Ethereum’s (ETH) cost remains to come to grips with substantial pressure, having actually dropped listed below $2,400 for the 2nd time in 3 days

While the wider market could really hope that this newest decrease notes all-time low, on-chain evaluation pleads to vary.

Financiers Relocate Far From ETH

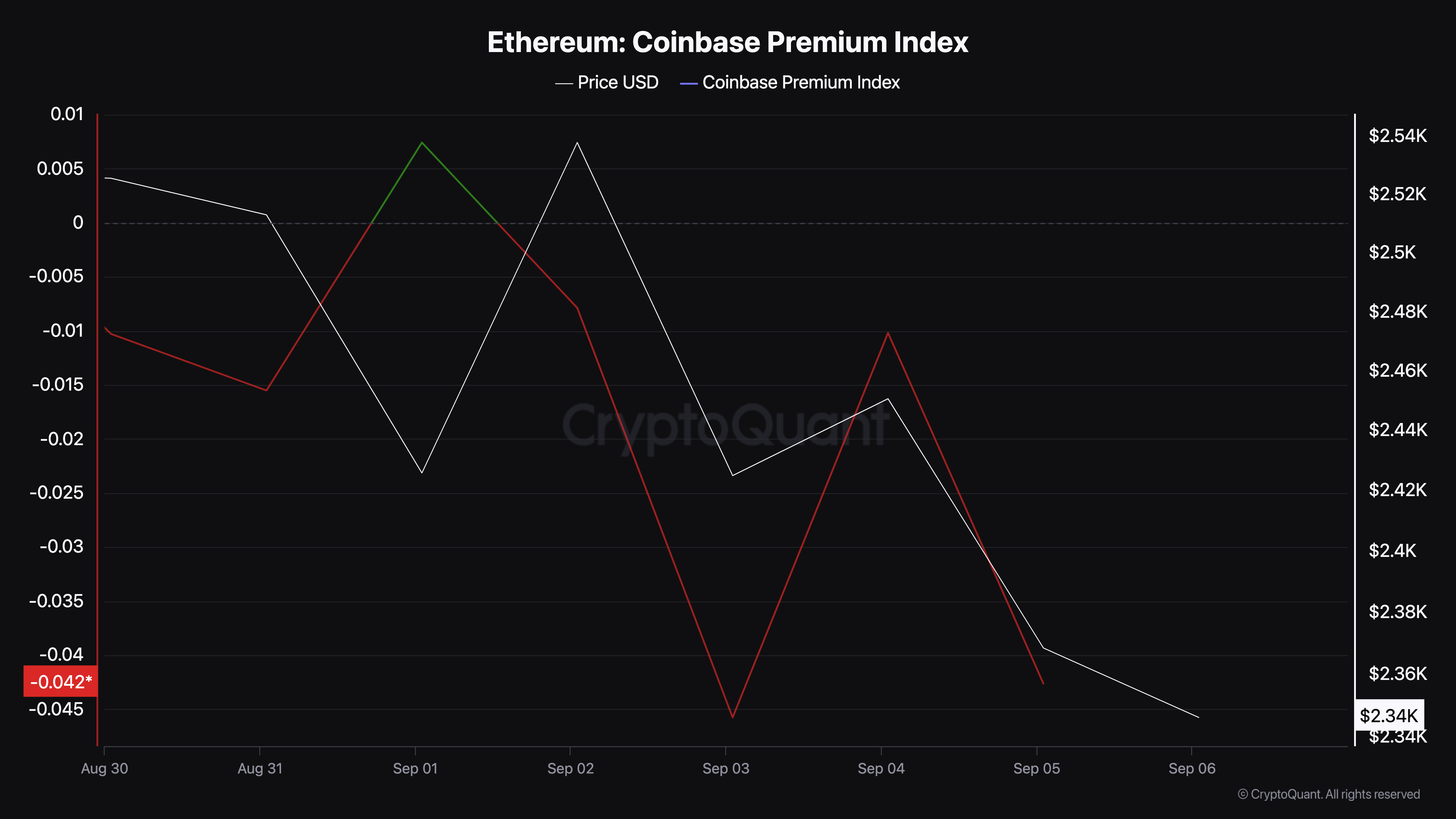

On August 24, Ethereum’s cost reached $2,800, triggering conjecture that the cryptocurrency could retest $3,000. However that did not occur, as ETH remains to trade reduced. At press time, Ethereum’s Coinbase Costs Index has actually plunged, recommending that the cost could catch one more remarkable decrease.

The Coinbase Costs Index assesses the distinction in between the Ethereum place cost on Binance which of Coinbase. High worths of this sign recommend significant acquiring stress in the United States. Reduced worths, nevertheless, indicate that United States financiers are avoiding acquiring however marketing.

