Bitcoin’s (BTC) failure to trade over particular cost degrees for over a week might mean larger concerns for the front runner cryptocurrency. These battles have actually elevated legitimate worries as bearish belief remains to acquire grip while market volatility increases.

7 days earlier, Bitcoin tried to retest $60,000. Nevertheless, it dealt with being rejected and has actually given that been not able to get to the area. The following is what need to take place for Bitcoin to stay clear of a market collapse even worse than that of August 5.

BTC Survival Hangs in the Equilibrium

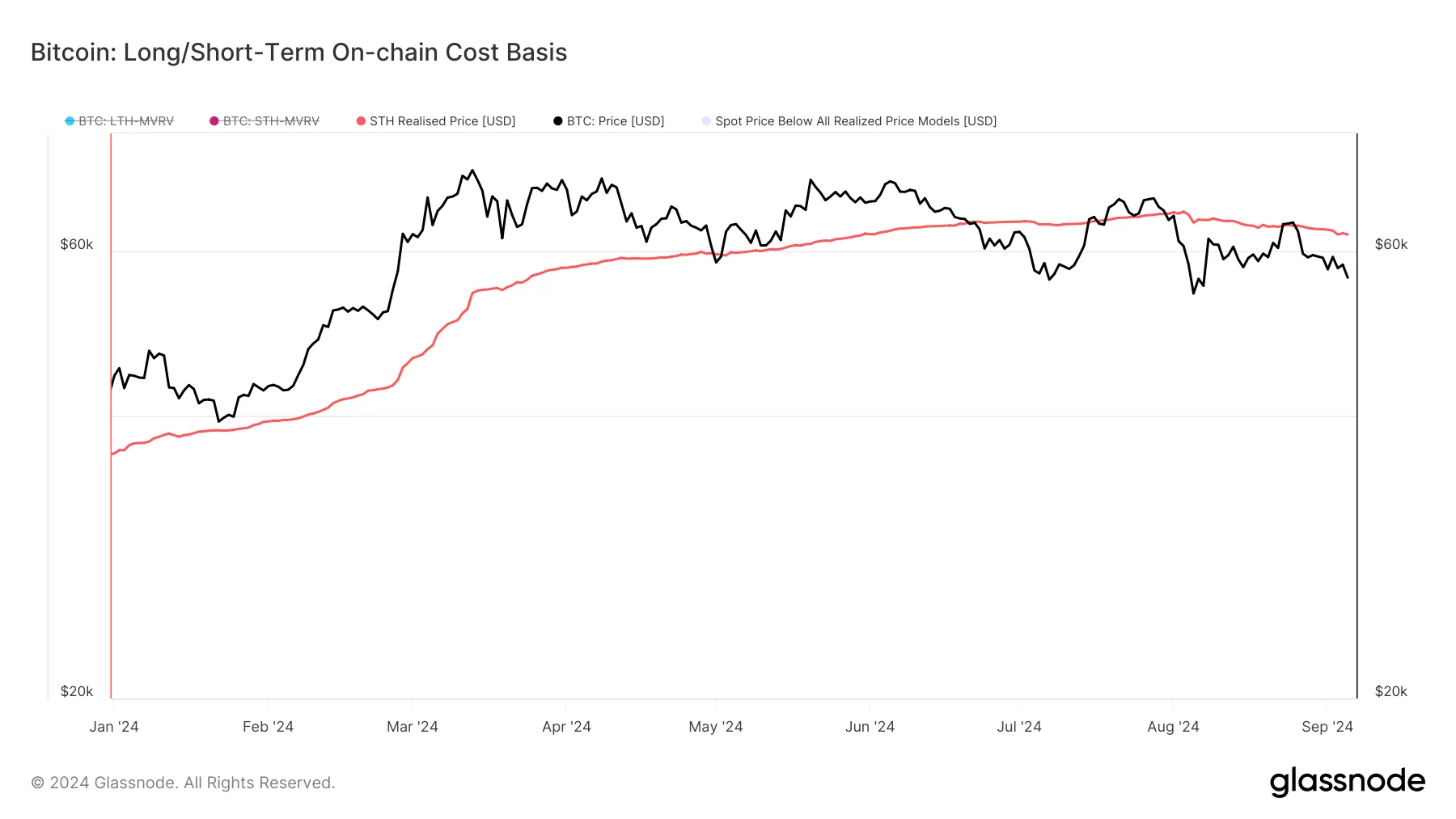

According to Glassnode, Bitcoin cost has actually dropped listed below the Short-Term Owners (STH) Recognized Rate. For context, the STH-Realized Rate tracks the typical on-chain price for BTC that was relocated within the last 155 days. Since the statistics programs if owners remain in latent earnings or losses, it is essential to assess the cost possibility.

