Ethereum’s (ETH) cost relies on holding the vital $1,900 degree to avoid a prospective decrease. This degree will certainly determine if ETH gains upwards energy or deals with additional descending stress.

With the marketplace’s present problem, the following actions for the altcoin will certainly rest on whether it can exceed this crucial limit or catch a decrease.

Ethereum Understood Rate Failure Might Trigger a Decrease

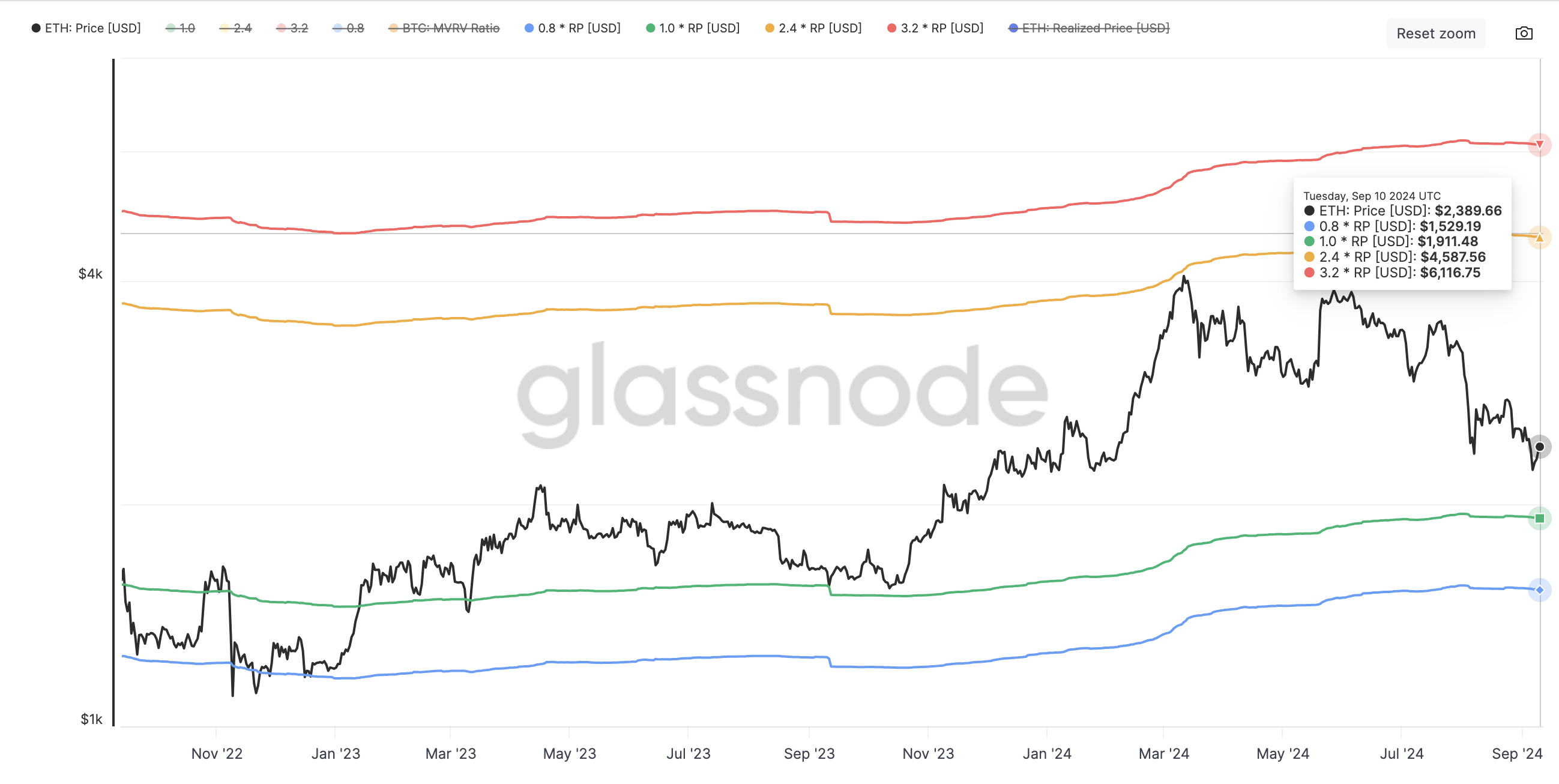

According to the marketplace Worth to Understood Worth (MVRV) prices bands, which usually indicate extremes in latent earnings or losses, Ethereum’s mean Understood Rate presently stands at $1,911. This degree is vital for the altcoin’s future efficiency, as stopping working to hold over it might press ETH’s cost to $1,529.

The Understood Rate mirrors the typical worth at which Ethereum was last relocated. Going down listed below this limit raises the threat of capitalist capitulation, where owners could cost a loss, intensifying descending stress.

Learn More: Just how to Purchase Ethereum ETFs?

