The Bitcoin (BTC) market is presently emitting blended signals. On-chain information shows security and care, making it vague whether the coin is charting its means towards the $64,500 high or considering the $49,500 reduced.

This item discovers these on-chain metrics, what they indicate, and what financiers need to try to find.

Bitcoin Owners at Crossroads

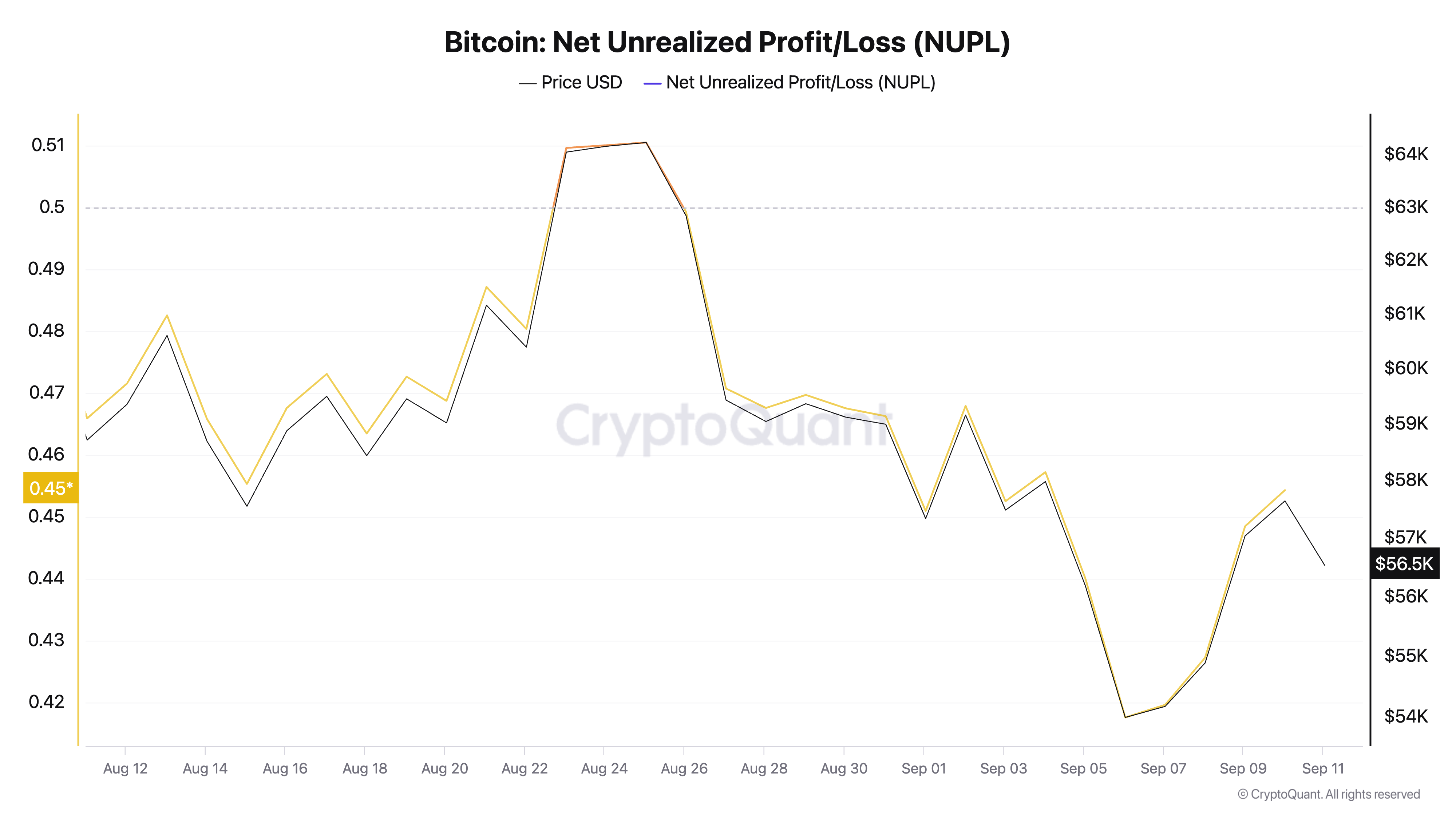

The initial vital statistics to check out is Bitcoin’s Internet Unrealized Revenue and Loss (NUPL) m, which determines general financier belief and earnings. Presently, the NUPL stands at 0.45, suggesting that if financiers marketed their coins at present market value, they would certainly, usually, understand a 44% earnings contrasted to the cost at which they last obtained their coins.

This degree shows a reasonably favorable belief in the marketplace.

Nevertheless, CryptoQuant reports that BTC’s present NUPL worth recommends owners are reluctant to offer. This anxiousness originates from unpredictability around the upcoming Customer Rate Index (CPI) launch, prospective 50 basis factor rate of interest cuts by the Federal Get, and the honest United States governmental political elections.

