XRP’s solid connection with Bitcoin (BTC) could be restricting its efficiency, as the token has actually stayed reasonably low-key over the previous 2 months, regardless of numerous occasions that would generally activate favorable cost activities.

For example, in July, reports exposed that Donald Trump elevated over $4 million in project contributions via electronic symbols, consisting of XRP, yet this information did not influence XRP’s cost. Furthermore, the altcoin revealed no response when 33 million symbols were moved to a Binance pocketbook on August 22. Most lately, after Surge revealed strategies to present wise agreements to the XRP Journal (XRPL), XRP’s cost visited 3%.

Surge’s Ties with Bitcoin Spells Problem

Surge’s news of strategies to present wise agreements to the XRP Journal (XRPL) must preferably have actually triggered a favorable cost response for XRP. Nevertheless, the altcoin’s solid connection with Bitcoin (BTC), with a connection coefficient of 0.72, has actually caused a soft feedback. This number shows a moderately solid favorable connection in between both properties.

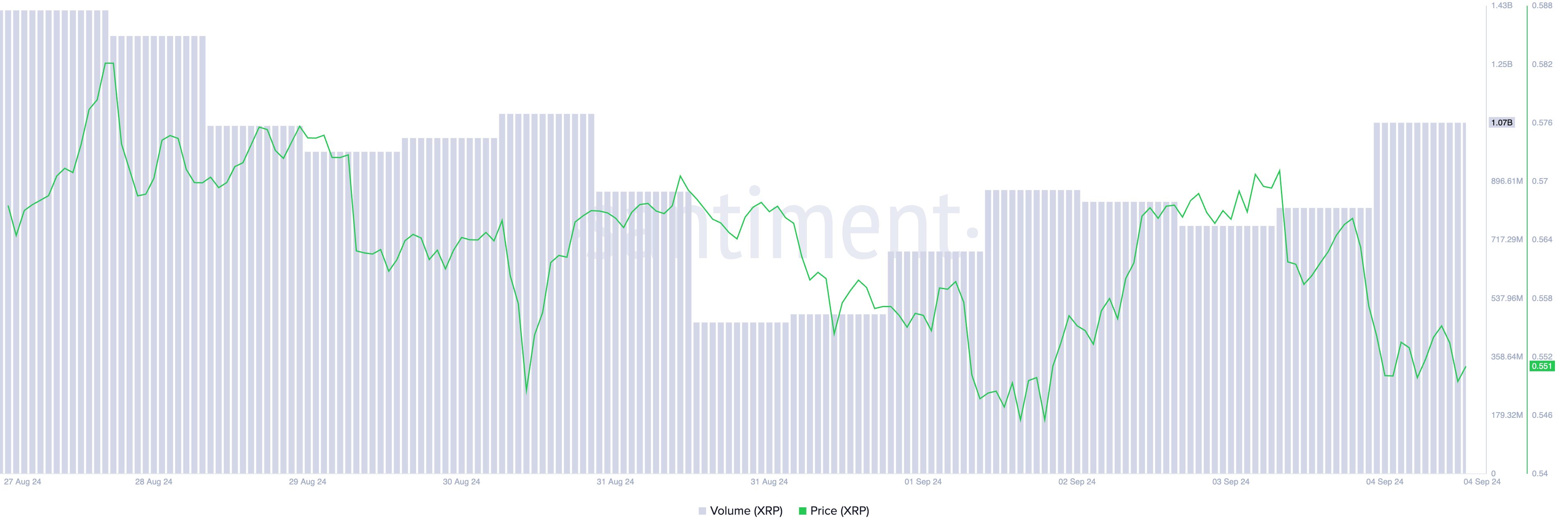

In the previous 1 day, Bitcoin’s cost has actually come by 4%, and XRP adhered to with a 3% decrease. In spite of this decline, XRP’s trading quantity rose by 39%, developing an adverse aberration. Such aberration generally suggests enhancing marketing stress, recommending XRP might encounter more decrease.

