Uniswap Procedure chief executive officer Hayden Adams tested accusations that the decentralized cryptocurrency exchange takes allurements to enable implementations on its system.

As an open-source procedure, Uniswap offers liquidity and trading for ERC20 symbols on the Ethereum blockchain.

Uniswap Chief Executive Officer Refutes Taking Kickbacks

Adams disregarded the accusations, mentioning they were made to lure involvement. He cleared up that neither Uniswap Labs neither the Uniswap Structure bills methods for releasing on its system. He even more discussed that administration ballots identify whether a method is released or otherwise.

” I hardly ever involve with forks attempting to lure involvement, however, for the document, this is totally incorrect. Neither Uniswap Labs neither Uniswap Structure have actually ever before billed for a method release,” Adams explained.

Uniswap Labs is accountable for creating both the Uniswap procedure and the Uniswap user interface. For the user interface, the environment concentrates on the task and initiative needed for chain-specific release.

Adams’ remarks remained in reaction to complaints made by a customer called Alexander on X (previously Twitter), that declared that Uniswap approached some methods with quantities as high as $20 million.

” If you, or somebody you like, has actually been asked to bet $20 million for an inadequate Uniswap release feel in one’s bones that you are not the only one and we’re below to aid,” Alexandar wrote.

Find Out More: Just How To Purchase Uniswap (UNI) and Whatever You Required To Know

Alexander’s statements adhered to claims by Millicent Labs cofounder Kene Ezeji-Okoye, that declared that Uniswap bills $10 million for procedure implementations and an added $10 million for individual motivations targeted at trading carbon credit reports.

In 2022, the Celo Structure, which manages the Celo blockchain– a carbon-negative, mobile-first system for Web3 and ecological effect– came close to Uniswap to advertise eco-friendly usage instances. As component of this campaign, the Celo Structure looked for to reorganize its treasury making use of eco-friendly asset-backed symbols.

A proposition sent to Uniswap in support of the Celo Structure and various other events detailed that Celo would certainly devote $10 million in CELO symbols for Uniswap-specific individual motivations and gives, in addition to an added $10 million in monetary motivations.

According to a snapshot of the governance proposal vote, customers authorized it with 12 million ‘ayes’ versus just 603 ‘nays’. BeInCrypto connected for remark, yet neither Hayden Adams neither Alexander promptly reacted.

On the other hand, the decentralized exchange lately resolved its instance versus the United States Commodities Futures Payment (CFTC). In the middle of accusations of unlawful retail asset purchases making use of electronic possessions, the exchange paid $175,000 in penalties, a put on the wrist adhering to Uniswap’s collaboration with the authorities.

Find Out More: Uniswap (UNI) Cost Forecast 2023/2025/2030

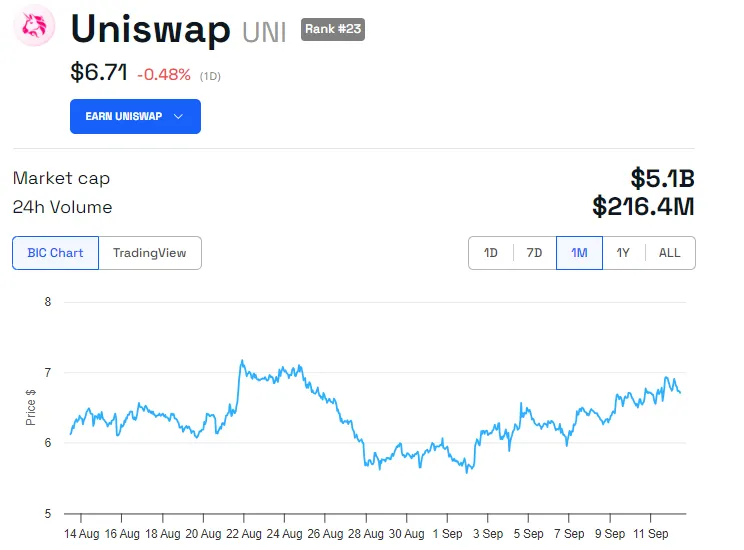

In the middle of the current conflict, the Uniswap token (UNI) is down by 0.48% considering that the Thursday session opened up. Since this writing, it is trading for $6.71.

Please Note

In adherence to the Trust fund Task standards, BeInCrypto is dedicated to impartial, clear coverage. This newspaper article intends to supply precise, prompt details. Nevertheless, visitors are suggested to confirm realities individually and talk to an expert prior to making any type of choices based upon this material. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.