Based upon CryptoQuant’s information, the index has actually gone down to -0.042, recommending a remarkable decrease in acquiring stress from American financiers.

Learn More: 9 Finest Places To Bet Ethereum in 2024

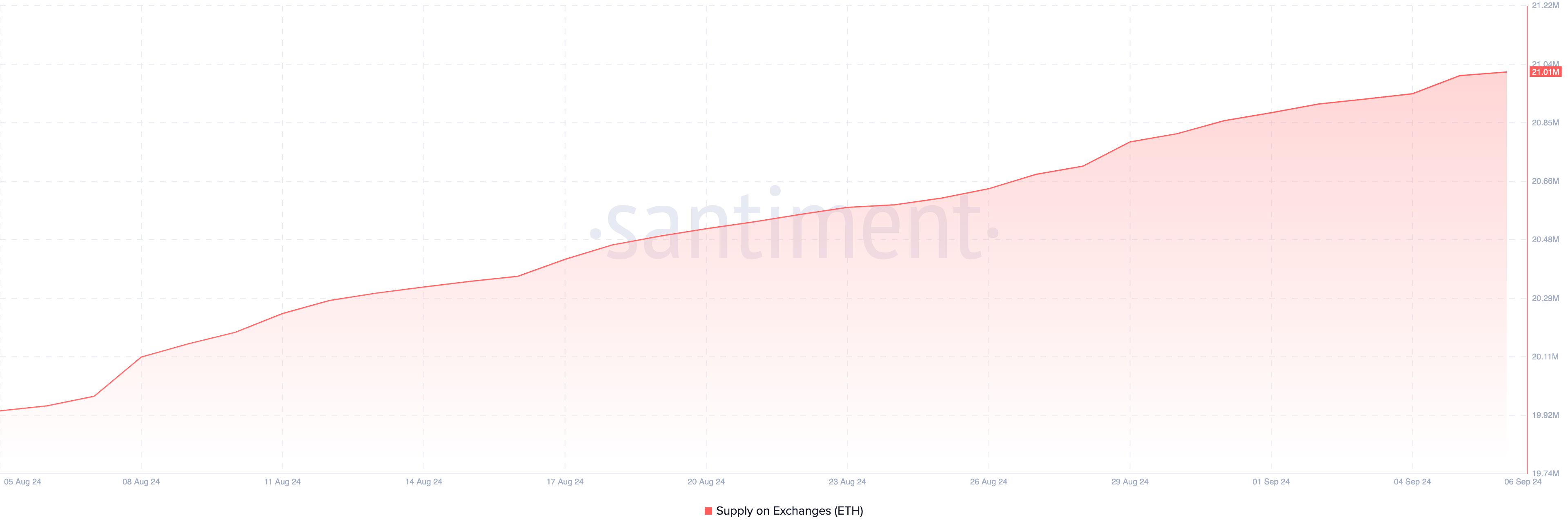

Also, the place Ethereum ETFs have actually likewise encountered an absence of need. On-chain information from Santiment discloses that the ETH supply readily available on exchanges has actually been climbing up.

One month back, the quantity of ETH in exchanges was 19.94 million. Today, the exact same statistics mores than 21 million, suggesting that even more coins have actually moved right into these streamlined systems.

A reduced exchange supply normally indicates favorable problems, as it suggests that many financiers are not intending to market quickly. Nevertheless, offered Ethereum’s existing circumstance, it could run into substantial marketing stress, which can drive the cost lower.

Ethereum Rate Forecast: Freefall

On the regular graph, ETH’s cost had actually developed a collection of greater lows considering that December 2022. Nevertheless, the cost modification seen in very early August totally revoked the predisposition that the cryptocurrency could leap to a greater worth.

Since this writing, Ethereum’s cost is $2,345, which is in between the need area of $2,200 and $2,350. Need to the altcoin loss listed below the reduced border of this area, its cost could go down to $2,048.

Additionally, the Family member Toughness Index (RSI), which gauges energy by analyzing the rate and dimension of cost adjustments, is listed below the neutral degree. This RSI placement recommends that the energy around Ethereum is bearish, and if maintained, it can speed up the decrease towards $2,200.

Damaging listed below this degree develops an extremely bearish situation, as Ethereum’s cost can go down to $1,577.

Learn More: Exactly How to Get Ethereum (ETH) and Every Little Thing You Required to Know

Regardless of the downhearted situation, there is still really hope. If acquiring stress from United States financiers and the wider market rises, Ethereum can rebound. Need to this occur, ETH’s cost could leap towards $2,800 once again.

Please Note

In accordance with the Count on Task standards, this cost evaluation short article is for educational objectives just and must not be thought about monetary or financial investment guidance. BeInCrypto is dedicated to precise, impartial coverage, however market problems go through transform without notification. Constantly perform your very own research study and talk to a specialist prior to making any type of monetary choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.