Find Out More: XRP ETF Described: What It Is and Just How It Functions

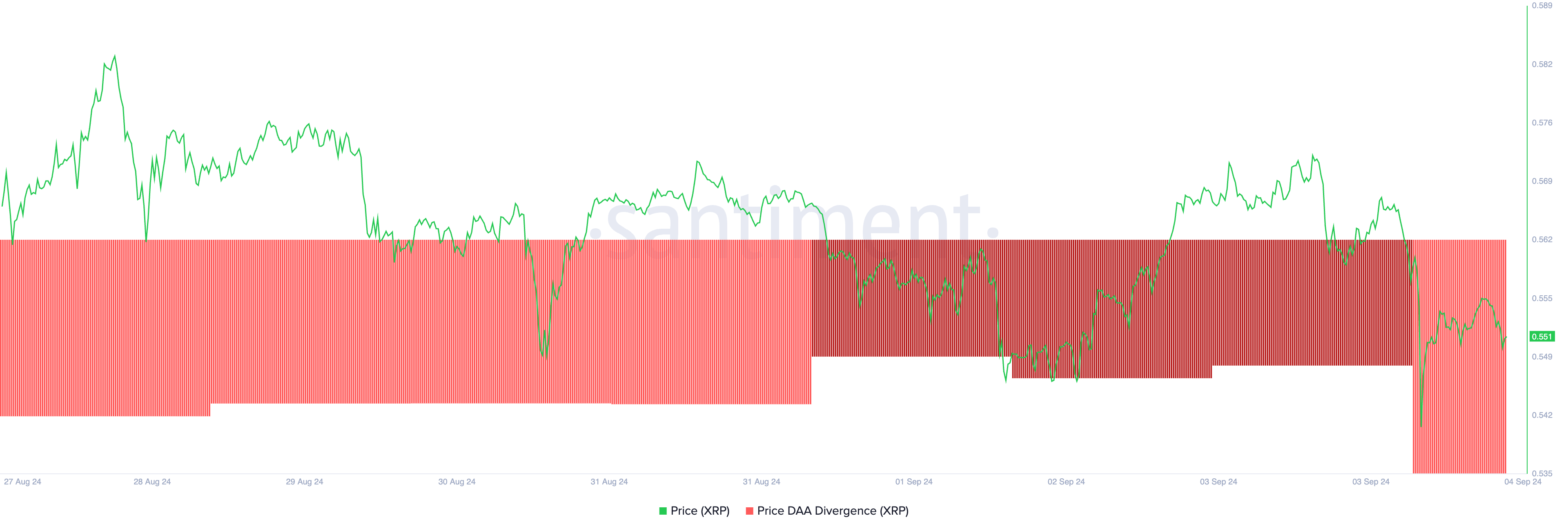

XRP’s unfavorable price-to-daily energetic address aberration better verifies the rise in marketing task. This statistics tracks the possession’s cost activities and contrasts them with adjustments in the variety of everyday energetic addresses.

Since this writing, XRP’s price-to-daily energetic address aberration stands at -63.81, signifying lowered involvement in acquiring, marketing, or holding XRP, which might add to ongoing cost stress.

XRP Rate Forecast: Dental Braces For Much More Decline

At press time, XRP is trading at $0.55, and its 12-hour graph recommends more decrease. The token’s MACD line (blue) rests listed below its signal line (orange) and the absolutely no line, suggesting a solid bearish pattern. This configuration indicates an ongoing drop unless a turnaround happens, triggering investors to either prevent the marketplace or take into consideration brief settings.

Furthermore, XRP’s bull-bear power, gauged by the Elder-Ray Index, exposes that vendors control the marketplace. Currently, the index stands at -0.035, having actually stayed unfavorable considering that August 26, suggesting bear power remains in control.

Find Out More: Surge (XRP) Rate Forecast 2024/2025/2030

If bears remain to subdue bulls, XRP’s cost might go down to $0.52. Must this degree fall short to hold, an additional decrease to $0.46 might comply with. Nevertheless, if market belief changes to favorable, XRP might climb to $0.56.

Please Note

In accordance with the Trust fund Task standards, this cost evaluation short article is for educational functions just and must not be thought about economic or financial investment guidance. BeInCrypto is devoted to precise, objective coverage, however market problems go through alter without notification. Constantly perform your very own study and seek advice from a specialist prior to making any type of economic choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.