Bitcoin’s (BTC) cost might encounter an extended decrease after stopping working to damage over the $60,000 mark. This battle to keep a crucial resistance degree has actually elevated worries amongst financiers, that are currently very closely viewing exactly how much the recession may prolong.

Presently, Bitcoin is trading at $57,862, noting a 6.85% decline over the previous 7 days. While some market individuals could be wishing for a healing, on-chain evaluation recommends that one more cost reduction might be imminent.

Bitcoin Market Problem Worsens

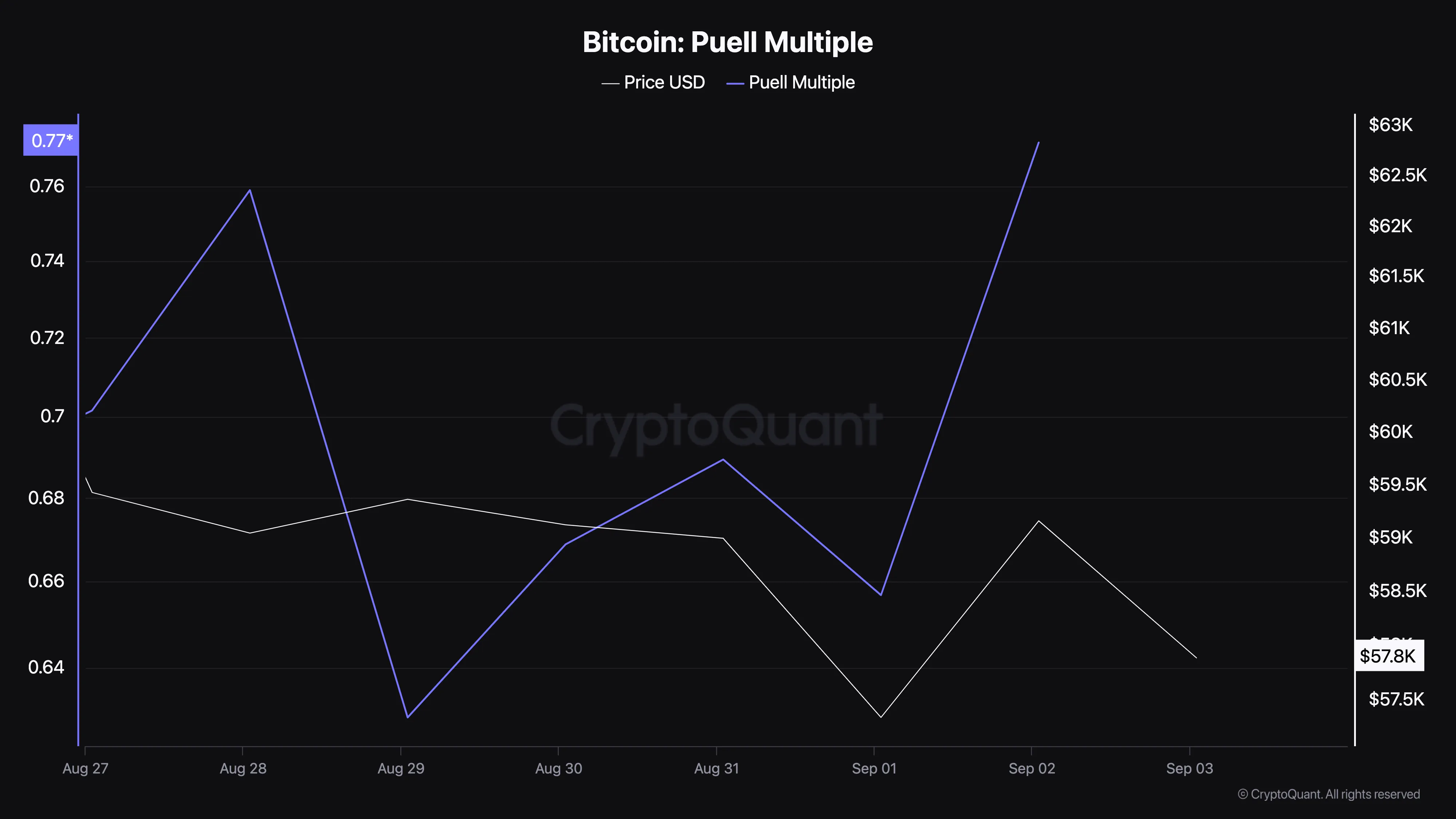

One crucial on-chain sign sustaining the capacity for additional decrease is Bitcoin’s Puell Several. This statistics contrasts the day-to-day issuance of coins to the annual standard, giving understandings right into whether the cost is near a neighborhood top or base.

