From worrying on-chain metrics to technological signs, Chainlink’s (WEB LINK) cost could experience a harsh course as it goes for a greater worth. These indication followed the token lately revealed preparedness to get to $12.

While the prospective transfer to the cost over stays an alternative, this on-chain evaluation clarifies why it might take longer than expected.

New Issues Arise for Chainlink

On Tuesday, September 11, Chainlink’s Sharpe proportion was nearing a greater degree. Nevertheless, already, the proportion, which determines whether the threat absorbed investing deserves the prospective benefit, has actually gone down to 0.25.

When the Sharpe proportion increases, it recommends a most likely favorable roi. Alternatively, a decrease or adverse analysis shows that the volatility of the possession might not warrant the risk-adjusted returns.

Based upon this evaluation, acquiring web link at its existing cost in the short-term might posture a remarkable threat to spent resources.

Find Out More: Leading 11 DeFi Protocols To Watch on in 2024

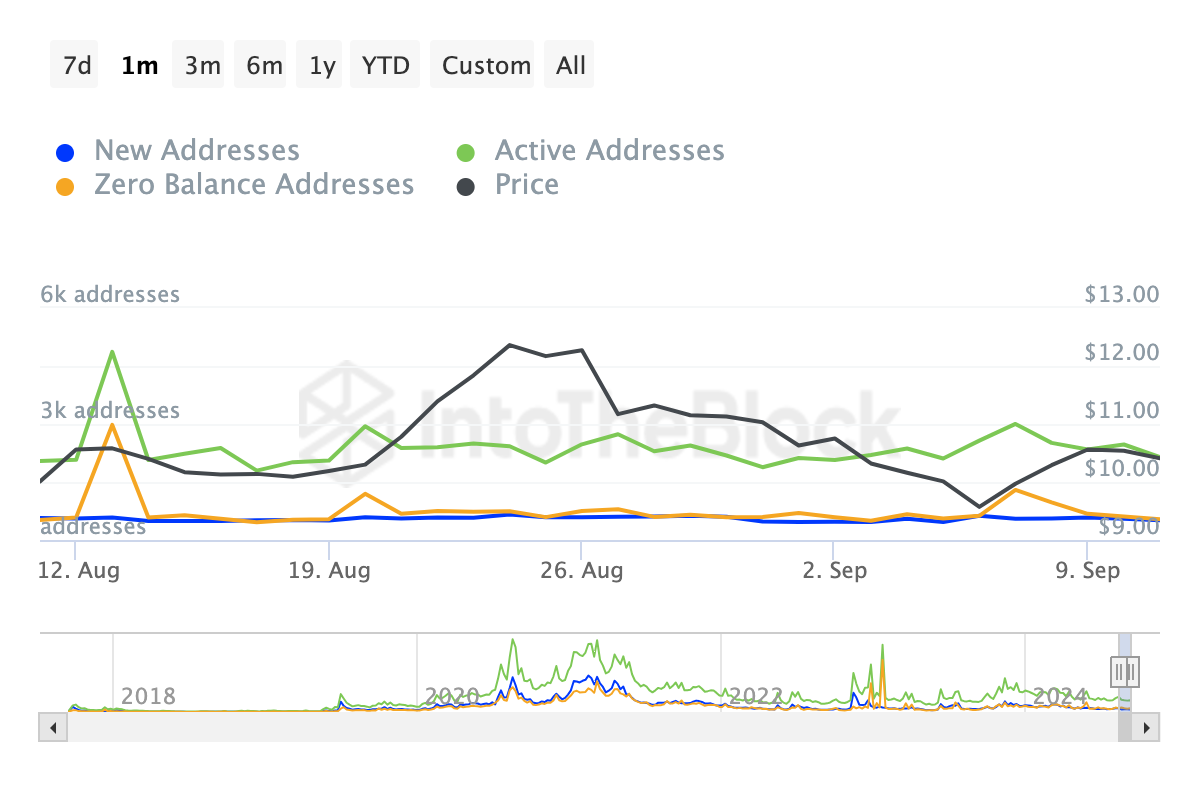

One more statistics presenting such view is Chainlink’s network task. According to IntoTheBlock, the energetic, zero-balance, and brand-new addresses have actually reduced considerably in the last 7 days.

A boost in these metrics showed a high degree of individual involvement, which is usually a favorable indicator. Hence, this decrease shows that less market individuals are using the network.

Such a decrease in general task might adversely influence Chainlink’s cost, particularly as it accompanies reduced trading quantity.

Web Link Rate Forecast: Essential Days Ahead

An evaluation of the everyday graph reveals that web link’s cost last surpassed $12 on August 25. 2 weeks later on, it came by 22%, dropping listed below $10. While the altcoin has because rebounded, BeInCrypto kept in mind prospective resistance at $10.74.

Moreover, the Chaikin Cash Circulation (CMF), an essential indication of market fads, stopped working to increase over the absolutely no navel. The CMF is important for establishing whether a cryptocurrency is getting in an uptrend or sag. A climbing CMF signals an uptrend or the prospective to maintain one, while a decreasing CMF recommends the contrary.

Find Out More: 12 Ideal Altcoin Exchanges for Crypto Trading in September 2024

If the CMF remains to drop, it might suggest enhanced profit-taking from the current cost rise. Subsequently, web link’s cost might go down to $9.47, with a very bearish circumstance possibly bringing the token to $8.08. Nevertheless, if the more comprehensive market changes right into a continual favorable stage, web link might increase to $12.33.

Please Note

In accordance with the Trust fund Job standards, this cost evaluation post is for informative objectives just and must not be thought about economic or financial investment guidance. BeInCrypto is dedicated to exact, honest coverage, however market problems go through transform without notification. Constantly perform your very own research study and talk to an expert prior to making any type of economic choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.