State Road Global Advisors and Galaxy Property Administration have actually presented 3 brand-new crypto-focused exchange-traded funds (ETFs), in spite of current hefty discharges from comparable financial investment items.

Recently released ETFs will certainly begin trading on Tuesday, according to a declaration.

Galaxy, State Road Present 3 Crypto ETFs

State Road Global Advisors and Galaxy Property Administration have actually released 3 brand-new ETFs– SPDR Galaxy Digital Property Ecological Community ETF (DECO), SPDR Galaxy Hedged Digital Property Ecological Community ETF (HECO), and SPDR Galaxy Transformative Technology Accelerators ETF (TEKX)– focused on providing financiers direct exposure to the blockchain market while taking care of volatility.

Rather than holding cryptocurrencies straight, these brand-new funds will certainly buy shares of crypto-related business and various other ETFs that hold physical Bitcoin or Bitcoin futures.

” Some financiers are reluctant regarding the temporary cost swings of specific cryptocurrencies. Our company believe the following action in this market is the intro of proactively handled electronic possession profiles,” said Anna Paglia, Principal Company Police Officer for State Road Global Advisors.

Find Out More: Just how to Purchase Ethereum ETFs?

The DECO ETF concentrates on business taking advantage of blockchain and cryptocurrency fostering, such as Bitcoin miners Core Scientific, Hut 8, and Terawulf. It additionally consists of conventional financing business like Meta and Visa, in addition to holdings in Integrity’s FBTC place Bitcoin ETF.

HECO has a comparable profile however changes Meta and FBTC with BlackRock and BlackRock’s IBIT place Bitcoin ETF shares. To take care of volatility, HECO includes protected telephone call and safety put choices. TEKX targets business associated with turbulent modern technologies, consisting of blockchain and expert system, while additionally holding some United States buck placements.

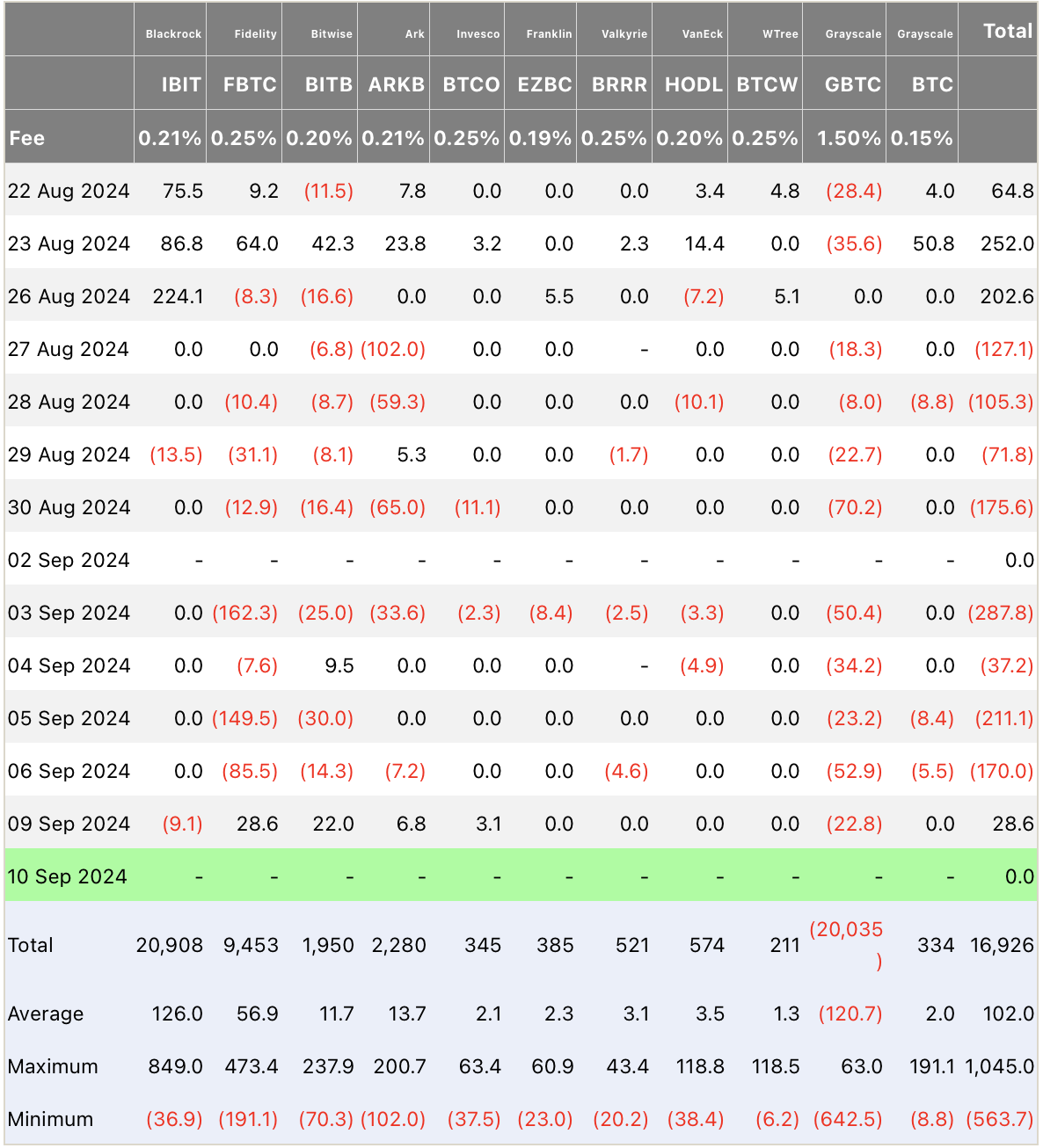

The timing of the brand-new ETFs launch is much less than suitable. As BeInCrypto lately reported, crypto financial investment items saw discharges of $726 million recently, the highest possible given that March. Bitcoin (BTC) led the discharges with $643 million, complied with by Ethereum with $98 million in withdrawals.

Nonetheless, today noted the very first day of place Bitcoin ETF inflows after 8 successive days of discharges, with a moderate $28.7 million inflow.

Find Out More: Just how To Profession a Bitcoin ETF: A Step-by-Step Technique

CoinShares experts ascribe the adverse circulations to price reduced unpredictability. This complied with recently’s weak work record and various other United States financial information, which left investors and financiers mindful regarding future market problems.

” This adverse view was driven by macroeconomic information from the previous week, which boosted the possibility of a 25 bp rate of interest reduced by the United States Federal Book. Nonetheless, day-to-day discharges reduced later on in the week as work information disappointed assumptions. The marketplaces are currently waiting for Tuesday’s CP|rising cost of living record, with a 50bp cut more probable if rising cost of living is available in listed below assumptions,” checked out the record.

Please Note

In adherence to the Count on Job standards, BeInCrypto is devoted to honest, clear coverage. This newspaper article intends to give exact, prompt info. Nonetheless, visitors are suggested to confirm realities individually and seek advice from a specialist prior to making any type of choices based upon this material. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.