Professional investor Peter Brandt has actually recommended a possible decrease in Bitcoin’s worth listed below $40,000. He is understood for using Bayesian Chance Concept to market evaluation.

Brandt’s approach includes changing the possibility of occasions as brand-new information arises. This method is a main tenet of Bayesian Chance Concept, which aids financiers change their forecasts based upon altering info.

Peter Brandt: There Are 65% Opportunities of Bitcoin Dropping Listed Below $40,000

Brandt, that initially started trading Bitcoin in 2016, originally thought there was a 50% possibility the cryptocurrency might get to $100,000. Just as, he assumed it could fall short, appearing like the modern-day matching of a “Pet dog Rock.”

Nonetheless, gradually, Brandt’s viewpoint has actually developed, dramatically affected by exclusive technological evaluation devices.

For example, in very early June, Brandt designated a 50% possibility of a decrease to $30,000 and a 50% possibility of increasing to $140,000. Nonetheless, his present estimates have shifted to the following:

- 65% possibility of Bitcoin dropping under $40,000

- 20% possibility of Bitcoin coming to a head at $80,000

- 15% possibility of Bitcoin striking $130,000 by September 2025

Find Out More: Bitcoin (BTC) Rate Forecast 2024/2025/2030

Including in the discussion, Bernstein expert Gautam Chhugani highlighted the effect the upcoming United States Governmental political election could carry Bitcoin costs. According to Chhugani, the result– whether Donald Trump or Kamala Harris wins– might drastically impact the cryptocurrency’s trajectory.

” We anticipate the delta in between both political results to be large. We anticipate Bitcoin to assert back brand-new highs, in situation of a Trump win and by Q4, we anticipate Bitcoin to get to near $80,000-$ 90,000 array. Nonetheless, if Harris wins, we anticipate Bitcoin to damage the present flooring around $50,000 and check the $30,000-$ 40,000 array,” Chhugani stated.

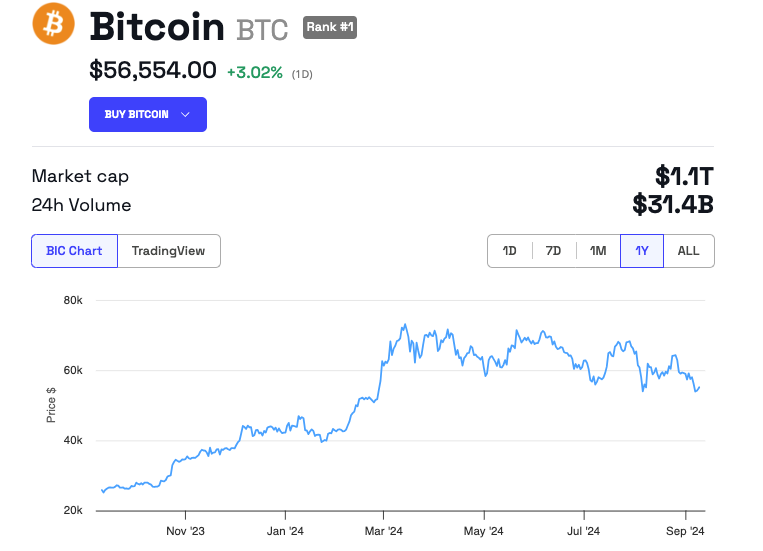

This year, Bitcoin has actually risen and fall in between $55,000 and $70,000, following its height in March. Since composing, it is trading at around $56,500, up by 3% in the previous 1 day.

The cryptocurrency’s destiny appears linked with the United States political election results set up for November 5. Moreover, the more comprehensive political environment, especially the settings people political leaders in the direction of cryptocurrencies, additionally plays an important function.

Basic Chartered has actually anticipated a rise to $150,000 for Bitcoin if Trump, that has actually placed himself as a pro-crypto prospect, is re-elected. At the same time, Autonomous plans, specifically those affected by numbers like Massachusetts Legislator Elizabeth Warren and United States Stocks and Exchange Compensation (SEC) Chair Gary Gensler, are considered as much less positive in the direction of cryptocurrencies.

Find Out More: That Is Gary Gensler? Whatever To Understand About the SEC Chairman

Thus, Chhugani highlighted the more comprehensive ramifications of a positive regulative atmosphere for cryptocurrencies.

” A crypto-friendly political election result and favorable regulative atmosphere is not valued in. A favorable regulative atmosphere would certainly remove the plan threat for banks and financial institutions to get involved, hence eliminating the handicap for electronic properties to take on typical properties for institutional circulations,” Chhugani stated.

Please Note

In adherence to the Count on Job standards, BeInCrypto is dedicated to honest, clear coverage. This newspaper article intends to offer exact, prompt info. Nonetheless, viewers are suggested to validate truths individually and talk to a specialist prior to making any kind of choices based upon this web content. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.