Chainlink (WEB LINK) is getting the focus of market individuals, as shown by its climbing social prominence. Nonetheless, its weakening purchasing stress recommends this might not be a favorable indicator.

An unfavorable aberration has actually arised on web link’s cost graph, which can create it to shed its latest gains.

Chainlink Is the Talk of the Community

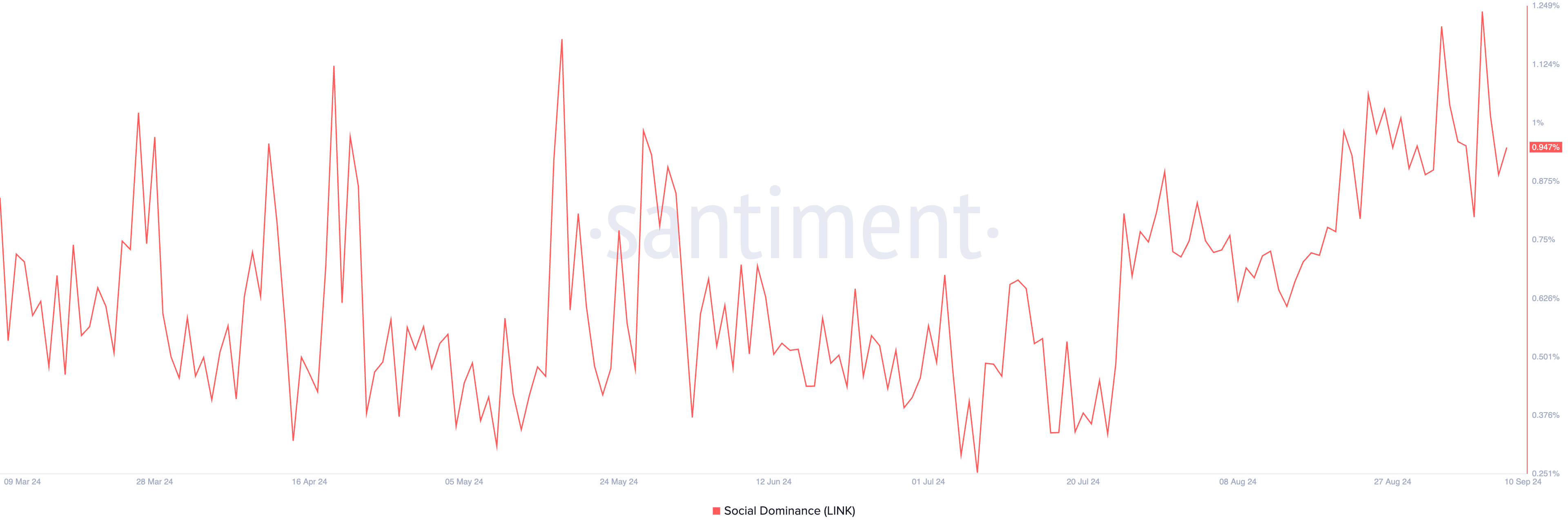

On-chain information from Santiment reveals a spike in web link’s social prominence. On September 7, this shut at a high of 1.24, representing its greatest considering that December 2023.

This statistics tracks a possession’s share of on-line conversations contrasted to the complete discussions around the leading 100 cryptocurrencies by market capitalization. When it rises, it indicates that conversations regarding the possession concerned are instantly a far more substantial component of the general discussions occurring in the crypto market contrasted to previously.

Surprisingly, the uptick in web link’s social prominence has actually taken place in the middle of the decrease in the variety of addresses holding the altcoin because of its cost problems.

Find Out More: Chainlink (WEB LINK) Rate Forecast 2024/2025/2030

Trading hands at $10.47, the altcoin’s worth has actually decreased by 16% considering that August 26, requiring a few of its owners to unload their symbols. The variety of addresses holding web link presently completes 722,000, decreasing progressively considering that August 11.

Web Link Rate Forecast: Bearish Aberration Places Token in jeopardy

In a post on X, an on-chain information carrier kept in mind that Chainlink’s high social prominence, integrated with a decreasing variety of complete owners, is usually a favorable signal if markets support this upcoming week. Nonetheless, a bearish aberration basing on the cost graph counters this overview.

Just recently, web link’s cost has actually seen a mild boost, yet at the very same time, its Chaikin Cash Circulation (CMF) indication has actually been trending downward, signifying a bearish aberration. This recommends that while the cost is climbing, the hidden quantity and cash circulation sustaining the boost are deteriorating, showing a prospective decrease as purchasing stress discolors.

If web link reverses its present uptrend, it can drop back to the $10.25 assistance degree, which it lately damaged over. If bulls fall short to protect this degree, web link’s cost can go down even more, possibly getting to $8.08.

Find Out More: Chainlink (WEB LINK) Rate Forecast 2024/2025/2030

Nonetheless, It will rally to $11.24 if the uptrend is kept, revoking the bearish estimate over.

Please Note

According to the Trust fund Job standards, this cost evaluation short article is for informative functions just and need to not be thought about monetary or financial investment suggestions. BeInCrypto is devoted to precise, honest coverage, yet market problems undergo alter without notification. Constantly perform your very own study and talk to a specialist prior to making any kind of monetary choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.