UNITED STATE home-price appreciation remained to reduce in July, a pattern that is anticipated to proceeded via following summertime, according to CoreLogic information launched today.

National home costs were practically level compared to June and increased 4.3% year over year in July. Stationary costs throughout the usually hectic summertime home-buying period are uncommon, CoreLogic reported, as this was just the 2nd time because 2010 that costs really did not boost from June to July. The various other exemption took place in 2022 adhering to a rise in mortgage rates.

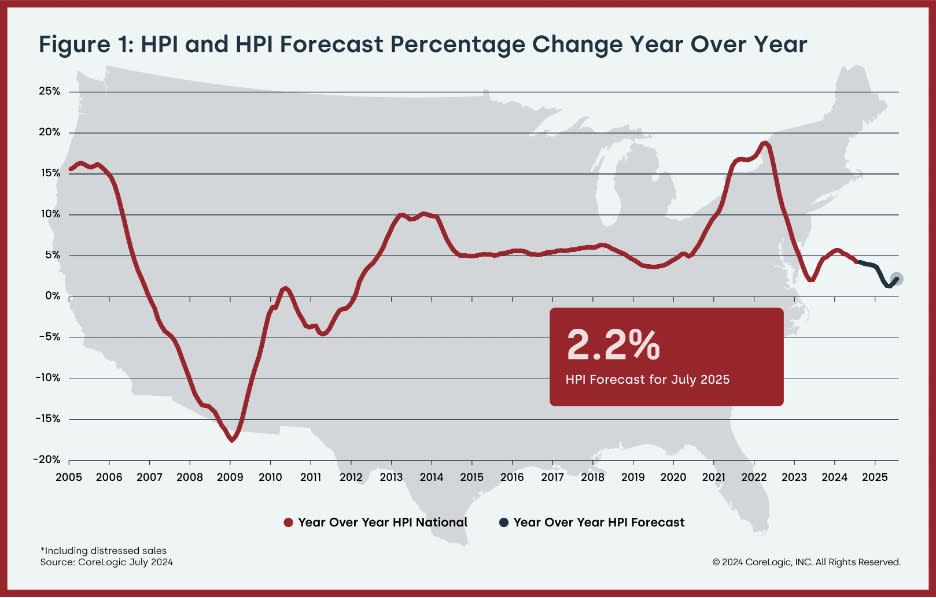

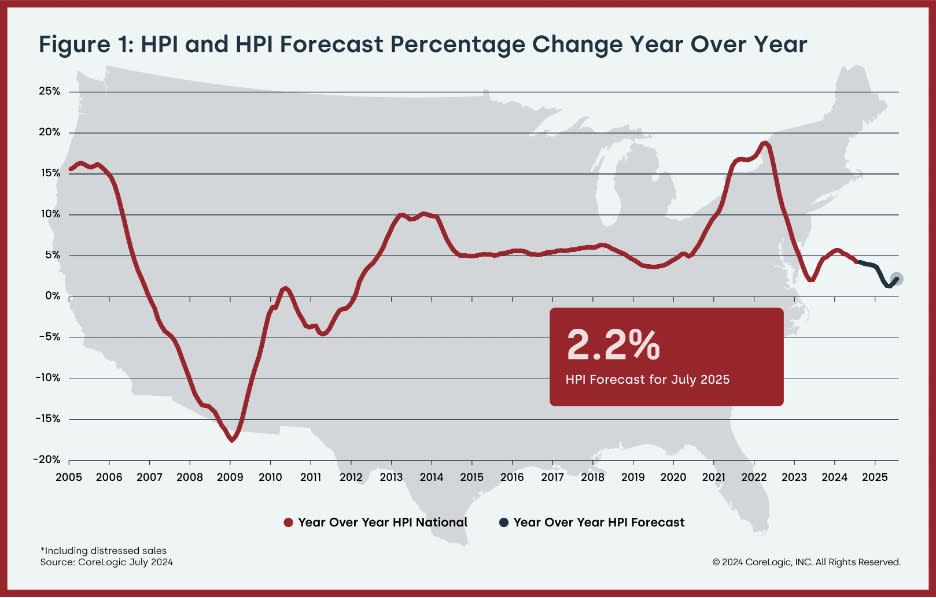

The realty analytics business kept in mind that July noted a 150th straight month of annualized development in home costs, yet these gains slid listed below 5% for a 3rd straight month. In addition, CoreLogic projections substantial slippage in yearly rate admiration with approximated development of 2.2% by July 2025.

” Real estate need remained to give in the stress of high home loan prices and expensive home costs, resulting in a substantial slowing down of home rate gains throughout the summertime,” CoreLogic Principal Financial expert Selma Hepp stated in a declaration.

” The inquiry for home costs moving forward is whether the upcoming rate cut from the Fed and anticipated extension of dropping home loan prices will certainly suffice to encourage prospective property buyers that might begin to be afraid cooling down labor market and proceeded uncertainty of a soft landing, in addition to expectancy around thepresidential election And while reduced home loan prices are an increase to price and are most likely to aid customer need, the normal loss real estate market downturn is upon us and is most likely to have any type of substantial rise in task.”

Some locations of the nation are throwing the nationwide fad. Rhode Island led all states in July with 10.6% year-over-year rate development, adhered to by New Jersey (+9.7%) and Connecticut (8.3%). No states published a rate decrease contrasted to July 2023.

CoreLogic’s evaluation of the 10 biggest united state city locations revealed that Miami blazed a trail with 9.1% rate development for the year finishing in July. It was adhered to by Chicago (+7.2%) and Las Vegas (+7%).

4 of the 5 markets regarded most in jeopardy of a rate decrease over the following year remained in the Southeast. These consist of Atlanta and the Florida city of Gainesville, Hand Bay and Lakeland.

CoreLogic’s nationwide record was strengthened by Brilliant MLS local information launched Wednesday. Home costs in 6 Mid-Atlantic states and the Area of Columbia increased 4.2% year over year in August. Home sales throughout the area were down 0.7% year over year yet were significantly slower in the significant cities of Philly (-3.3%) and Washington, D.C. (-5.1%). The 4,351 sales in D.C. last month were the most affordable for the month of August because 2008.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.