Since this writing, the STH Recognized Rate is $62,443, and it has actually been over Bitcoin’s area worth given that August 25.

Commonly, if the area cost drops listed below the STH Recognized Rate for an extensive duration, maybe an indicator of a feasible bearish market. For that reason, it is not misplaced to state that Bitcoin takes the chance of a steeper cost modification unless it increases over $62,443.

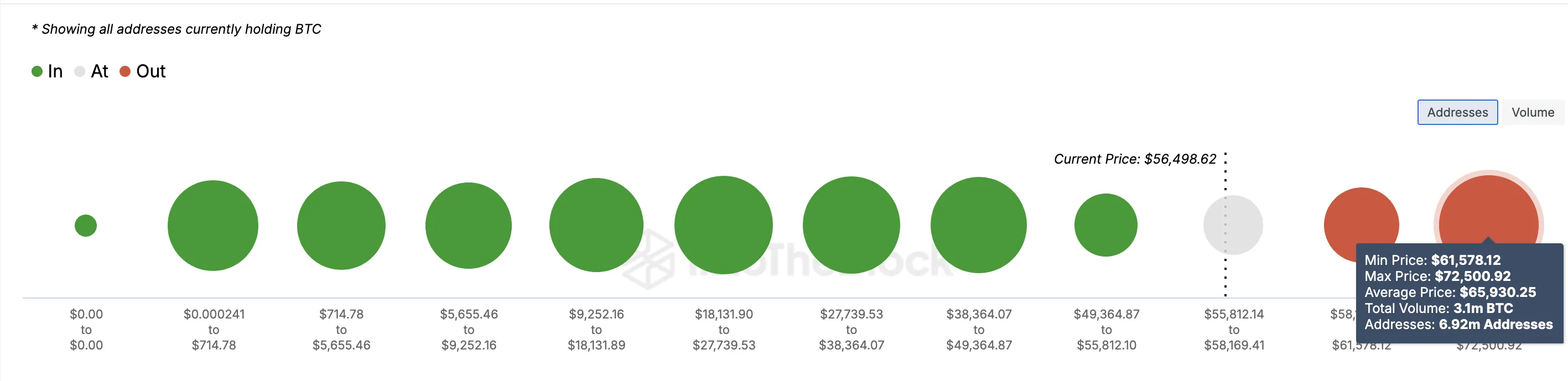

Besides this on-chain price basis, the International In/Out of Cash sign (GIOM) reveals that Bitcoin might encounter substantial resistance in between $61,578 and $72,500 if the cost efforts to get to these degrees. Right here, 6.92 million addresses gathered 3.1 million BTC.

This number is a great deal greater than the variety of addresses that acquired the cryptocurrency at an ordinary cost of $52,516.

Find Out More: Pepe: Just How To Acquire Bitcoin (BTC) on eToro: A Detailed Overview

Thus, if Bitcoin tries to exceed $61,000, the supply obstacle might draw it back. If this occurs and need falls short to appear, Bitcoin’s cost dangers going down to $49,364, the reduced purchase limit.

Bitcoin Rate Forecast: Listed Below $50,000

From a technological perspective, the three-day Bitcoin graph verifies the bearish predisposition. Based upon the graph, BTC has actually created a loudspeaker leading pattern, which shows up when the cost strikes 3 greater highs and 2 reduced lows.

Normally, this technological pattern suggests a turnaround from favorable to bearish. In situations where a decrease has actually been developed, the down fad proceeds.

If verified, Bitcoin’s cost might come by roughly 15% and get to $47,778 while doing so. Presently, offering stress looks more powerful as it appears that numerous market individuals are still on the sidelines. Need to this continue to be the very same, a feasible decrease listed below $50,000 may take place.

Find Out More: Pepe: 7 Finest Crypto Exchanges in the United States for Bitcoin (BTC) Trading

Nevertheless, if BTC resists this fad and recovers $61,935, the forecast may be revoked. Because circumstance, the cryptocurrency’s cost may burst out and rally towards $71,453.

Please Note

According to the Count on Job standards, this cost evaluation write-up is for educational functions just and need to not be thought about economic or financial investment suggestions. BeInCrypto is dedicated to exact, objective coverage, yet market problems go through transform without notification. Constantly perform your very own study and seek advice from a specialist prior to making any kind of economic choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.