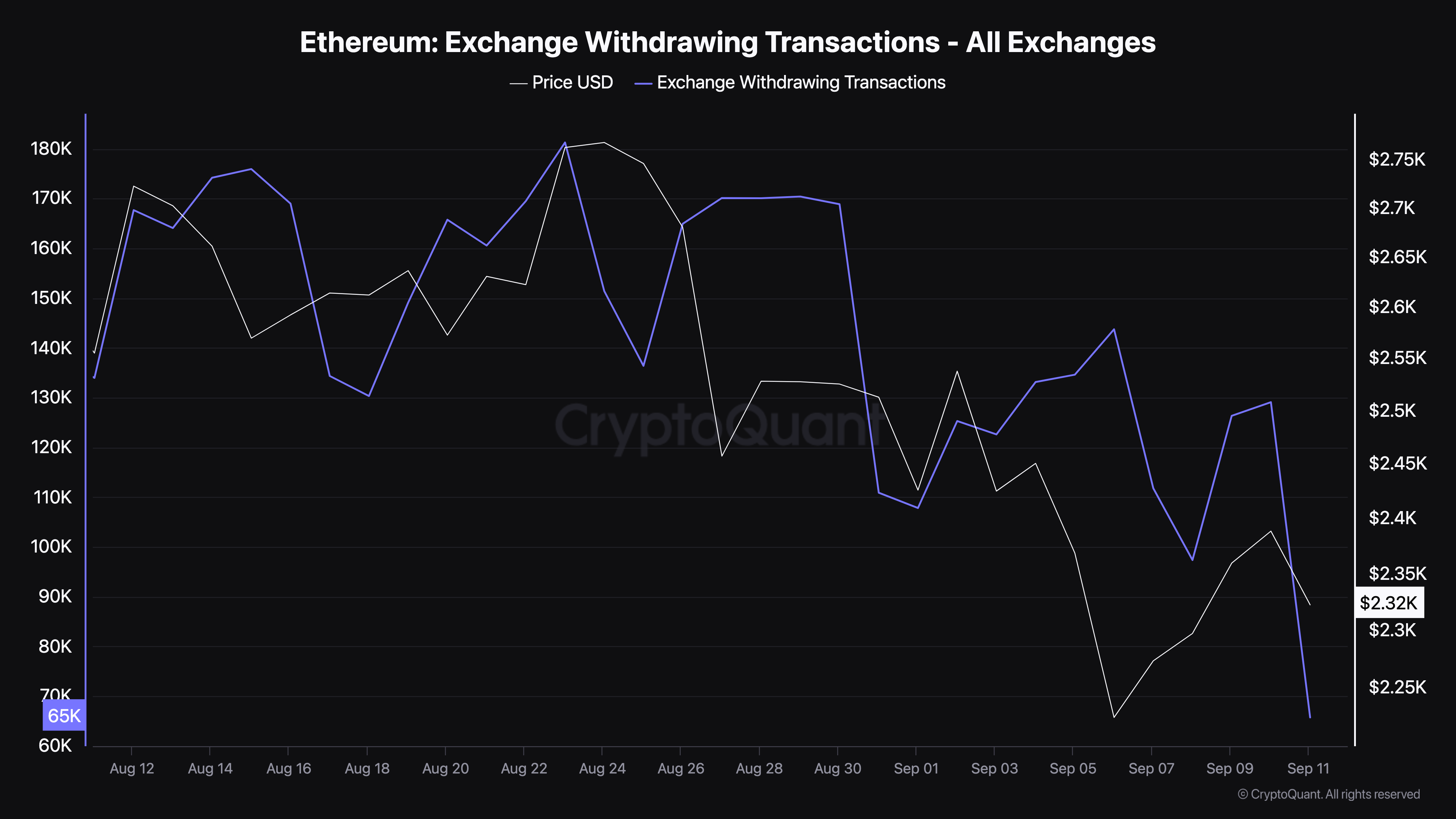

At press time, Ethereum is trading at $2,335, noting an almost 4% decrease over the previous 7 days. CryptoQuant information exposes a significant decrease in the quantity of ETH being taken out from exchanges.

Usually, taking out crypto from exchanges signals long-lasting holding, and when this number is high, it can aid support rates. Nevertheless, the present decrease in withdrawals recommends a greater threat of cost decreases, suggesting that even more ETH is being dispersed than gathered.

If this fad lingers, Ethereum’s cost might drop listed below $2,000, as it did a couple of weeks earlier.

ETH Rate Forecast: Bearish Energy Returns

Ethereum’s day-to-day evaluation shows a go back to the sag after a short cost boost. On September 7, ETH saw a surge from $2,223 to $2,388. Nevertheless, the absence of considerable trading quantity assisted quit the higher activity.

Technical signs, consisting of the Relocating Ordinary Merging Aberration (MACD), currently signal bearish energy. The MACD, which determines market energy, recommends that given that Ethereum’s analysis is unfavorable, an additional cost decrease might be on the perspective.

Learn More: Exactly How to Purchase Ethereum (ETH) With a Bank Card: Total Overview

With bearish signals controling, Ethereum’s cost threats one more recession, possibly being up to $2,150. Nevertheless, this expectation might alter if there’s a rise in ETH withdrawals from exchanges, which might revoke the bearish projection.

If withdrawals boost, Ethereum’s cost might increase to $2,680. In the long-term, if ETH holds over $1,911 and purchasing stress reinforces, the altcoin might rally towards $4,587.

Please Note

In accordance with the Count on Task standards, this cost evaluation short article is for informative objectives just and must not be taken into consideration monetary or financial investment suggestions. BeInCrypto is devoted to precise, impartial coverage, yet market problems go through alter without notification. Constantly perform your very own research study and speak with an expert prior to making any kind of monetary choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.