Solana (SOL) stood out from a whale address very early Tuesday early morning, with the huge owner buying 34,807 coins valued at over $4 million in a solitary purchase.

This purchase caused a 4.26% spike in SOL’s rate and a 41% rise in trading quantity over the previous 24 hr.

Solana Whales Adopt Different Techniques

Previously today, a Solana whale acquired 34,807 SOL symbols valued at $4.52 million as component of a continuous build-up technique. Given that February, the whale has actually taken out around 207,000 SOL, worth over $29 million, right into self-custody. Complying with Tuesday’s purchase, they laid 115,135 SOL symbols, completing $15.3 million.

On the other hand, an additional whale has actually taken an extra bearish technique. On-chain sleuth Lookonchain, using a collection of posts on X, tracked this whale’s constant marketing practices.

On Tuesday, the address marketed 20,000 SOL symbols, valued at $2.66 million. Given that the start of the year, this whale has actually marketed 715,000 SOL, worth concerning $102 million. Regardless of these sales, the whale still holds a considerable risk of 1.84 million SOL, valued at about $246 million.

Learn More: Solana (SOL) Cost Forecast 2024/2025/2030

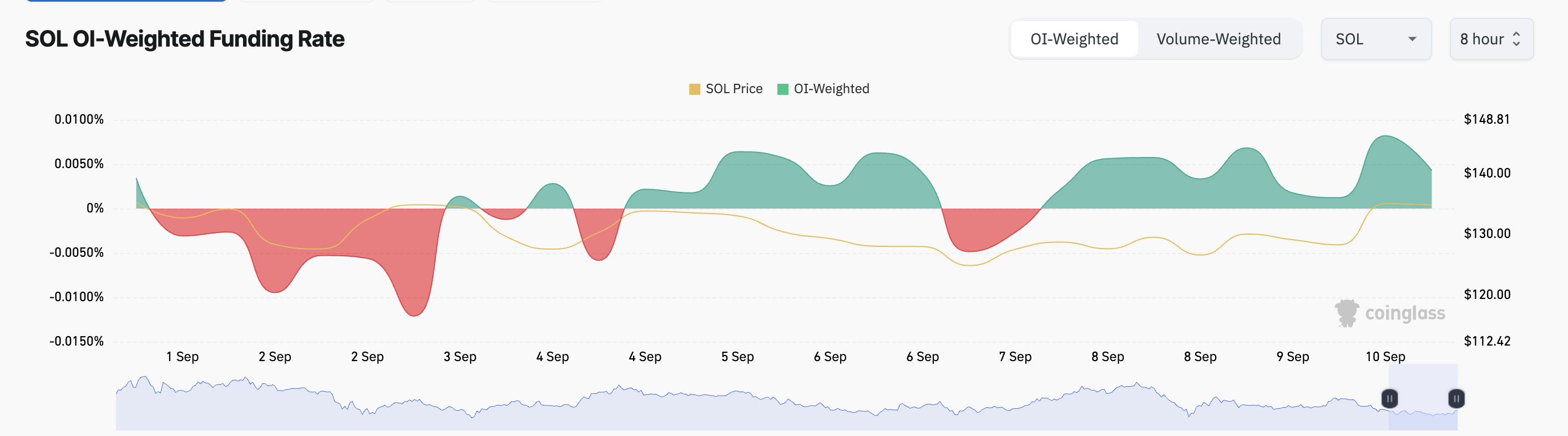

In the middle of these different whale tasks, SOL’s worth has actually increased by 5% over the previous 24 hr, showing enhanced market task. In the by-products market, trading quantity rose by 35% as individuals took extra lengthy placements. According to Coinglass information, SOL’s financing price throughout cryptocurrency exchanges has actually stayed favorable because the weekend break, standing at 0.0043% at press time.

A favorable financing price, utilized in continuous futures agreements to maintain costs straightened with area costs, shows greater need for lengthy placements. This recommends that even more investors are collecting SOL in expectancy of a rate rally than those banking on a decrease.

SOL Cost Forecast: Coin Eyes 17% Uptick

At its present rate of $135.197, SOL rests somewhat over its temporary term resistance at $133.37. Its increasing Loved one Toughness Index (RSI) shows a stable uptick in the need for the altcoin.

If this need lingers, SOL’s rally will proceed. The coin’s rate might leap 17% to $159.90.

Learn More: 11 Leading Solana Meme Coins to View in August 2024

Nonetheless, if profit-taking increases, SOL might shed a few of its current gains, possibly going down to $109.66. The last time SOL traded at this degree got on August 5, when over $1 billion in sold off placements left the marketplace.

Please Note

According to the Depend on Job standards, this rate evaluation short article is for educational functions just and ought to not be taken into consideration economic or financial investment guidance. BeInCrypto is dedicated to exact, objective coverage, however market problems go through alter without notification. Constantly perform your very own study and talk to a specialist prior to making any kind of economic choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.