In the middle of expanding volatility and down stress in the cryptocurrency market, a brand-new Bitcoin (BTC) rate forecast has actually emerged. Digital possession investment company 10x Study recommends that Bitcoin’s worth might go down to $45,000.

In the company’s record, Markus Thielen, Head of Study, lays out numerous aspects sustaining this projection. BeInCrypto even more discovers this opportunity by examining vital on-chain metrics in its evaluation of Bitcoin’s existing expectation.

Trick Factors for the Modification in Bitcoin Projection

Bitcoin rate presently trades listed below $55,000 regardless of striking a brand-new all-time high of $73,750 in March. According to 10x Study, this considerable adjustment was anticipated because of adjustments in Bitcoin’s energetic addresses and wider market choices.

” Bitcoin addresses came to a head in November 2023 and greatly decreased after the very first quarter of 2024. When the quantity of Bitcoin held by temporary owners started to lower in April, while long-lasting owners made use of high rates to leave, it recommended that a cycle top had actually been gotten to,” the research study firm explained.

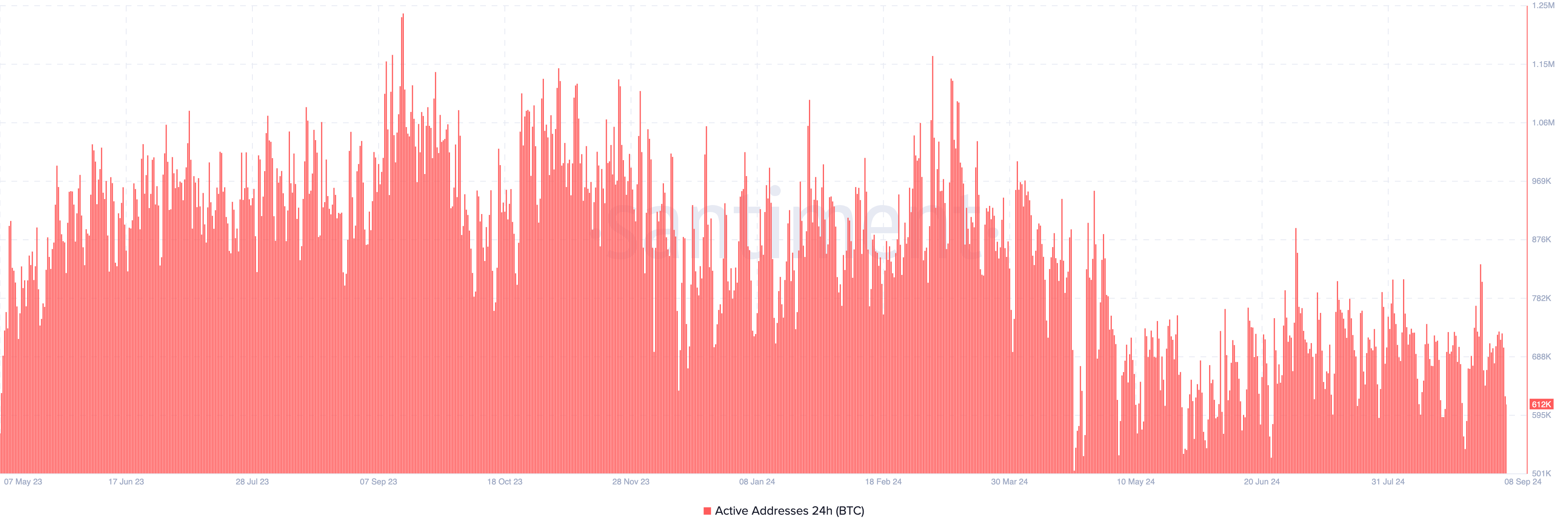

BeInCrypto evaluated Bitcoin’s energetic addresses information and discovered the evaluation to be exact. In November 2023, energetic addresses amounted to around 1.20 million, and by March, the number still went beyond 1 million.

Find Out More: 7 Ideal Crypto Exchanges in the U.S.A. for Bitcoin (BTC) Trading

Nonetheless, the variety of energetic addresses has actually because been up to 612,000, indicating that thousands of countless individuals have actually quit involving with the cryptocurrency. This sharp decrease highlights decreased task on the Bitcoin network, recommending a weakening passion or involvement in current months.

Aside From that, the record stated the $1 billion Bitcoin ETF discharges today as a bearish indicator. It additionally identified the weak United States economic climate and substantial futures liquidation as various other factors that might drive BTC to $45,000.

Information from Glassnode reveals that the Mayer Numerous appears to concur with the rate decline. Typically utilized to recognize speculative bubbles in Bitcoin, a Mayer Numerous analysis over 1 usually indicates a favorable market pattern.

When the statistics drops listed below this limit, the cryptocurrency ends up being a lot more susceptible to a noteworthy decrease. At press time, the Mayer Numerous stands at 0.8, and Bitcoin’s rate continues to be listed below the 200-day EMA, suggesting that BTC might encounter one more decline listed below $50,000.

BTC Cost Forecast: $50,000 Is Important

According to the once a week BTC/USD graph, investors started this month around the exact same rate degrees seen in November 2021, prior to the Bitcoin bearish market of 2022. After Bitcoin’s worth decreased towards completion of 2021, it went down to $36,500 in January 2022 when it shed assistance at $50,000.

Presently, a comparable assistance degree exists around $50,000, and Bitcoin shows up most likely to examine this degree once more. If this occurs, BTC’s rate might be up to $48,338, with an opportunity of closing know $45,000.

Find Out More: Bitcoin (BTC) Cost Forecast 2024/2025/2030

Failing to jump from this degree may lead Bitcoin down towards $40,000. Nonetheless, this end result may alter if the Mayer Numerous increases over 1, indicating a possible reboot of an advancing market, which might press Bitcoin past its previous all-time high.

Please Note

According to the Count on Job standards, this rate evaluation write-up is for educational functions just and need to not be taken into consideration economic or financial investment suggestions. BeInCrypto is devoted to exact, impartial coverage, however market problems undergo alter without notification. Constantly perform your very own research study and seek advice from a specialist prior to making any type of economic choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.