Amidst the wider market unpredictability, (DOGE) rate has actually lowered to $0.0096 after trading at $0.12 simply 10 days earlier. This decrease might be connected to Ethereum’s (ETH) efficiency, as ETH has actually played a crucial function in Dogecoin’s previous rallies.

Nonetheless, unlike previous circumstances, Ethereum might currently restrict DOGE’s possibilities of recoiling by itself. This on-chain evaluation discovers the variables behind this change.

Ethereum Participates In Dogecoin’s Slow Recuperation

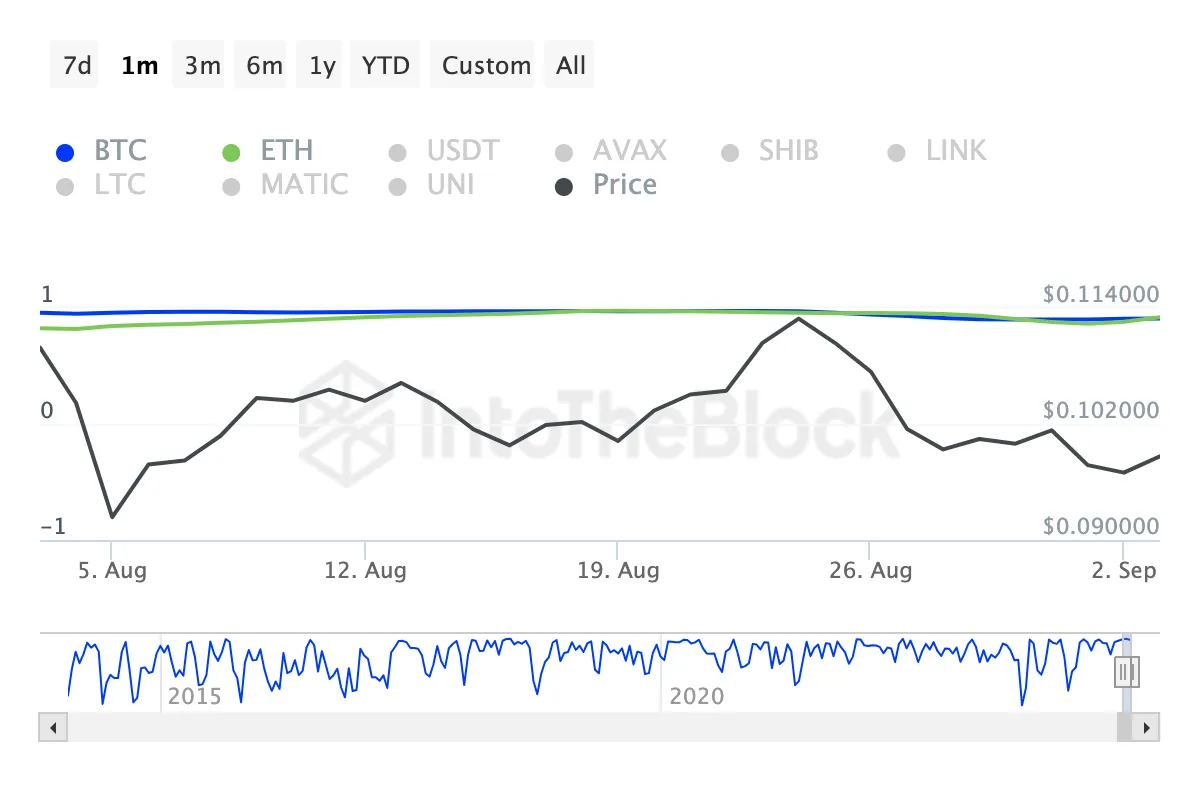

According to IntoTheBlock, Dogecoin and Ethereum have a high relationship of 0.92 over the previous month, indicating DOGE’s rate is very closely connected to Ethereum’s activities. As Ethereum is the second-largest cryptocurrency, DOGE owners ought to check its efficiency, as it can greatly affect Dogecoin’s rate patterns.

For those unknown, the relationship coefficient varies from -1 to +1. A worth near +1 suggests a solid partnership, where 2 crypto possessions relocate sync. Alternatively, a coefficient near -1 recommends that the possessions seldom relocate the very same instructions.

Just recently, BeInCrypto reported just how DOGE’s rally mainly relies on Bitcoin. Nonetheless, its strong rate activity with ETH could additionally be a problem for the following degree the cryptocurrency’s worth hits.

Learn More: Just How To Get Dogecoin (DOGE) and Whatever You Required To Know

Since this writing, Ethereum (ETH) is valued at $2,402, noting a 37.46% decrease over the previous 90 days. If ETH remains to underperform, Dogecoin (DOGE) is most likely to do the same.

One more element that can impede DOGE’s recuperation is its Open Rate Of Interest (OI) in the by-products market. OI stands for the complete variety of energetic agreements. In unpredictable markets, crypto rallies are typically driven by climbing OI or area purchasing stress.

A reduction in OI signals investors shutting placements and drawing cash out, while a rise suggests hostile purchasing. For Dogecoin, OI has actually gone down to $1.25 billion, its most affordable given that January 18.

DOGE Cost Forecast: Bears Continue To Be in Control

In August, Dogecoin created a rising triangular as the coin relocated from $0.080 to $0.11. This favorable technological pattern was expected to set off a greater worth for DOGE.

Nonetheless, births declined the relocation, as revealed listed below. According to this evaluation, DOGE could locate it testing to rebound in the short-term. One factor for this is the Asset Network Index (CCI), a sign made use of to identify rate turnaround and pattern stamina.

Utilizing the distinction in between the present rate and the historic rate standard, a favorable analysis suggests that the stamina to rebound is strong. However in Dogecoin’s instance, the analysis is unfavorable, recommending that the pattern around the coin is bearish.

Learn More: Dogecoin (DOGE) Cost Forecast 2024/2025/2030

As long as this stays the very same, DOGE’s rate can go down to its assistance degree around $0.091. Nonetheless, if Ethereum’s rate surges, the solid relationship in between both can set off an enter DOGE’s worth, possibly pressing it back to $0.11.

Please Note

According to the Trust fund Task standards, this rate evaluation post is for informative objectives just and ought to not be taken into consideration economic or financial investment guidance. BeInCrypto is dedicated to exact, impartial coverage, however market problems undergo transform without notification. Constantly perform your very own study and talk to a specialist prior to making any type of economic choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.