( Bloomberg)– The European Reserve bank will most likely reduce rate of interest on Thursday in an overture to a United States relocate the complying with week, as the international financial cycle turns towards a lot more integrated alleviating.

Many Review from Bloomberg

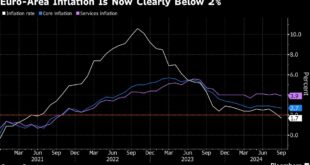

Euro-zone authorities have actually indicated that they’ll provide a 2nd decrease in loaning expenses, acting on July’s action, which will certainly be inspected by capitalists searching for policymakers’ objectives for any kind of additional actions later on this year. At the very least another cut is seen most likely in 2024.

In Addition To the Sept. 4 price action from the Financial institution of Canada, the ECB conference’s timing – days prior to the Federal Book’s very own first decrease anticipated on Sept. 18 – emphasizes just how big innovative economic situations are currently changing a lot more in tandem as authorities pivot to sustaining financial development since they evaluate rising cost of living threats to have actually discolored.

In the euro area, alleviating in a vital procedure of wage development throughout the 2nd quarter will certainly have aided push policymakers.

Likewise, a United States consumer-price record due on Wednesday might supply Fed authorities confidence that rising cost of living stress are maintaining, on the heels of information on Friday that revealed United States working with disappointed projections.

For capitalists, the concern hanging over this month’s conferences is the degree to which such price decreases declare a much deeper alleviating cycle that might not just get rid of tightness on significant economic situations, however likewise start to boost them.

What Bloomberg Business Economics Claims:

” We anticipate the ECB to reduce by an additional 25 basis factors in December. Nonetheless, the raised price of wage development and sticky solutions rising cost of living need to create the Governing Council to avoid dedicating to that beforehand.”

— David Powell, elderly economic expert. For complete evaluation, go here

Potential customers for development will certainly be an emphasis when ECB Head of state Christine Lagarde addresses reporters on Thursday– not the very least because of just-released information revealing second-quarter growth was weak than originally reported.

Governing Council authorities are believed to be a lot more comfy transforming prices at conferences like the upcoming one, when they have newly-produced quarterly projections handy. That would certainly make a more cut in December a lot more possible than one at their following celebration on Oct. 17.

In other places today, Chinese rising cost of living information, UK wage numbers and price choices from Pakistan to Peru are amongst the highlights.

Click On This Link of what occurred recently, and listed below is our cover of what’s showing up in the international economic climate.

United States and Canada

Fed authorities are going into a blackout duration from public occasions prior to their conference. Ahead of that, Guv Christopher Waller stated after Friday’s tasks report that it is necessary to start reducing prices. Waller likewise kept in mind that he’s “broad-minded” concerning the capacity for a bigger decrease. “The present set of information no more calls for perseverance, it calls for activity,” he stated.

The labor market gets on the front heater for Fed policymakers as cost stress have actually cooled down. The August CPI record is anticipated to reveal a step of core rising cost of living, which removes out food and power, climbed by 0.2% momentarily month. On a year-over-year basis, the core CPI most likely raised 3.2%, matching the yearly number for July that was the tiniest because 2021.

Various other United States information in the coming week consist of August manufacturer rates, regular unemployed insurance claims and the College of Michigan’s initial September customer view study.

Looking north, Financial institution of Canada Guv Tiff Macklem will certainly talk in London concerning changes in international profession and financial investment from a Canadian point of view, and will certainly take inquiries from press reporters. On the other hand, nationwide annual report information will certainly clarify houses’ total assets and debt-to-income proportion in the 2nd quarter.

Asia

China is front and facility, starting with information Monday that’s anticipated to highlight the continuous frailty of residential need.

Customer rising cost of living is seen getting simply a little bit, to what would certainly still be an anemic 0.7% speed, while decreases in factory-gate rates are anticipated to strengthen.

Information at the end of the week might include in the grief, with development in commercial outcome, retail sales and dealt with possession financial investment all most likely to have actually regulated in August, while home financial investment is seen dropping at a double-digit clip for a 4th straight month.

In other places, Japan’s financial rebound in the 2nd quarter might be changed a little greater after strong capital expense information through are factored in.

