Pay attention and sign up for Supplies in Translation on Apple Podcasts, Spotify, or any place you locate your favored podcasts.

Thursday notes the one-month wedding anniversary of Aug. 5’s “yen shock”– a mini-market panic that rapidly spread out throughout worldwide markets after starting in Japan the Monday complying with the July work report.

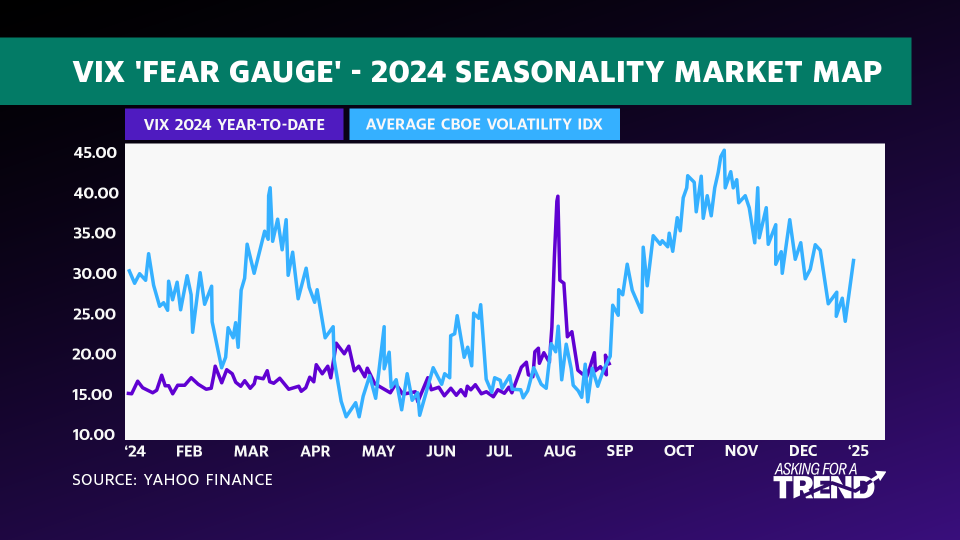

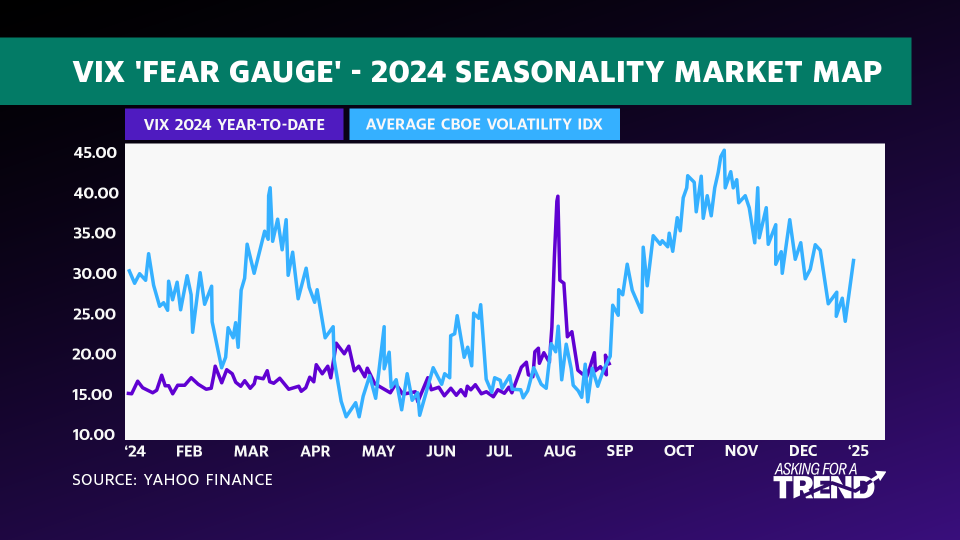

The Nikkei supply index (^ N225) hemorrhaged 12% that Monday– its largest one-day decline because 1987– while the S&P 500 plunged 3%. The VIX Volatility Index (^ VIX) surged to 65, the third-highest degree on document.

Yet nearly as quickly as the marketing mored than that early morning, the eye-popping recuperation started, which can be why there’s not also an engaging, agreed-upon name for the occasion. By noontime in the United States on that particular fateful Monday, the VIX had actually currently been up to 30– its largest intraday collision on document.

By mid-August, United States supplies had actually currently eliminated the losses. Yet this roller-coaster adventure of volatility highlights some vital mistaken beliefs concerning the VIX. And historic cost activity bordering August shocks recommends that supplies are not in the clear right now.

This ingrained web content is not offered in your area.

The VIX has actually long been referred to as the “concern scale” by monetary media (including your own absolutely), yet this tag oversimplifies its feature. As Steve Sosnick, primary planner at Interactive Brokers, discussed on a current episode of Supplies in Translation, “[The] VIX is not a worry scale. It plays one on television.”

The VIX determines the marketplace’s assumption of S&P 500 (^ GSPC) volatility over the following one month, as it is computed from choices on the criteria. It does not make up real concern yet instead shows the marketplace’s finest quote of future volatility, which usually accompanies market concern, or panic.

According to Sosnick, “VIX is the most effective proxy for the need for [institutional] hedging security due to the fact that it is truly the easiest method to do a brief, fast bush on a profile.”

Institutional and retail capitalists alike can touch deep and fluid markets for VIX futures and ETFs– in addition to choices on those tools. (Yet the VIX itself is an index and does not in fact profession, similar to the S&P 500.)

Capitalists could presume that a reduced VIX implies markets are steady and not seeking hedging. Yet a reduced VIX is an economical VIX. “Get security when you can, not when you must,” goes theWall Street adage Reflecting to the Monday market disaster with knowledge, the best play was to market the VIX by noontime– by either shorting or covering prior lengthy wagers.

The BofA Information Analytics group has a historic caution for capitalists that have actually currently passed last month’s shock.

” August delicacy leads loss volatility (and it’s not valued in),” the group composed in a note to capitalists.

The group additionally kept in mind that from a historic viewpoint, the VIX often tends to climb from August via October, which can be bearish for supplies.

The graph over tracks the ordinary VIX degree throughout the fiscal year, utilizing information from 1990 to 2023. The tiny top around the start of August currently flawlessly recorded the Aug. 5 spike that rattled capitalists. And today is when volatility often tends to grab and fad higher right into November.

The financial institution advises capitalists that in previous years, markets really did not right away recuperate from August market shocks. In August 2007, there were pre-global monetary dilemma shakes. After that S&P reduced United States financial obligation in August 2011, and China shocked the globe in 2015 by cheapening its money, the yuan.

In each of these years, even more disadvantage for supplies adhered to.

In the existing circumstance, nevertheless, the financial institution sees a chance: “In our sight, the document VIX retracement provides the possibility to include equity bushes at comparable degrees as prior to the early-August shock, and in advance of important forthcoming stimulants.”

On Yahoo Financing’s podcast Stocks in Translation, Yahoo Financing editor Jared Blikre puncture the marketplace trouble, loud numbers, and embellishment to bring you crucial discussions and understandings from throughout the spending landscape, supplying you with the vital context required to make the right choices for your profile. Discover a lot more episodes on our video clip center or enjoy on your favored streaming solution

Go Here for the current securities market information and comprehensive evaluation, consisting of occasions that relocate supplies

Check out the current monetary and company information from Yahoo Financing

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.