The home mortgage market has actually grumbled loudly and often that federal government law and capitalist demands are adding to spiraling prices that obtain handed down to customers. And Rohit Chopra, the hard-charging supervisor of the Consumer Financial Protection Bureau, that is typically the target of such grievances, obviously concurs. A minimum of when it pertains to redundancies with refinancings, that is.

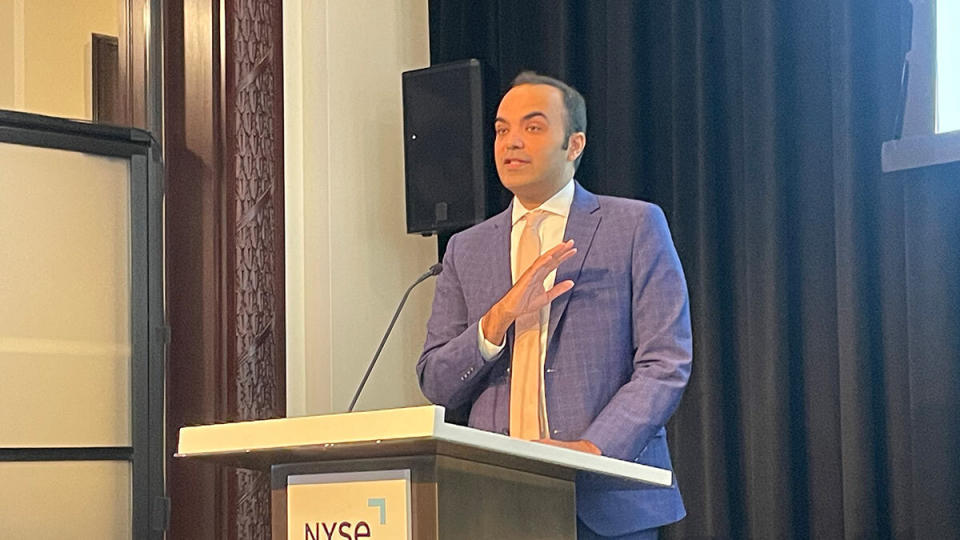

” We actually believe closing prices can be a considerable barrier to refinancing,” Chopra stated at an AI and modern technology seminar collectively held by ICE Mortgage Technology and the National Housing Conference at the New York Supply Exchange on Monday. “They can amount to numerous portion factors of the complete home mortgage quantity. This suggests it will not make good sense for consumers to re-finance unless the deal rates of interest is considerably less than their present price.”

In his keynote address, Chopra indicated the closing costs that consumers can not go shopping as perpetrators– credit scores records, FICO scores, employment verification andlender’s title policy However he likewise mentioned that particular redundancies are under the microscopic lense.

” We’re checking out whether we must ensure adjustments to the present home mortgage guidelines to enhance the procedure and to minimize closing prices,” he stated. “When an existing or contending lending institution is looking for to re-finance a home mortgage with a much reduced price or a significantly comparable quote, it might not be beneficial for the lending institution to duplicate most of the actions that were taken throughout the acquisition procedure.”

He proceeded: “We’re particularly curious about the prices and time required to re-finance a home mortgage that are solely connected to following government home mortgage regulation, as opposed to actions that might be required by capitalists for various other factors. We’re likewise considering recognizing means to start competitors in particular closing price classifications, which can likewise aid stimulate even more task. Third, we’re seeking regulations to speed up the change to open financial with home mortgages in mind.”

The CFPB will certainly be viewing carefully the execution of brand-new home mortgage modern technology, consisting of applications being marketed as using expert system, he stated. There are some unique uses information, consisting of generative A I in numerous phases of the home mortgage procedure, and numerous might stand for jumps that profit lending institutions and customers. However inadequate execution might worsen existing variations and produce brand-new ones, Chopra stated.

Chopra kept in mind that the CFPB recently has actually worked with numerous engineers to determine locations ripe for advancement, yet likewise to prosecute offenses of the regulation.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.