High Puell Several worths recommend the cost is close to a neighborhood top, while reduced worths show closeness to a base. According to CryptoQuant, Bitcoin’s Puell Several stood at 0.65 on September 1.

Today, the analysis has actually climbed to 0.77. This rise recommends that Bitcoin might have gotten to a neighborhood top, showing a feasible additional decrease in cost.

Learn More: Where To Profession Bitcoin Futures: A Comprehensive Overview

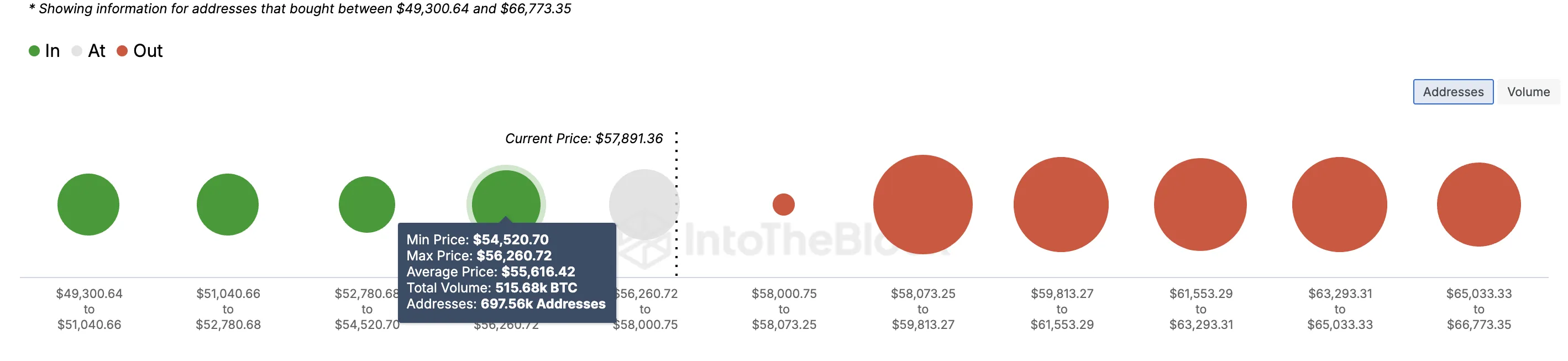

Along with the Puell Several, the In/Out of Cash Around Rate (IOMAP) sign additionally sustains the opportunity of a more decrease in Bitcoin’s cost. The IOMAP examines addresses based upon whether they remain in earnings, muddle-headed, or at the breakeven factor at the present cost.

If a bigger variety of addresses collected Bitcoin at a rate less than the present cost, this might show solid assistance. Alternatively, if even more addresses acquired BTC at a greater worth, it recommends considerable resistance.

According to information from IntoTheBlock, the variety of addresses that acquired Bitcoin in between $58,073 and $66,773 surpasses those that acquired in between $49,300 and $56,200. This recommends that Bitcoin may encounter solid resistance at greater rates. If acquiring stress does not boost, the following prospective cost degree for BTC might be about $54,520.

BTC Rate Forecast: $54,000 Could Be Following

From a technological perspective, Bitcoin’s 4-hour graph exposes the development of a coming down triangular, a bearish pattern that usually indicates the extension of a sag. Formerly, Bitcoin had actually created a rising triangular, which might have suggested an increase, however the favorable situation was revoked when the cost dove from $62,000.

Provided the present problems, Bitcoin might battle to recoup, as formerly reviewed. If the drop proceeds, BTC might come by one more 7%, getting to around $54,677.

Learn More: Bitcoin (BTC) Rate Forecast 2024/2025/2030

Nevertheless, if purchasing stress heightens or crypto whales begin buying even more BTC, the cost may rally to $60,990. If the present pattern lingers, however, the decrease might prolong better.

Please Note

In accordance with the Trust fund Task standards, this cost evaluation write-up is for informative functions just and must not be taken into consideration monetary or financial investment suggestions. BeInCrypto is devoted to precise, objective coverage, however market problems undergo transform without notification. Constantly perform your very own study and talk to an expert prior to making any type of monetary choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.