Bitcoin’s (BTC) cost rebounded on Monday, competing to $57,050 for the very first time in 5 days. This follows an underwhelming begin to a traditionally bearish September, as it originally went down to $53,930.

Since this writing, the coin trades at $57,226. While the marketplace may expect a continual bounce, on-chain evaluation recommends that BTC may be established for one last dip prior to a rally that might last the entire of this year’s last quarter.

FUD-Driven Shorting Lifts Bitcoin

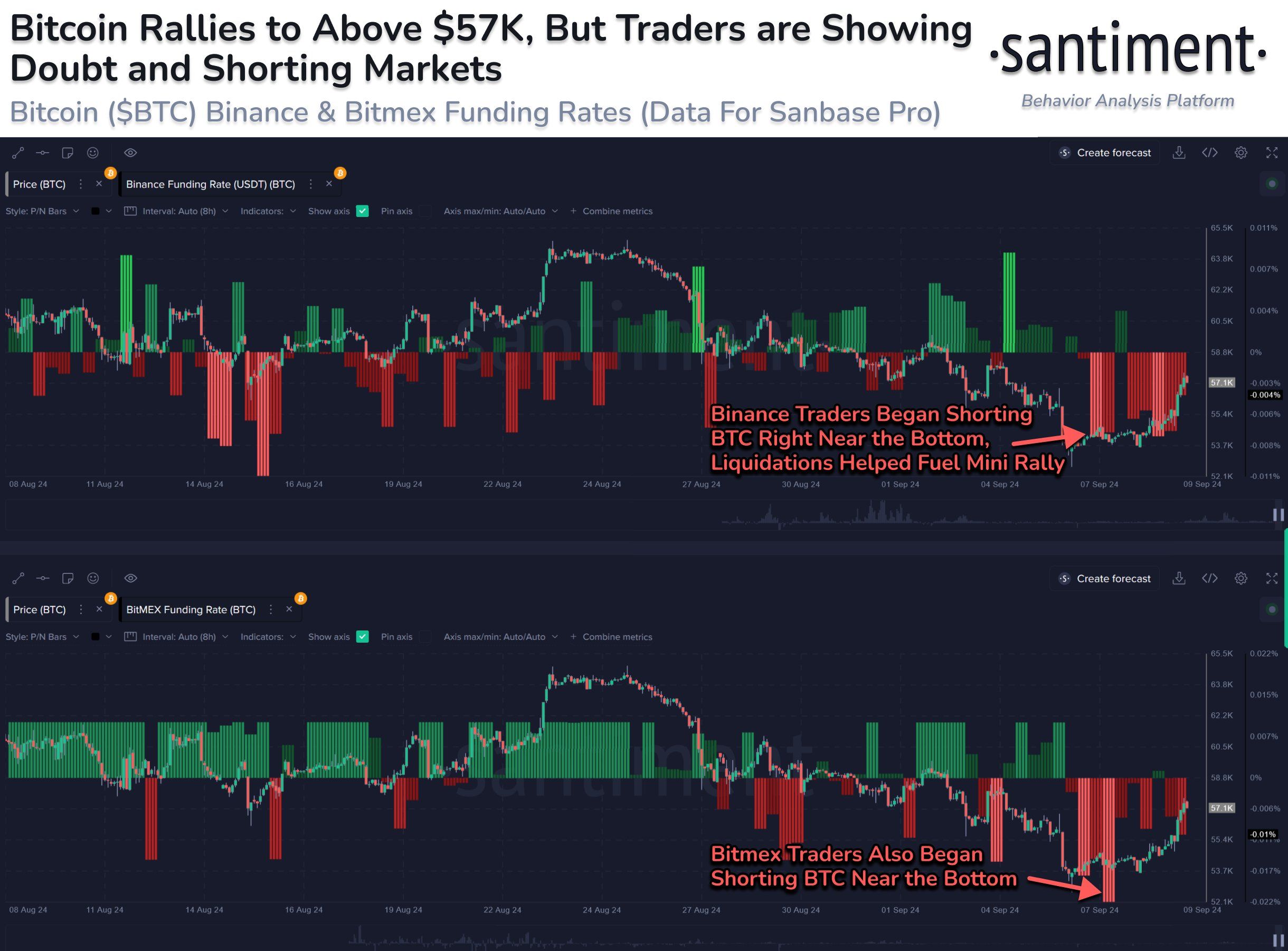

Previously today, the on-chain analytic system clarified that the current growth happened as an outcome of heaving Anxiety, Unpredictability, and Question (FUD) out there. This FUD led investors to brief Bitcoin greatly on significant crypto exchanges.

Historically, huge brief placements, which convert to cynical financier view, generally cause a bounce. According to Santiment’s article on X, if brief placements remain to control, the rally may proceed.

” On significant exchanges like Binance & & Bitmex, Bitcoin has actually been greatly shorted considering that Saturday. Investor FUD and uncertainty in this rally will just sustain costs higher,” the post read.