India’s August rising cost of living information on Thursday can tip the Book Financial institution of India towards an October price cut, according to Bloomberg Business economics, which anticipates cost development to reduce momentarily month.

Profession numbers schedule throughout the week from China, India, Taiwan and the Philippines, and Australia obtains determines for customer and service self-confidence on Tuesday.

On the financial front, Pakistan’s reserve bank is anticipated to reduce its benchmark price on Thursday for a 3rd straight conference. Its equivalent in Uzbekistan likewise chooses plan that day.

Europe, Center East, Africa

UK information might attract the interest of capitalists. Wage numbers on Tuesday are most likely to reveal weak pay stress, though the yearly speed of rise still stays greater than double the Financial institution of England’s 2% rising cost of living target.

Month-to-month gdp on Wednesday is anticipated by financial experts to reveal a small rise in July, indicating a warm beginning to the 3rd quarter. And the BOE will certainly launch its most recent rising cost of living assumptions study on Friday.

Transforming to the euro area, commercial manufacturing numbers in Italy, Spain and the area all at once will certainly likewise indicate the problem of the economic climate there as it started the 2nd fifty percent of the year. Based upon the efficiency of Germany and France, in information launched on Friday, it’s most likely the larger economic climate got on a weak ground.

In Germany itself, Money Preacher Christian Lindner will certainly provide the nation’s 2025 spending plan to parliament on Tuesday, complied with by comments the following day by Chancellor Olaf Scholz and various other federal government preachers.

In other places on the continent, rising cost of living numbers in Norway and the Czech Republic on Tuesday, and in Sweden on Thursday, will certainly be enjoyed carefully as reserve bank policymakers analyze the sticking around toughness of cost stress.

Transforming southern, investors will certainly see Egypt on Tuesday to see if rising cost of living slowed down for a 6th straight month. It got to 36% in February however has actually because dropped listed below 26%, many thanks in big component to a big worldwide bailout.

In a similar way, a record on rising cost of living assumptions on Thursday will certainly notify policymakers at the South African Book Financial institution, which makes use of two-years-ahead numbers to assist its choice making. A decline towards the 4.5% omphalos, where the reserve bank favors to secure them, will certainly include motivation for its initial price reduced because the elevation of the pandemic.

Other Than the ECB, a number of various other price choices are arranged:

-

On Thursday, the National Financial institution of Serbia might leave its price at 6% after rising cost of living climbed in July for the very first time in greater than a year.

-

The complying with day, interest will certainly concentrate on whether the Financial institution of Russia proceeds tightening up after treking loaning expenses by 200 basis factors in July. Information on Wednesday might reveal rising cost of living there has actually passed a yearly top.

Ultimately, the International Monetary Fund is because of finish an evaluation of Ukraine’s economic climate and funds in the coming week, and will certainly reveal whether the loan provider’s board need to authorize the following piece of a $15.6 billion lending for the war-torn nation.

Latin America

Latin America’s 3 biggest economic situations will certainly report August customer cost information as the area’s main lenders alter their financial plan.

On Monday, Mexico’s nationwide stats institute will likely report that rising cost of living relieved to 5.05% from 5.57% the month prior. The country’s expense of living has actually been thrust by rising rates of solutions, vegetables and fruits in current months.

Still, the anticipated downturn currently will certainly offer the reserve bank a lot more space to think about an additional price cut later on this month to strengthen a weak economic climate.

The following day, Brazil is anticipated to report that rising cost of living dropped back from the 4.5% ceiling of the reserve bank’s resistance array. Any kind of decrease stands to give restricted alleviation; policymakers encounter stress to raise loaning expenses in September because of cost threats consisting of raised public investing, durable financial development, and a depreciated money.

Ultimately, Argentina will certainly launch its information on Wednesday as Head of state Javier Milei’s management proclaims progression in initiatives to tame the expense of living.

Month-to-month cost rises have actually undoubtedly wound down from 25.5% in December– when Milei’s federal government took workplace– to 4% in July. Yearly rising cost of living is still well over 200%.

— With help from Matthew Malinowski, Brian Fowler, Laura Dhillon Kane, Monique Vanek, Paul Wallace and Tony Halpin.

( Updates with BOE in EMEA tale)

Many Review from Bloomberg Businessweek

© 2024 Bloomberg L.P.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.