Injective blockchain has actually revealed an unique tokenized index for BlackRock’s USD Institutional Digital Liquidity (BUIDL) Fund. This index makes it possible for investors to access the fund with on-chain economic tools, noting a jump in possession tokenization.

The index presents a continuous market that tracks the supply of the BUIDL fund instead of its cost. This strategy deals with an expanding need for openness in fund streams and supplies understandings right into institutional crypto involvement.

Injective (INJ) Cost Skyrockets After BlackRock BUIDL Fund Statement

Eric Chen, founder and chief executive officer of Injective Labs, stressed the index’s value.

” For the very first time, organizations and retail individuals alike can get straight accessibility to an unique RWA offering that tracks the real fund led by BlackRock,” Eric Chen, Chief Executive Officer of Injective Labs, said.

The intro of the BUIDL index has actually likewise favorably affected Injective’s indigenous token, INJ, which instantly rose 14% after the index’s launch. Since creating, the INJ cost is up by around 10.80%, trading at $17.18.

Learn More: What is The Influence of Real Life Property (RWA) Tokenization?

The BUIDL index operates Injective’s decentralized exchanges, such as Helix, where investors can utilize take advantage of to take lengthy or brief settings on the index. Its cost is changed based upon modifications in the supply of BUIDL symbols, making use of a 1-hour time-weighted ordinary cost (TWAP) to lower volatility from substantial token activities.

This advancement broadens the ease of access of the BUIDL fund. Previously, it was an institutional financial investment item, which called for a minimum of $5 million. Therefore, just 18 BUIDL token-holders exist, with the biggest having greater than 33% of the fund, valued at concerning $178 million.

Nevertheless, currently, a wider target market can access the BUIDL index with access factors as reduced as $1. This change intends to equalize accessibility to tokenized properties, possibly improving retail capitalist involvement.

Since very early September, the BUIDL fund flaunts a market capitalization of over $517 million. Enhancing this, the fund taped a $2.1 million returns payment in July, noting a document monthly high.

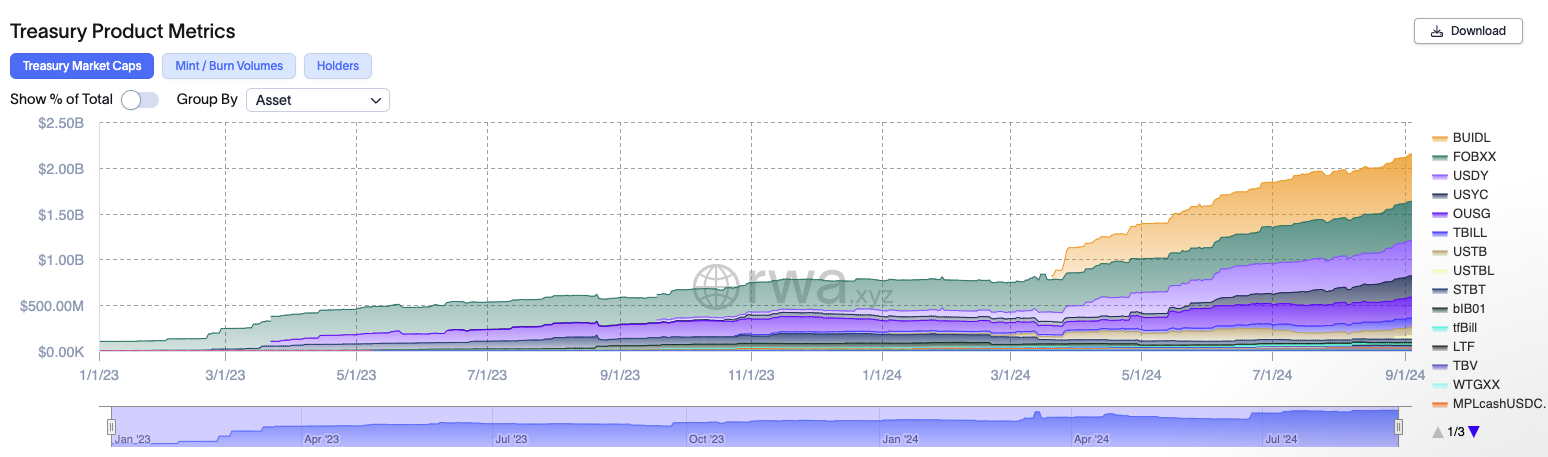

Property tokenization, specifically people treasuries with systems like BlackRock’s BUIDL and Franklin Templeton’s FOBXX, adds considerably to the marketplace, collecting a consolidated worth of $2.15 billion.

Learn More: Exactly How To Buy Real-World Crypto Possessions (RWA)?

This fad shows a solid passion in real-world possession markets and settings the BUIDL fund as an important indication of institutional belief towards cryptocurrencies.

Please Note

In adherence to the Depend on Job standards, BeInCrypto is dedicated to honest, clear coverage. This newspaper article intends to give exact, prompt info. Nevertheless, viewers are encouraged to confirm realities separately and speak with a specialist prior to making any kind of choices based upon this web content. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.