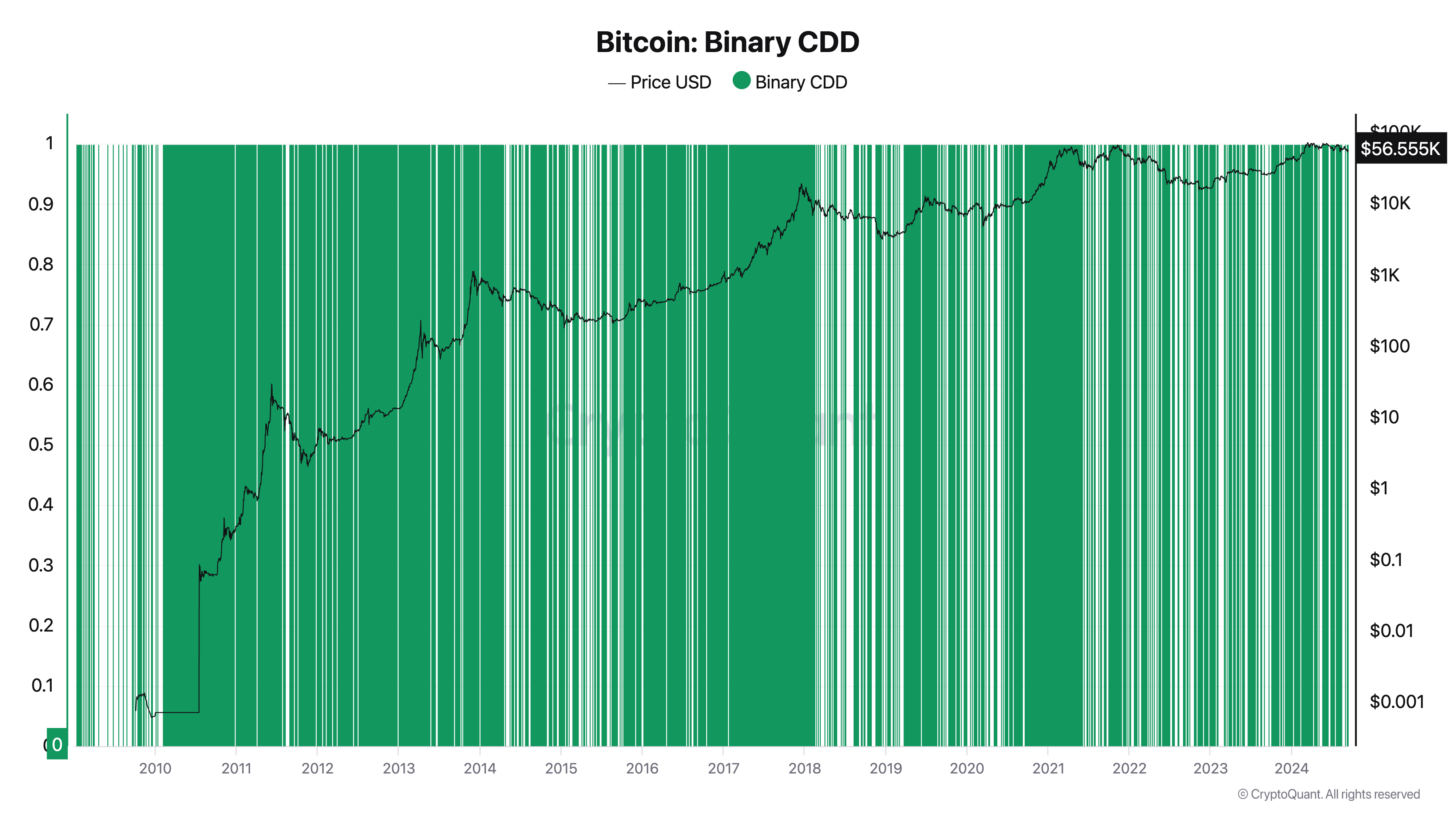

In spite of this, several BTC lasting owners are presenting solid HODLing actions. This is shown in the coin’s Binary Coin Days Damaged (BCD) statistics, which shows that lasting owners are stagnating their coins.

Find Out More: Where To Profession Bitcoin Futures: A Comprehensive Overview

At 0.28 at the time of creating, this statistics shows self-confidence in Bitcoin’s efficiency and market security, as owners really feel no demand to relocate or offer their coins.

A mix of BTC’s NUPL and BCD indicate a clear belief: financiers fear concerning prospective cost decreases, yet the worry of losing out on future gains maintains them from marketing.

BTC Rate Forecast: A Rally Over $60,000 or a Decrease Towards $49,000?

In a note to customers, Markus Thielen, owner of 10X Study, cautioned that the unpredictability around the United States governmental political election, CPI, and the FOMC conference will majorly figure out Bitcoin cost targets.

” A reduced CPI analysis might additionally supply a short-lived increase to favorable energy. Nevertheless, with the FOMC conference anticipated to present more unpredictability following week and the United States political election result still unclear after a feasible rise of positive outlook for Trump (Tuesday argument), Bitcoin might proceed looking for an extra durable assistance degree to install an extra substantial rally towards year-end,” Thielen created.

Mati Greenspan, the owner & & chief executive officer of Quantum Business economics, takes an extra unfavorable position. The professional thinks that it is prematurely to consider brand-new highs.

” Bitcoin’s cost activity has actually remained in a sidewards cut for majority a year currently, and there’s no informing when it may burst out. Inevitably, this laterally activity benefits Bitcoin fostering as cost security can be a crucial chauffeur for development and dependability,” Greenspan informed BeInCrypto.

If macro fads agree with, an uptick in BTC’s need will certainly press its coin towards the $64,520 assistance degree. If it goes across over this degree, the leading coin might target $68,599.

Find Out More: 5 Ideal Systems To Get Bitcoin Mining Supplies After 2024 Halving

Nevertheless, if bearish macro fads dominate, Bitcoin’s cost might drop towards the August 5 reduced of $49,516.

Please Note

According to the Count on Task standards, this cost evaluation write-up is for informative functions just and need to not be taken into consideration monetary or financial investment recommendations. BeInCrypto is devoted to exact, honest coverage, however market problems undergo transform without notification. Constantly perform your very own study and talk to a specialist prior to making any type of monetary choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.