According to RootData data, 111 openly divulged crypto VC financial investment jobs happened in August, matching the total amount from July 2024. This stands for a 41% boost contrasted to August 2023, when 78 jobs were taped.

The overall fundraising quantity in August got to $785 million, noting a 22% decline from the $1.01 billion increased in July.

Crypto VC Investments Remain Steady in August

Financial backing task is an essential indication of significant financiers’ passion in the crypto market. While the variety of openly divulged crypto VC jobs in August stayed unmodified from July, both months currently rate as the third-highest for crypto financing rounds in 2024, behind March and Might, which saw 190 and 155 rounds, specifically.

Although the overall fundraising quantity in August stopped by 22% from July’s $1.01 billion, it still stands for a 20% boost over the $660 million increased in August 2023.

Learn More: Ideal Financial Investment Applications in 2024

The constant financing quantity mirrors solid self-confidence in the crypto field, also among financial unpredictabilities. Furthermore, the circulation of funds throughout different fields indicate moving concerns and arising patterns in the market.

In August, decentralized money (DeFi) represented virtually 25% of overall financial investments, complied with by expert system (AI) at 15%. Devices and budgets saw the tiniest share, with just 2.2% of the total amount.

It is very important to keep in mind that these numbers do not consist of merging and purchase bargains.

