Telehealth firm Hims & & Hers Wellness ( NYSE: HIMS) has actually been excellent for financiers this year by virtually any kind of requirement; share costs have actually almost increased from a year earlier. Yet investors aren’t really feeling the pleasure. The supply is down almost 45% given that coming to a head in June, and the unfavorable energy is considering on financiers. The marketplace is unexpectedly examining whether the firm can be successful.

One issue being elevated is that deep-pocketed Amazon currently provides telehealth remedies. Does Hims & & Hers stand an opportunity? An additional issue is that the Ozempic lack will ultimately finish, and financiers are worrying regarding what that may suggest for Hims & & Hers.

These shedding concerns require solutions, which can just drop by taking a much deeper study this supply’s financials. Below is what you require to recognize.

The GLP-1 buzz has actually left the supply

Hims & & Hers is a consumer-facing telehealth firm that provides clinical examinations and recommends medicines and various other items for numerous health-related problems, consisting of sex-related health and wellness, skin care, loss of hair, weight monitoring, psychological health and wellness, and extra. Currently, the marketplace seems infatuated on GLP-1 fat burning medications like Ozempic as a make-or-break possibility for the firm. Certain, Hims & & Hers offers compounded semaglutide to take advantage of the continuous Ozempic lack.

Nevertheless, as I have actually formerly created, the GLP-1 sector is just a tiny item of the Hims & & Hers tale. The supply has actually proceeded dropping because that write-up appeared last month, so I wished to adhere to up. Hims & & Hers revealed its GLP-1 launch on May 20, 2024. Today, the supply professions listed below where it was the day prior to this statement:

It’s uncertain when the Ozempic lack will certainly finish and whether Hims & & Hers will certainly be allowed to generate compounded semaglutide then. Nevertheless, you can suggest it does not matter currently. The supply rate has actually dropped a lot that it resembles the GLP-1 buzz train never ever left the terminal. Keep in mind that Hims & & Hers did $315.6 million in Q2 sales; about $15 million originated from GLP-1s.

Is the Amazon hazard genuine?

Competitors is one more prominent debate versus Hims & & Hers supply. Much more particularly, ecommerce large Amazon has actually released its telehealth item, Amazon One Medical, throughout the USA. You need to value a rival like Amazon, though the plain reference of the firm possibly contending in the very same market has actually come to be a supply rate depressor. Rather, financiers should be wondering about: Is Amazon a real hazard today?

