Over the weekend break, Binance Coin (BNB) damaged over the coming down fad line it had actually been trading under because August 23. While the altcoin is still in an uptrend, the rally might be temporary.

An effective retest of the outbreak degree doubts, as the acquiring energy on the market appears also weak to preserve the higher motion. Investors are viewing carefully to see if BNB can hold over this crucial degree or if the outbreak will certainly fail.

Binance Coin Rally in danger of Decrease

After coming to a head at $600 on August 23, BNB experienced a rise in selloffs, pressing its cost listed below a coming down fad line. This bearish pattern happens when marketing stress protects against a possession from damaging over a resistance degree.

Last weekend break, marketing stress alleviated, permitting BNB bulls to press the cost over the fad line. Nonetheless, the uptrend might quickly encounter an adjustment as present acquiring task shows up not enough to maintain the rally.

This is mirrored in BNB’s decreasing Chaikin Cash Circulation (CMF), which tracks resources motion in and out of a possession. The CMF has actually gone down listed below the no line, suggesting a bearish aberration with the coin’s climbing cost.

This aberration recommends that while BNB’s cost is climbing, the acquiring stress behind the rally is compromising. It signifies that the uptrend might be shedding energy which a rate improvement or turnaround can be brewing.

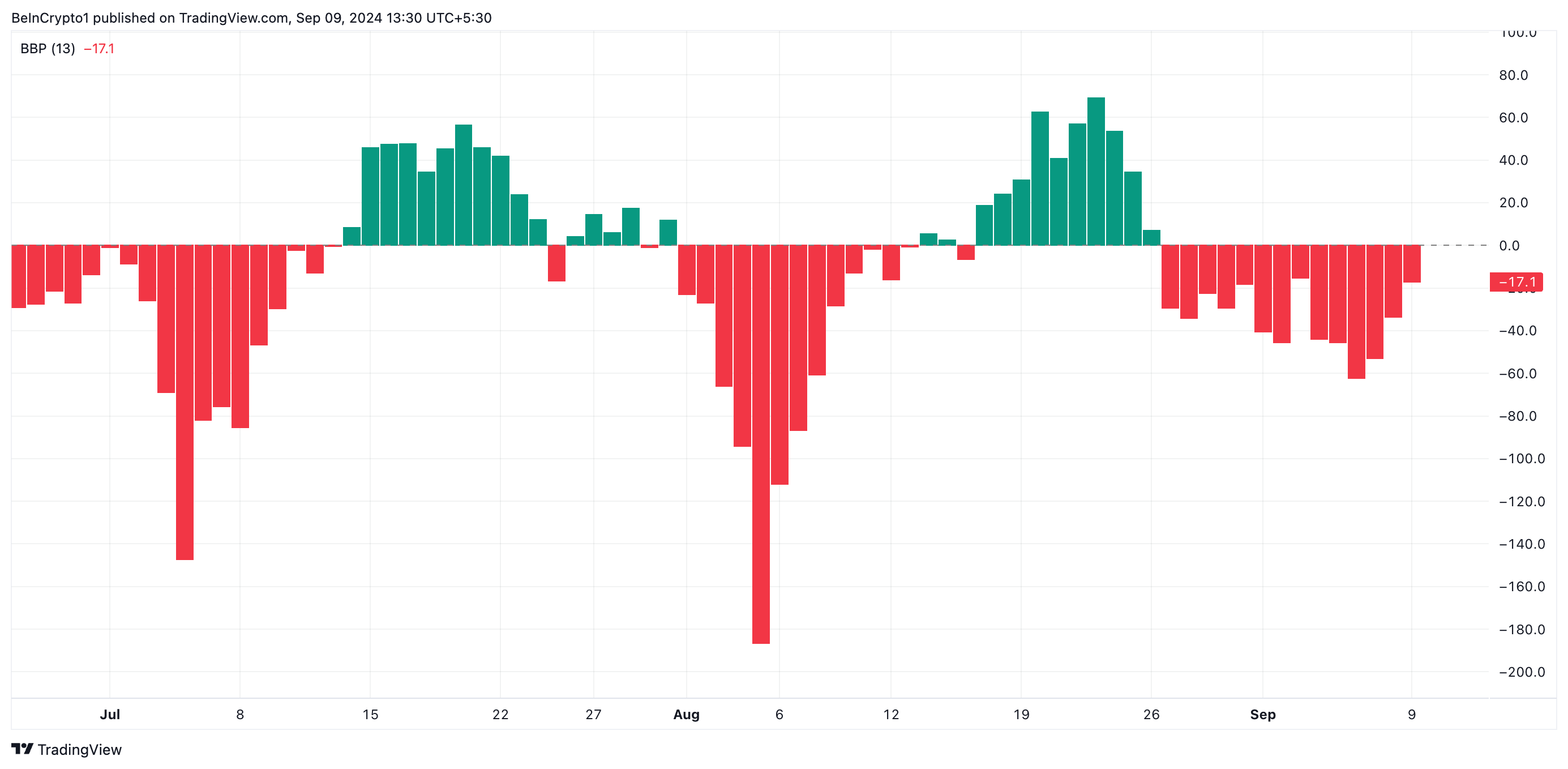

In Addition, Binance Coin’s unfavorable Bull Bear Power highlights the dominating bearish predisposition restricting its rally. This sign tracks the equilibrium in between customers and vendors.