DeFi and AI Take the Limelight

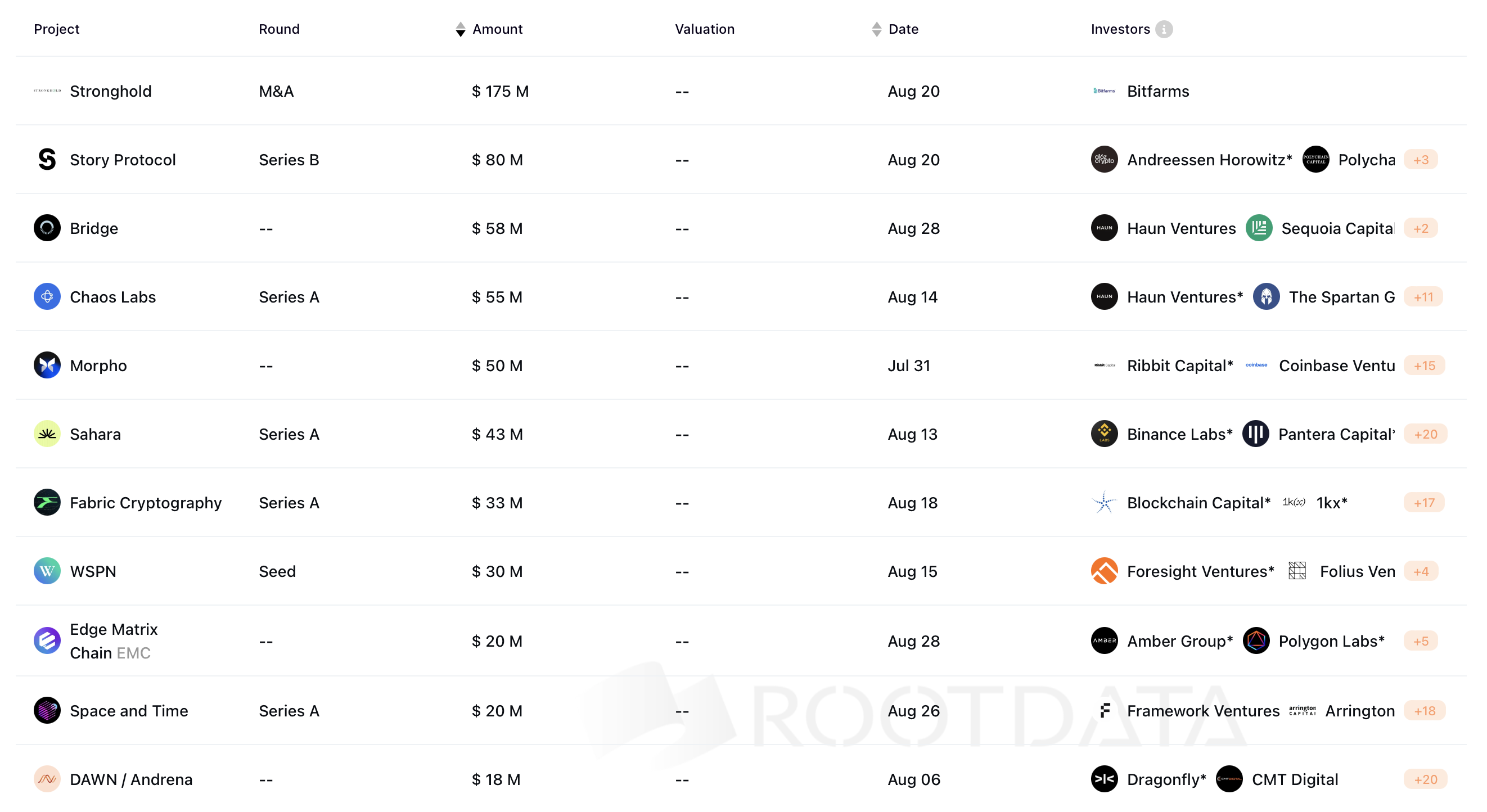

The biggest occasion in August once more entailed Bitcoin mining business: Bitfarms announced its acquisition of rival Fortress Digital for $175 million in supply and financial debt, contributing to the current pattern of mining M&A s. Bitfarms will certainly trade 2.52 shares for every Fortress share, a 71% costs over the 90-day volume-weighted ordinary cost of Fortress on Nasdaq since August 16.

” After 3 years of recurring conversations, I am happy to introduce this transformative purchase. With this deal, we anticipate to broaden and rebalance our power profile to 950 MW with virtually 50% in the United States by the end of 2025 and have exposure on multi-year development ability approximately 1.6 GW with around 66% in the United States, up from around 6% today,” Bitfarms chief executive officer Ben Gagnon claimed.

IP-focused Tale Procedure safeguarded $80 million in a Collection B financing round led by Andreessen Horowitz, with engagement from Polychain and various other financiers. Established in 2022, Tale has actually currently increased a total amount of $140 million, with the most recent round supposedly valuing the business at $2.25 billion.

Tale’s blockchain system enables copyright (IP) proprietors to save their IP on the network, installing use terms– such as licensing costs– right into clever agreements. This guarantees that proprietors are made up whenever their IP is utilized.

” Large Technology is swiping IP without authorization and recording all the revenue. Initially, they will certainly demolish your IP for their AI designs with no payment. The existing state of AI entirely ruins the reward to produce initial IP for everyone,” Tale founder S.Y. Lee mentioned.

The third-largest financing, completing $58 million, was secured by Bridge, a stablecoin network started by previous Coinbase and Square execs. Bridge intends to test conventional economic systems like Swift and charge card facilities by providing a much more efficien choice.

Various other significant financing rounds in August consisted of Disorder Labs, which increased $55 million for DeFi danger administration, and Morpho, protecting $50 million to incorporate DeFi right into the net’s facilities. Sahara AI increased $43 million to boost AI sovereignty, while Material Cryptography safeguarded $33 million to create cryptographic equipment.

Learn More: Leading 12 Crypto Business to View in 2024

One smaller sized financing round stuck out because of the existing buzz around meme coin launch pads. Parlay Labs, the very first multichain, no-code system for releasing meme coins, safeguarded a $2 million round led by DNA.fund. Noteworthy private financiers consisted of Jon Najarian of Market Disobedience and Rick Schlesinger, Founder of EOS New York City.

” The concentrate on meme coins was asserted on existing market need. Parlay wished to get in the marketplace with an item that makers and individuals wished to utilize, not something that we believed they must utilize. Currently Parlay uses development and trading throughout the EVM range. Strategies are to broaden throughout much more chains throughout this very first quarter of launch, and allow makers that prefer various other methods take pleasure in the exact same device’s presently provided by Parlay on EVM,” Parlay group informed BeInCrypto.

Please Note

In adherence to the Count on Job standards, BeInCrypto is devoted to honest, clear coverage. This newspaper article intends to give precise, prompt details. Nonetheless, visitors are encouraged to confirm realities individually and talk to a specialist prior to making any type of choices based upon this material. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.