Financial investment administration company VanEck introduced strategies to shut its Ethereum futures ETF after a comprehensive assessment. The Board of Trustees at VanEck ETF Count on decided on Thursday.

Ethereum-based ETFs have actually continually underperformed, in comparison to their Bitcoin (BTC) equivalents.

VanEck to End Ethereum Futures ETF

VanEck will certainly close down its Ethereum Technique ETF, which trades on the Chicago Board Options Exchange (Cboe) under the ticker icon EFUT, after a comprehensive assessment. The firm assessed aspects such as efficiency, liquidity, possessions under administration (AUM), and capitalist passion prior to choosing to sell off the fund.

VanEck has actually advised EFUT investors to offer their shares on the Cboe prior to the marketplace shuts on September 16. Hereafter day, EFUT will certainly no more be provided on the exchange. The fund will certainly be totally sold off on September 23, with the profits dispersed to investors.

” Had not been mosting likely to be really effective taking into consideration exactly how the ETH ETFs have actually been doing,” one individual on X said.

Learn More: Exactly how to Purchase Ethereum ETFs?

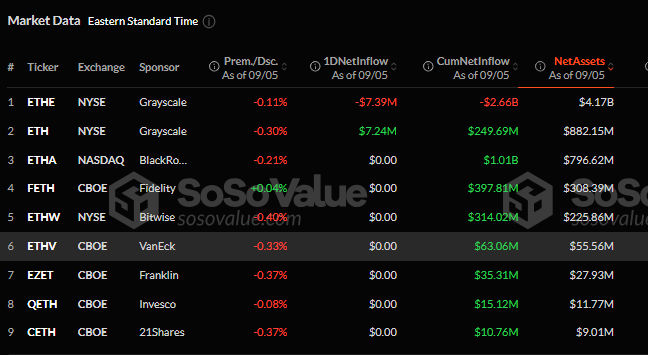

Area Ethereum ETFs have actually been battling because their launch, with inadequate efficiency throughout the board. Information from Farside Investors reveals that VanEck’s place ETH ETF, ETHV, which brings a 0.20% cost, has actually tape-recorded inflows on just 2 of the last 13 trading days. This underperformance isn’t restricted to VanEck; lots of providers encounter comparable or even worse end results, consisting of Grayscale’s ETHE.

BeInCrypto highlighted that Ethereum place ETFs have actually revealed disappointing outcomes, with simply one week of inflows tape-recorded over 30 trading days since August 22. According to SoSoValue, just BlackRock’s ETHA ETF has actually gone beyond the $1 billion mark in collective web inflows, adhered to by Integrity with $397 million.

BlackRock’s ETHA ETF, which has actually surpassed its peers, has actually also increased to Brazil, trading under the ETHA39 ticker with Brazilian Depositary Bills (BDRs) on the B3 stock market. Nonetheless, since September 5, collective complete web inflows for Ethereum ETFs continue to be unfavorable at -$ 562 million, according to SoSoValue.

Learn More: Ethereum ETF Described: What It Is and Just How It Functions

On the other hand, place Bitcoin ETFs have actually gotten on substantially much better, videotaping an advancing complete web inflow of $17.06 billion. Considering that its intro to Wall surface Road in January, the monetary tool has actually likewise added to boosted crypto fostering in Australia.

” Bitcoin ETFs are most likely to improve crypto fostering throughout both institutional and retail sectors in Australia. Institutional financiers are currently significantly accessing crypto with collaborations in between exchanges and conventional property administration companies and financial institutions. With the launch of Bitcoin ETFs, even more retail individuals are anticipated to include cryptocurrencies to their financial investment profiles. Retail financiers are looking for a managed, easy method to buy Bitcoin without managing the intricacies of handling exclusive secrets or browsing crypto purses. The convenience of gain access to is anticipated to drive more fostering amongst retail financiers, adding to the mainstream approval of cryptocurrencies in Australia,” Bitget COO Vugar Usi Zade informed BeInCrypto, pointing out Bloomberg Knowledge Elder ETF Expert Rebecca Wrong.

VanEck did not react to BeInCrypto’s ask for remark. The company humorously noted that the authorization of its place Ethereum ETP contributed in its choice.

Please Note

In adherence to the Count on Task standards, BeInCrypto is dedicated to impartial, clear coverage. This newspaper article intends to offer exact, prompt info. Nonetheless, viewers are encouraged to validate realities separately and talk to an expert prior to making any kind of choices based upon this material. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.