Goldman Sachs planners have actually considered in on the present state of the United States stock exchange, forecasting that a bearishness– a decrease of 20% or even more– is not likely.

Regardless of high assessments, blended development potential customers, and sticking around plan unpredictability, the group led by Christian Mueller-Glissmann highlights the toughness of the economic sector. It expects helpful steps from the Federal Get as essential aspects protecting against a market dive.

Bearish Market Unlikely, Yet Crypto Does Not Look Excellent

Mueller-Glissmann’s evaluation draws from historic patterns. Because the 1990s, the regularity of considerable slumps in the S&P 500 has actually lowered. This schedules partly to longer company cycles, minimized macroeconomic volatility, and positive treatments by reserve banks. These aspects develop a barrier that lessens the danger of a deep bearish market.

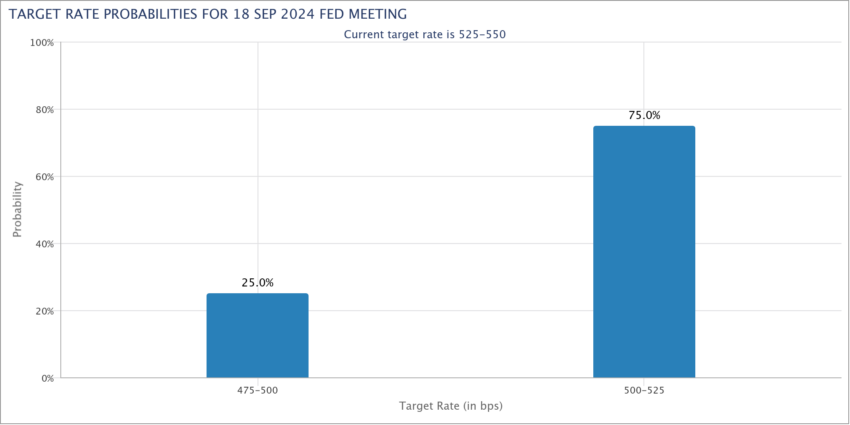

Furthermore, Goldman Sachs anticipates the Federal Get to start reducing rate of interest, which might relieve some stress on the marketplaces. While the stock exchange might still see a dip by year-end, the general overview stays meticulously positive.

The planners preserve a neutral position on possession appropriation yet bring a “gently pro-risk” sight for the following year.

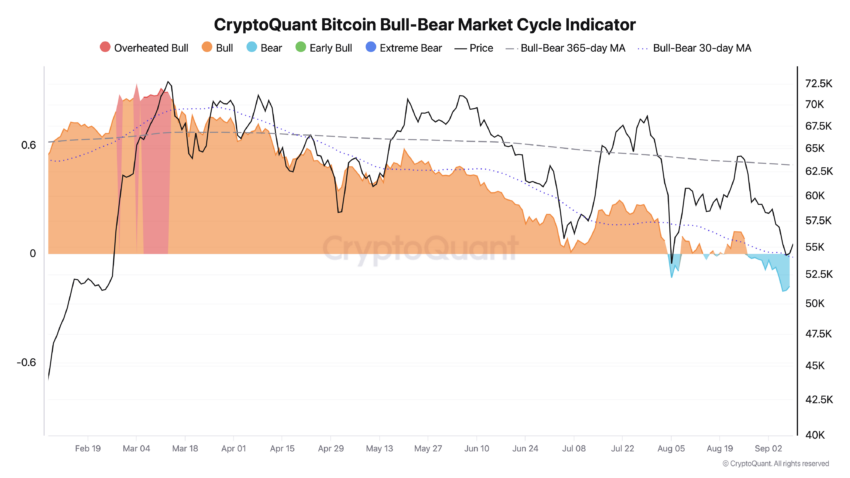

As opposed to the stock exchange overview, the cryptocurrency market is revealing indications of a prospective bearish market. Julio Moreno, Lead Expert at CryptoQuant, keeps in mind that Bitcoin is having a hard time as a result of decreasing need.

” All appraisal metrics remain in bearish area,” Morenosaid

Learn More: Bitcoin (BTC) Cost Forecast 2024/2025/2030

Expert investor Peter Brandt includes that there’s a 65% possibility Bitcoin might go down listed below $40,000, though he stays positive regarding a long-lasting cost rise, possibly getting to $130,000 by 2025.

” In very early June I was designating a 50% possibility of $30,000 (roughly a 50% cost decrease) and a 50% possibility of $140,000 (roughly an increasing of cost). Because June my technological cost indications have actually been accumulating for the $30,000 possibility,” Brandt stated.

To conclude, while the United States stock exchange shows up resistant, the cryptocurrency industry might deal with headwinds as financiers browse unpredictable financial waters.

Please Note

In adherence to the Count on Task standards, BeInCrypto is devoted to impartial, clear coverage. This newspaper article intends to supply precise, prompt details. Nevertheless, viewers are encouraged to validate truths individually and talk to a specialist prior to making any type of choices based upon this material. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.