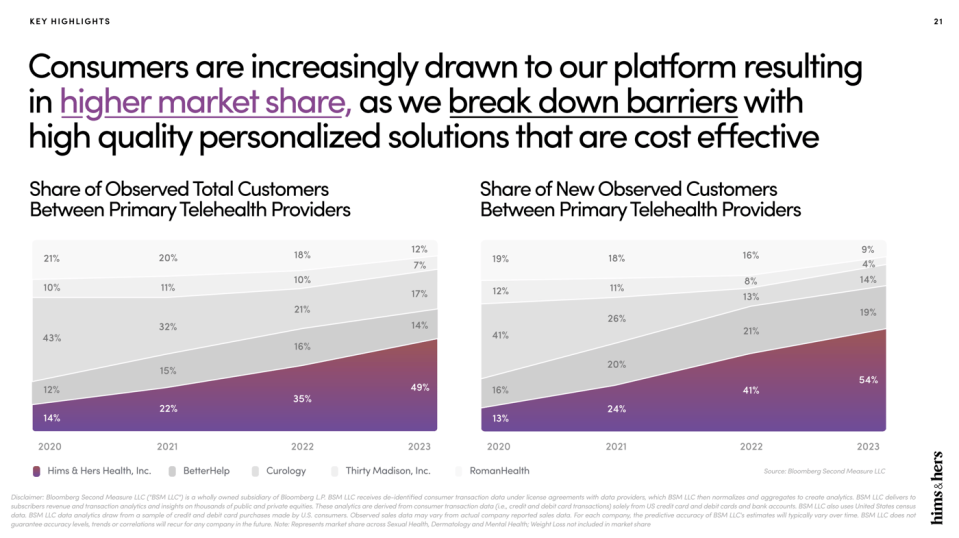

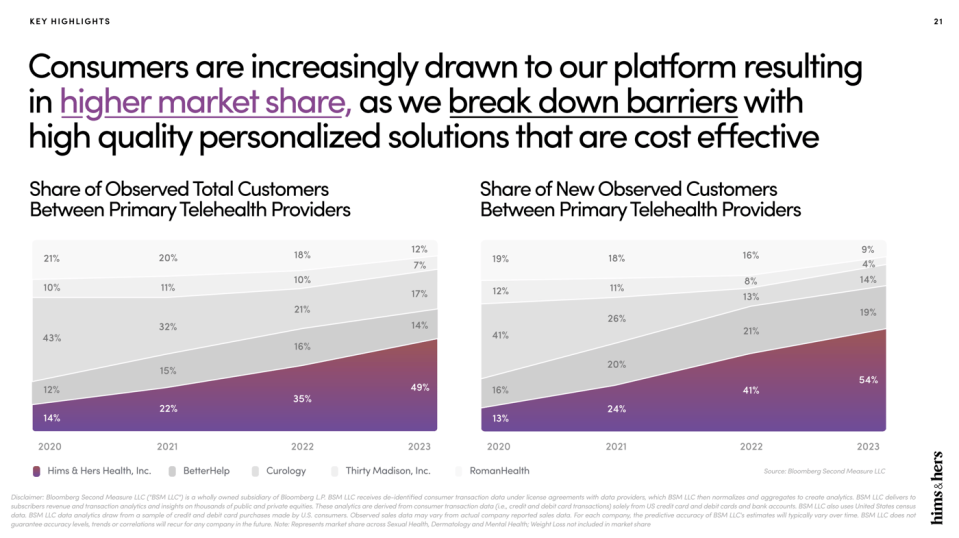

It’s difficult to state. The truth is that Hims & & Hers has actually currently dealt with down lots of competitors given that its begin. The firm also released market-share information highlighting exactly how it has actually grown versus comparable contending firms:

Sure, Amazon can supply examinations and recommend items. McDonald’s began marketing coffee to take on Starbucks For some, a more affordable, standard item triumphes. Others choose the costs brand name and individualized coffee. I see a comparable vibrant in between Hims & & Hers and Amazon. Amazon may record some market sections, while Hims & & Hers remains to love those that desire a much more customized and superior experience.

It appears early to think Amazon will certainly delve into the battle royal and clean Hims & & Hers out just since it is Amazon. Amazon released across the country protection in August in 2014; Hims & & Hers expanded income by 52% year over year in its latest quarter. It appears Hims & & Hers is, in the meantime at the very least, doing simply great.

Is the supply a buy?

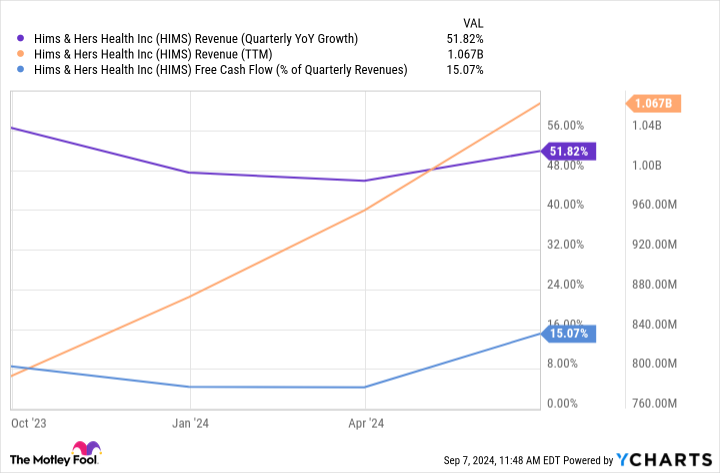

So if GLP-1s do not matter much to the supply, exactly what are financiers obtaining with Hims & & Hers? Many individuals are concentrated on GLP-1s that they neglect exactly how excellent a company Hims & & Hers is coming to be:

The firm has actually exceeded $1 billion in yearly income (with basically absolutely no GLP-1 payment) and is still expanding at over 50%. At the same time, productivity is swiftly boosting; the firm transformed 15% of its Q2 sales to free cash flow and is currently lucrative according to normally approved accountancy concepts (GAAP). With $227 million in cash money and absolutely no financial debt, those earnings are going down right to the base of the annual report.

Experts think Hims & & Hers will certainly gain $0.57 per share this year and $0.80 following year. That costs the supply at 17 times following year’s incomes, which appears mind-bogglingly inexpensive since incomes can rise as a result of a powerful mix of income development and running utilize (sales expand faster than costs, enhancing earnings).

I can be incorrect. Maybe Amazon will certainly injure Hims & & Hers’s development, or the GLP-1s issue greater than they appear to. Nevertheless, the prospective benefit is so high, and the appraisal is so reduced, that it resembles a piece of cake to consist of Hims & & Hers as a speculative supply in a varied profile.

Should you spend $1,000 in Hims & & Hers Wellness today?

Prior to you get supply in Hims & & Hers Wellness, consider this:

The Supply Consultant expert group simply recognized what they think are the 10 best stocks for financiers to get currently … and Hims & & Hers Wellness had not been among them. The 10 supplies that made it can generate beast returns in the coming years.

Take Into Consideration when Nvidia made this listing on April 15, 2005 … if you spent $1,000 at the time of our referral, you would certainly have $630,099! *

Supply Consultant supplies financiers with an easy-to-follow plan for success, consisting of advice on constructing a profile, normal updates from experts, and 2 brand-new supply choices every month. The Supply Consultant solution has greater than quadrupled the return of S&P 500 given that 2002 *.

* Supply Consultant returns since September 9, 2024

John Mackey, previous chief executive officer of Whole Foods Market, an Amazon subsidiary, belongs to The ‘s board of supervisors. Justin Pope has placements in Hims & & Hers Wellness. The has placements in and suggests Amazon and Starbucks. The has a disclosure policy.

Is Hims & Hers Health Stock a Buy? was initially released by The

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.