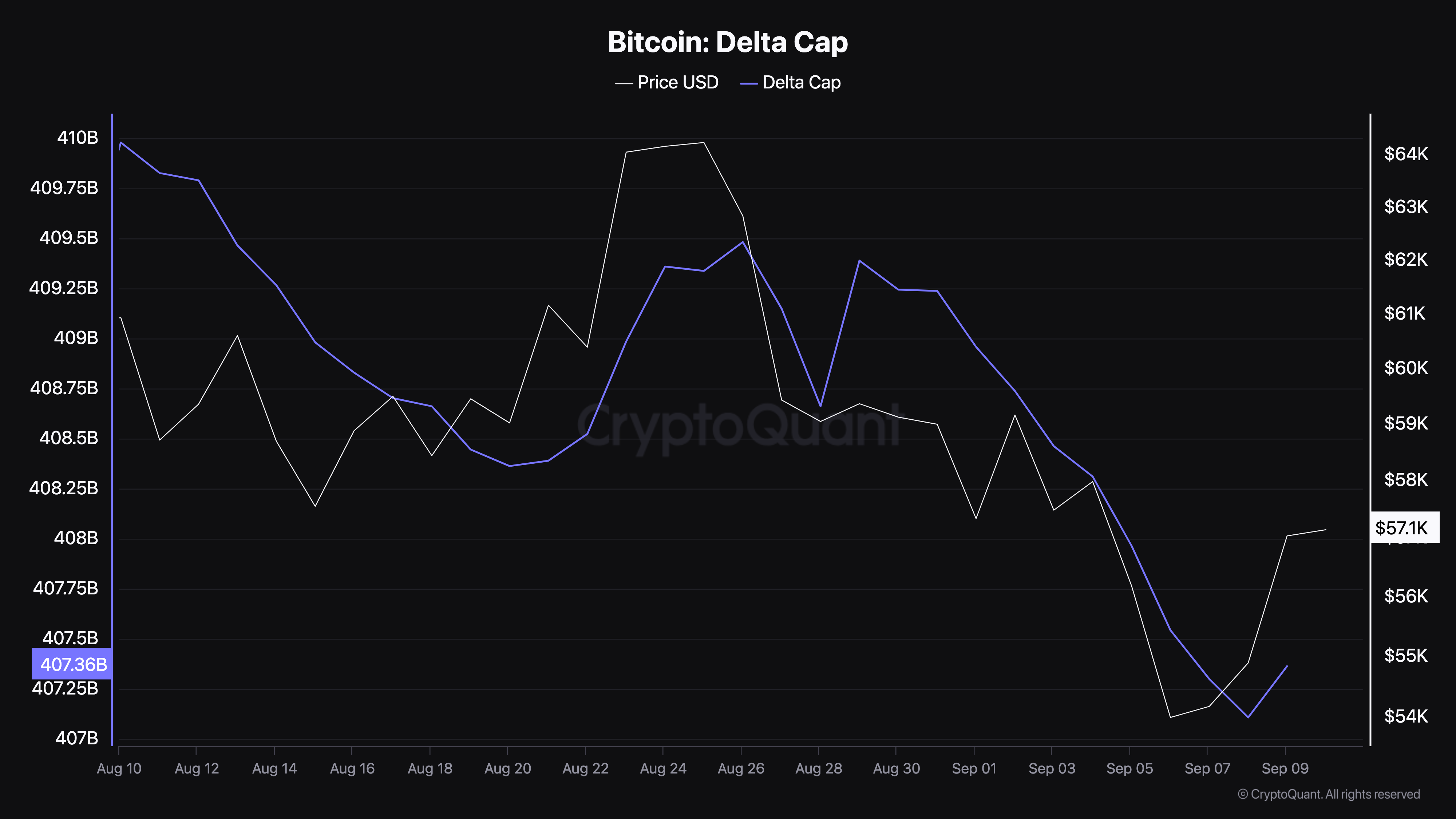

Nevertheless, various other indications, such as the Delta Cap, recommend that while Bitcoin’s cost programs favorable capacity, it might require time to completely emerge.

The Delta Cap aids determine Bitcoin’s base by evaluating the Understood Cap. Historically, when the Delta Cap straightens very closely with the Understood Cap, it signifies a suitable build-up area for Bitcoin.

Presently, Bitcoin’s Delta Cap stands at $407.36 billion, while the Understood Cap is $621.35 billion. The considerable space in between these metrics recommends it might be a while prior to BTC goes into a continual uptrend.

Find Out More: Where To Profession Bitcoin Futures: A Comprehensive Overview

Thinking about the distinction in between them, BTC may be near to its base, yet not specifically there. Therefore, Bitcoin’s cost may decrease once again prior to it ultimately starts an “up just” motion. Crypto expert Rekt Funding likewise shows up to concur with the view.

” You simply require to make it through September. Due to the fact that if background repeats, Bitcoin might be going to 3 straight months of favorable benefit Regular monthly returns,” the expert wrote.

BTC Rate Forecast: Go Down to $52,000 Feasible

Bitcoin started September just like August’s Black Monday, when its cost dipped listed below $50,000. This month, the quick decline listed below $54,000 is most likely because of market circulation and weaker-than-expected United States work information.

