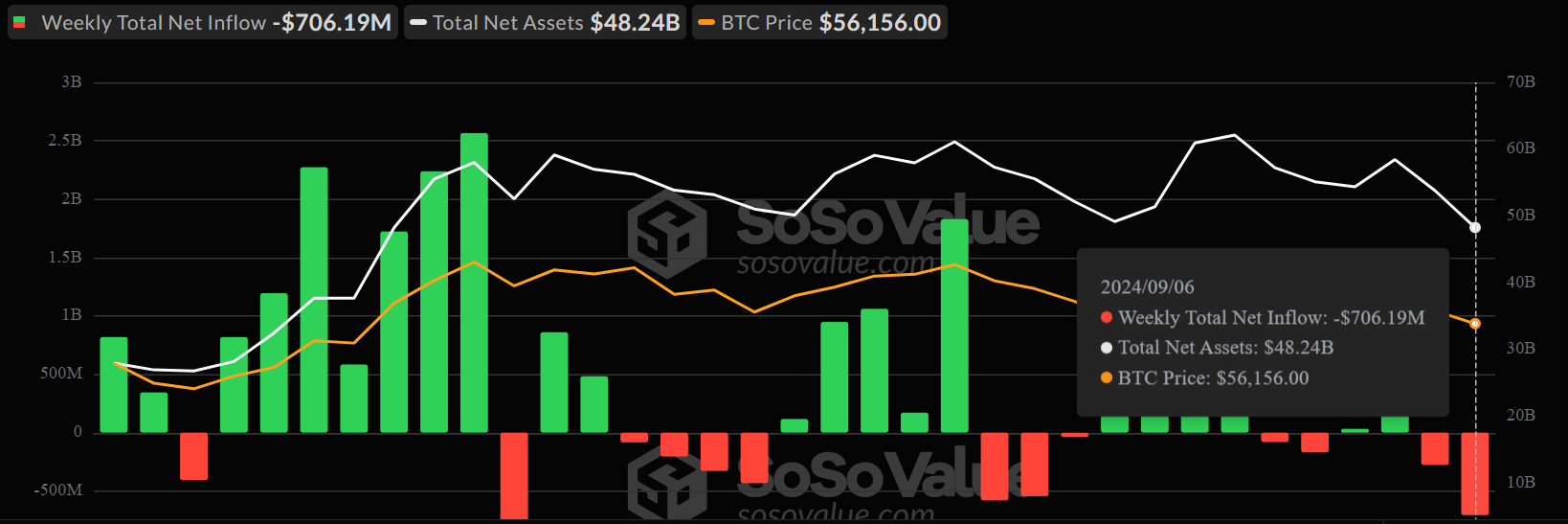

United States Bitcoin exchange-traded funds (ETFs) have actually tape-recorded web discharges for 8 days straight, leading to a loss surpassing $1 billion from August 27 to September 6.

This discharge fad has actually additionally added to bringing the complete web possessions of Bitcoin ETFs to under $50 billion.

Why Bitcoin ETFs Are Experiencing Hefty Discharges

Information from SoSoValue reveals that Bitcoin ETFs have actually experienced constant discharges completing around $1.1 billion given that August 27. Throughout the duration, Integrity led the redemptions, with financiers offering over $450 million well worth of shares in its FBTC fund.

Ark 21Shares’ ARKB fund adhered to with over $220 million in discharges. Bitwise’s BITB saw $109 million in discharges, while BlackRock’s IBIT experienced moderate discharges of under $15 million.

Grayscale’s GBTC, which transitioned right into an ETF in January, remains to deal with substantial redemptions, with $280 million in discharges throughout the duration. Because its conversion, GBTC has actually seen a bottom line of over $20 billion.

Learn More: Exactly how To Profession a Bitcoin ETF: A Step-by-Step Method

The advancing internet inflow for the ETFs has actually additionally decreased. From a height of $18.08 billion on August 26, it had actually been up to $16.89 billion at press time.

This slump shows a cooling excitement for Bitcoin ETFs, which released with record-breaking success. The majority of this decrease is connected to Bitcoin’s current rate battles.

After getting to a high of over $73,000 in March, Bitcoin has actually slid to as reduced as $52,598 throughout the previous day, proceeding a week-long descending fad that saw its worth decrease by around 10%.

Learn More: Bitcoin (BTC) Cost Forecast 2024/2025/2030

In spite of the discharge story, crypto expert Hitesh suggests that the marketplace has actually mostly forgotten inflows to these monetary tools. He kept in mind that while Bitcoin ETF netflows have actually been adverse for the previous 2 weeks, the ETF items have actually seen an advancing favorable netflow of $3.5 billion in the last 3 months.

According to Hitesh, this shows that financiers have actually acquired $3.5 billion well worth of Bitcoin in the $57,000–$ 68,000 rate variety.

” The majority of these financial investments were made at costs over $60,000, and I think the netflow might go back to favorable as quickly as Bitcoin rate returns to that degree once more,” he added.

Please Note

In adherence to the Trust fund Task standards, BeInCrypto is dedicated to honest, clear coverage. This newspaper article intends to supply exact, prompt details. Nevertheless, viewers are recommended to validate truths individually and speak with an expert prior to making any type of choices based upon this web content. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.