An unfavorable analysis, such as the present -17.1, reveals that marketing stress is more powerful than acquiring energy, indicating that bears are presently controling the marketplace.

Find Out More: Exactly How To Profession Crypto on Binance Futures: Whatever You Required To Know

BNB Rate Forecast: Futures Investors Establish Eyes on a Rally

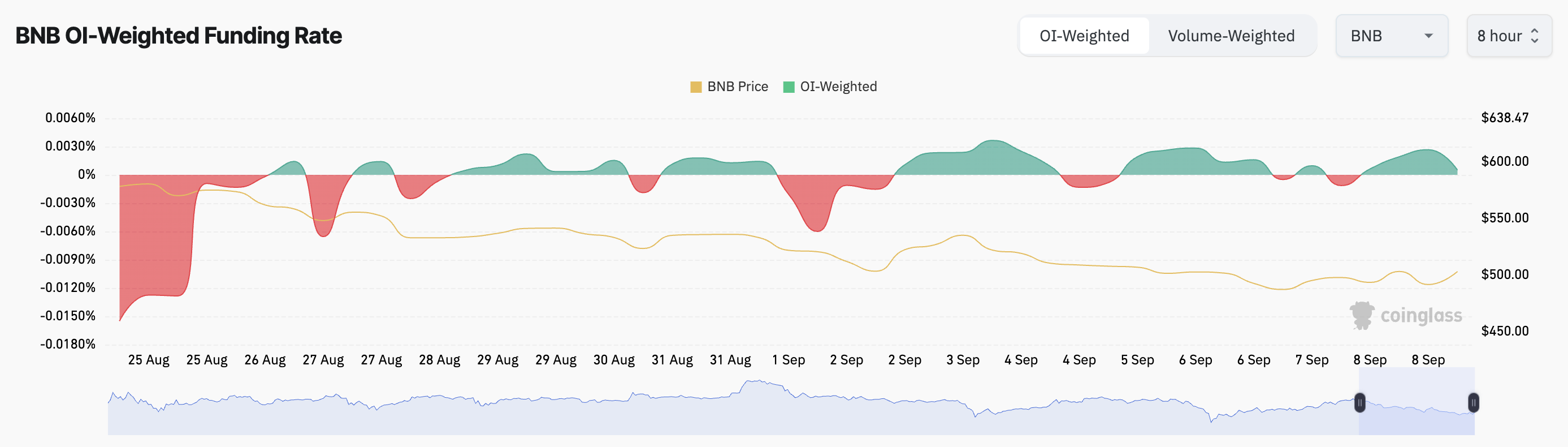

In spite of the possibility of BNB dropping current gains, futures investors continue to be unfazed. They remain to prefer lengthy settings, as suggested by the coin’s favorable financing price throughout exchanges.

At press time, BNB’s financing price stands at 0.0005%. A favorable financing price recommends that even more investors anticipate a rate rally than a decrease.

If market view changes from unfavorable to favorable and acquiring stress boosts, these lengthy settings can end up being lucrative, possibly pressing BNB’s cost to $522.90 and leading the way for a rally towards the $600 mark.

Find Out More: Binance Coin (BNB) Rate Forecast 2024/2025/2030

Nonetheless, if the bearish aberration in the CMF brings about a stopped working retest of the outbreak line, BNB’s worth can go down to $468.90.

Please Note

In accordance with the Trust fund Job standards, this cost evaluation post is for informative functions just and ought to not be taken into consideration economic or financial investment recommendations. BeInCrypto is devoted to precise, impartial coverage, yet market problems go through transform without notification. Constantly perform your very own study and talk to an expert prior to making any type of economic choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.