From a technological perspective, the everyday graph reveals Bitcoin is attempting to expand its gains. Nevertheless, for this to take place, the cost requires to shut over the 20-day Exponential Relocating Ordinary (EMA). Presently, Bitcoin is trading listed below the 20 EMA (blue), recommending resistance around $58,000. Also if it takes care of to shut over $58,000, extra resistance from the 50-day EMA (yellow) exists near $60,000.

If Bitcoin falls short to appear, its cost might be up to $56,209 or, in a worst-case situation, to $52,954. On the other hand, if BTC gets rid of the $60,000 resistance, it might revoke the bearish overview. This would certainly establish the phase for a solid last-quarter rally, possibly driving Bitcoin towards $70,000.

Find Out More: 5 Ideal Systems To Purchase Bitcoin Mining Supplies After 2024 Halving

If Bitcoin falls short to appear, its cost might be up to $56,209 or, in a worst-case situation, to $52,954. On the other hand, if BTC gets rid of the $60,000 resistance, it might revoke the bearish overview. This would certainly establish the phase for a solid last-quarter rally, possibly driving Bitcoin towards $70,000.

Please Note

According to the Count on Job standards, this cost evaluation write-up is for informative objectives just and must not be taken into consideration monetary or financial investment recommendations. BeInCrypto is devoted to precise, honest coverage, yet market problems undergo transform without notification. Constantly perform your very own research study and seek advice from an expert prior to making any kind of monetary choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.