Bitcoin (BTC) and the wider crypto markets are browsing difficult problems, traditionally aggravated by September’s seasonality battles.

In a current record, Kaiko scientists just recently discovered exactly how a possible United States price cut and various other vital financial occasions can influence Bitcoin. These 4 graphes supplied by the experts discuss what to get out of BTC in the coming weeks.

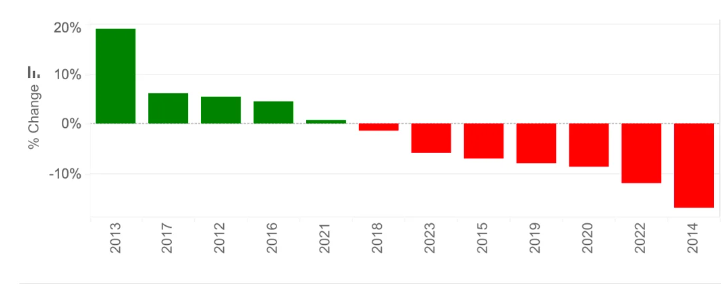

Month-to-month Modification in Bitcoin Rate in September

As BeInCrypto reported, the 3rd quarter has actually traditionally been testing for Bitcoin and the wider crypto market, with September typically supplying the most awful returns. Kaiko highlights that Bitcoin has actually decreased in 7 of the last twelve Septembers.

In 2024, this pattern proceeds, with Bitcoin down 7.5% in August and 6.3% thus far in September. Since this writing, Bitcoin is trading over 20% listed below its current all-time high of virtually $73,500, taped greater than 5 months earlier.

Learn More: How To Buy Bitcoin (BTC) and Everything You Need To Know

Nonetheless, according to Kaiko Study, upcoming United States price cuts can supply an increase to run the risk of possessions like Bitcoin. Bitget Pocketbook COO Alvin Kan shares this position.

” At the Jackson Opening conference, Federal Book Chairman Jerome Powell hinted that it may be time for plan changes, causing assumptions of future rate of interest cuts. The United States Buck Index reacted by going down greatly and is currently rising and fall around 100. With a price reduced in September coming to be an agreement assumption, the main beginning of price reduced trading can boost general market liquidity, supplying an increase to crypto possessions,” Kan informed BeInCrypto.

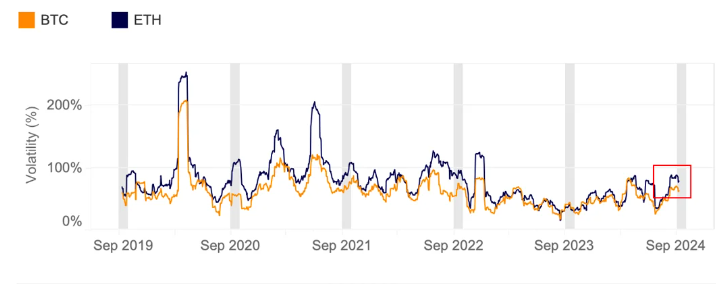

30-day Historic Volatility

According to the record, September is toning up to be very unstable, with Bitcoin’s 30-day historic volatility rising to 70%. This statistics steps the change in a property’s rate over the previous 1 month, showing exactly how substantially its rate has actually relocated within that duration.

Bitcoin’s existing volatility is virtually dual in 2015’s degrees and is coming close to the height seen in March, when BTC struck an all-time high of over $73,000.

Ethereum (ETH) has actually likewise skilled enhanced volatility, going beyond both March’s degrees and Bitcoin’s, driven by ETH-specific occasions such as Dive Trading’s liquidations and the launch of Ethereum ETFs.

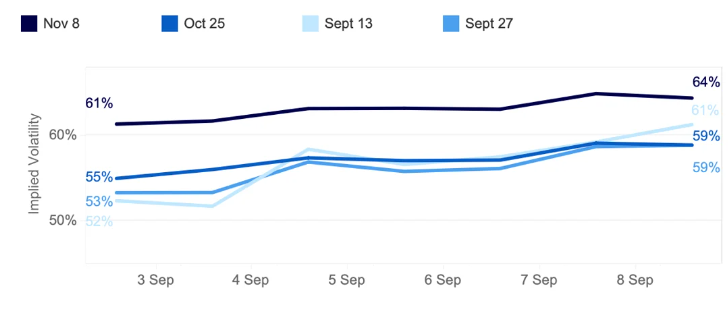

BTC Suggested Volatility by Expiration

Because the beginning of September, Bitcoin’s suggested volatility (IV) has actually increased after dipping in late August. The IV sign steps market assumptions for future rate changes based upon existing alternatives trading task. Greater IV recommends that investors prepare for bigger rate swings in advance, though it does not define the instructions of the relocation.

Especially, temporary alternatives expirations have actually seen the sharpest boost, with the September 13 expiration leaping from 52% to 61%, going beyond end-of-month agreements. For the layman, when temporary suggested volatility surpasses longer-term steps, it suggests enhanced market stress and anxiety, described as an “upside down framework.”

Threat supervisors typically see an upside down framework as a signal of increased unpredictability or market stress and anxiety. Because of this, they might translate this as a cautioning to de-risk their profiles by decreasing direct exposure to unstable possessions or hedging versus prospective disadvantage.

” These market assumptions straighten with recently’s United States tasks record, which moistened wish for a 50bps reduction. Nonetheless, upcoming United States CPI information can still guide the probabilities,” Kaiko scientists keep in mind.

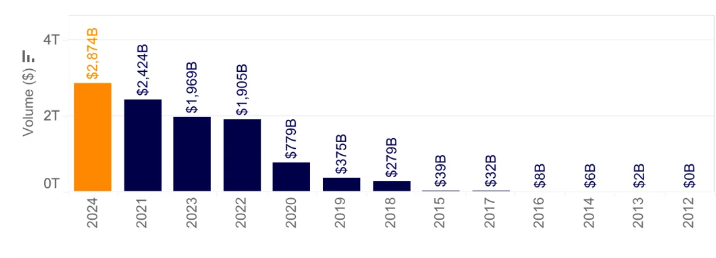

Profession Quantity

The Bitcoin profession quantities graph likewise highlights the existing market volatility, revealing raised investor involvement. Advancing profession quantity is nearing a document $3 trillion, up virtually 20% in the very first 8 months of 2024 after its last height in 2021.

Find Out More: Bitcoin (BTC) Rate Forecast 2024/2025/2030

Commonly, Bitcoin capitalists see a price reduced as a favorable market stimulant. Nonetheless, problems continue to be concerning exactly how the marketplace could translate a larger-than-expected cut. Markus Thielen, creator of 10X Study, warns that a 50 basis factors price cut can be regarded as an indication of seriousness, possibly setting off a resort from threat possessions like Bitcoin.

” While a 50 basis factor reduced by the Fed could indicate much deeper problems to the marketplaces, the Fed’s main emphasis will certainly be mitigating financial threats instead of taking care of market responses,” Thielen stated in a note to customers.

Alongside price reduced conjectures, various other elements adding to crypto market changes consist of the upcoming United States political elections. As BeInCrypto reported, the Donald Trump versus Kamala Harris discussion is anticipated to set off activity, specifically in Bitcoin and Ethereum.

Please Note

In adherence to the Count on Job standards, BeInCrypto is dedicated to objective, clear coverage. This newspaper article intends to supply exact, prompt info. Nonetheless, visitors are recommended to confirm truths separately and seek advice from a specialist prior to making any type of choices based upon this web content. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.