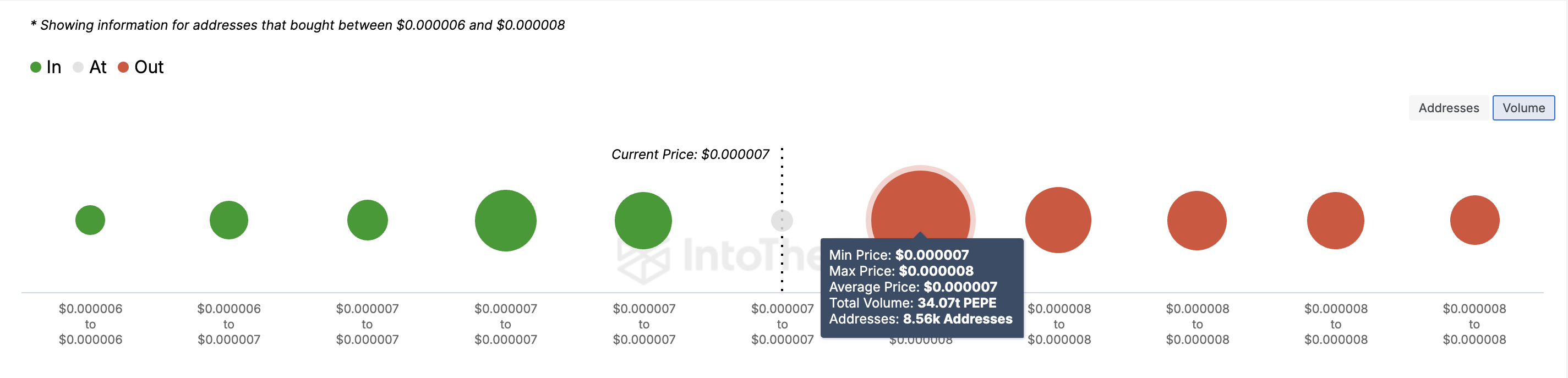

Pertaining to rate forecast, the In/Out of Cash Around Cost (IOMAP) statistics discloses that PEPE might come across substantial resistance as it attempts to climb up greater. The IOMAP teams addresses based upon whether they are generating income, shedding cash, or recovering cost at the existing rate. It after that examines the quantity of symbols purchased different rate degrees to establish prospective assistance or resistance areas.

If there’s a high quantity of symbols purchased and “out of cash” (presently muddle-headed), the cryptocurrency is most likely to deal with resistance. Alternatively, a greater quantity of symbols purchased “in the cash” (at an earnings) supplies assistance, suggesting a feasible rate rise.

Already, over 34 trillion PEPE symbols are held muddle-headed, with acquisitions made at an optimal rate of $0.0000080. On the other hand, regarding 7 trillion symbols were purchased $0.0000070 and are presently in earnings. This discrepancy recommends that PEPE might have a hard time to appear the $0.0000080 resistance, possibly dealing with denial.

Learn More: 5 Ideal Pepe (PEPE) Pocketbooks for Beginners and Experienced Users

Therefore, PEPE’s rate might be up to $0.0000070, and in a very bearish situation, it might go down additionally to $0.0000060. Nevertheless, a rise in acquiring quantity by bulls might transform the circumstance about, pressing PEPE towards a rally to $0.000010.

Please Note

According to the Trust fund Task standards, this rate evaluation short article is for educational functions just and need to not be taken into consideration economic or financial investment recommendations. BeInCrypto is dedicated to exact, objective coverage, however market problems go through alter without notification. Constantly perform your very own research study and talk to an expert prior to making any kind of economic choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.