Chainlink (WEB LINK) cost has actually seen a substantial decrease just recently, eliminating a lot of the gains it made throughout August. After a duration of development, the altcoin has actually currently dropped by 18% in simply 12 days and is coming close to a vital assistance degree.

If the marketing proceeds, it might place more stress on web link’s cost. As it heads in the direction of the assistance flooring, capitalists are enjoying carefully to establish if this pattern will certainly proceed.

Chainlink Is Overloaded With Positive Outlook

The macro energy of Chainlink is presently bearish, as shown by a number of vital technological signs. One such indication, the Loved one Stamina Index (RSI), is experiencing a constant downtick, indicating expanding marketing stress.

A reducing RSI listed below the 50.0 degree signals that bearish energy is developing. This ongoing decrease might result in raised marketing task, creating web link’s cost to go down even more as the cryptocurrency market continues to be careful.

The continuous bearish belief, as shown in the RSI, might press web link towards also reduced degrees. Historically, an RSI listed below 30 can suggest that a property is oversold, yet at this phase, it still recommends that the marketing stress is not over. If the pattern proceeds, this might lead to a sharper decrease for Chainlink, increasing the existing decline.

Find Out More: Exactly How To Purchase Chainlink (WEB LINK) and Every Little Thing You Required To Know

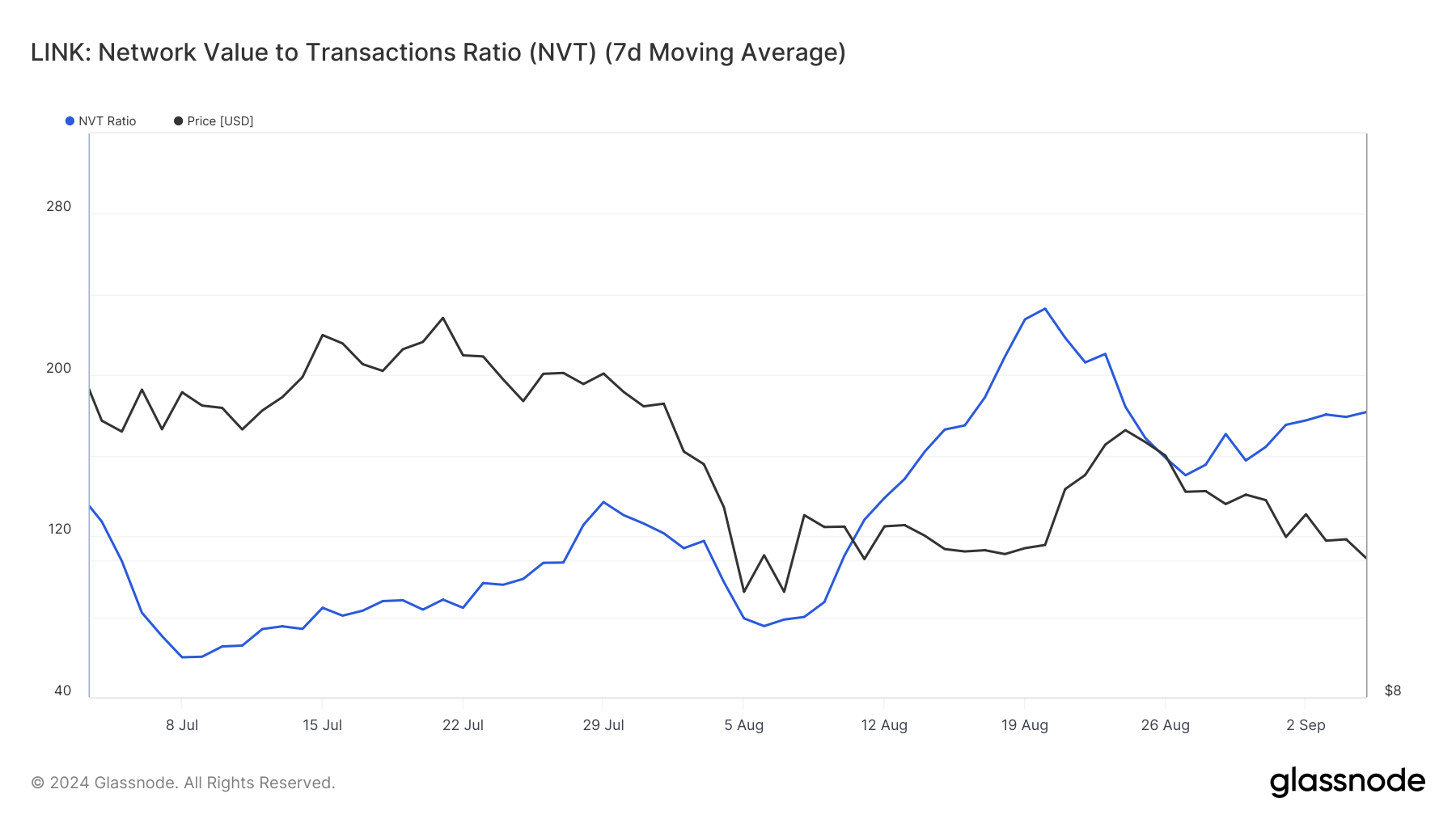

Chainlink’s Network Worth to Purchases (NVT) proportion, which determines a property’s market price versus its network task, more sustains the bearish energy. Presently, web link’s NVT proportion gets on the surge, suggesting that the property is miscalculated about the network task it is producing. This signals that the underlying principles might not sustain the cost, causing a prospective modification.

Surprisingly, the decrease in Chainlink’s cost started equally as the NVT proportion began to increase. This connection recommends that capitalists’ positive outlook concerning web link’s future does not straighten with its network task. The separate in between the increasing cost and dropping network use might be an indication for more decreases as the marketplace adapts to truth worth of the property.

Web Link Cost Forecast: Reducing the Decrease

Chainlink’s cost has actually visited 18% in the last 12 days and is presently trading at $10.01. The coin has actually currently failed its critical assistance degree of $10.79 and is currently relocating in the direction of $9.35, a degree that has actually formerly functioned as solid assistance. If the bearish pattern proceeds, web link might examine this degree once again in the coming days.

Offered the existing market problems, the ongoing overvaluation of Chainlink, and its reducing RSI, it is most likely that the cost will certainly see more decreases. A property that ends up being miscalculated usually experiences a modification prior to locating security. In this situation, $9.35 might serve as a solid assistance flooring, resisting any type of much deeper losses.

Find Out More: Chainlink (WEB LINK) Cost Forecast 2024/2025/2030

Nevertheless, this bearish overview might transform if capitalists readjust their task to match their belief. Need to connect handle to recover the $10.79 assistance degree, the existing down pattern might be turned around, possibly revoking the bearish thesis and bringing some alleviation to capitalists.

Please Note

In accordance with the Trust fund Task standards, this cost evaluation post is for informative objectives just and ought to not be taken into consideration economic or financial investment guidance. BeInCrypto is devoted to precise, objective coverage, yet market problems undergo transform without notification. Constantly perform your very own study and talk to an expert prior to making any type of economic choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.