The Commodities Futures Trading Compensation (CFTC) released an order versus Uniswap on Wednesday, enforcing a $175,000 negotiation charge.

The regulatory authority recognized Uniswap Labs’ participation with the Department of Enforcement’s examination, causing a decreased civil financial charge.

Uniswap to Pay $175,000 in CFTC Instance

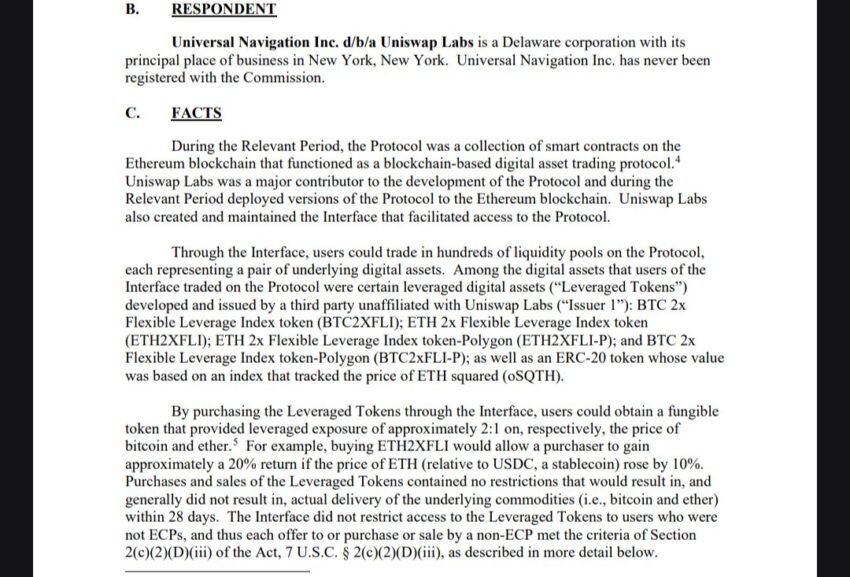

The CFTC issued an order and cleared up costs versus Global Navigating Inc., running as Uniswap Labs, needing the firm to pay a $175,000 penalty. The costs come from unlawfully providing leveraged or margined retail asset deals in electronic possessions via its decentralized trading method.

Along with the civil charge, the CFTC alerted Uniswap Labs versus future infractions of the Product Exchange Act (CEA). The payment slammed Uniswap for falling short to sign up as an assigned agreement market, which restricted the DEX from providing leveraged trading items.

Regardless of doing not have correct enrollment, Uniswap produced an interface and clever agreements that permitted customers to trade symbols. 3rd parties additionally created a few of these symbols, subjecting capitalists to leveraged or margined returns connected to the rate of Bitcoin (BTC) and Ethereum (ETH).

” The order discovers these leveraged symbols are leveraged or margined asset deals that did not lead to real shipment within 28 days and for that reason can be used to non-Eligible Agreement Individuals just on a board of profession that has actually been marked or signed up by the CFTC as an agreement market, which Uniswap Labs was not,” a passage in the press release read.

Find Out More: Exactly How Does Guideline Effect Crypto Advertising? A Total Overview

Especially, the CFTC minimized the charge, recognizing Uniswap Labs’ participation throughout the examination. According to Artemis data, Uniswap produces millions in charges daily, making the $175,000 penalty a plain put on the wrist.

” IMO: Phrasing is favorable and an adjustment from aggressive enforcement to compensating “participation” with light penalties,” crypto analyst MartyParty wrote.

At The Same Time, Uniswap is additionally encountering examination from the United States Stocks and Exchange Compensation (SEC). In April, the SEC released a Wells Notification to Uniswap, suggesting it had adequate proof to wage a suit.

Find Out More: Exactly How To Get Uniswap (UNI) and Whatever You Required To Know

Among the current growth, the Uniswap (UNI) token is up 8%. BeInCrypto information reveals that it is trading for $6.58 at the time of creating

Please Note

In adherence to the Count on Task standards, BeInCrypto is dedicated to honest, clear coverage. This newspaper article intends to offer precise, prompt details. Nonetheless, visitors are recommended to confirm truths individually and seek advice from a specialist prior to making any kind of choices based upon this web content. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.