Reviewing gas and fluid handling supplies’ Q2 profits, we analyze this quarter’s finest and worst entertainers, consisting of Parker-Hannifin (NYSE: PH) and its peers.

Gas and fluid handling business have the technological expertise and customized devices to manage useful (and often unsafe) materials. Recently, water preservation and carbon capture– which calls for hydrogen and various other gasses in addition to specialized framework– have actually been trending up, developing brand-new need for items such as filters, pumps, and shutoffs. On the various other hand, gas and fluid handling business go to the impulse of financial cycles. Customer costs and rates of interest, for instance, can substantially influence the commercial manufacturing that drives need for these business’ offerings.

The 12 gas and fluid handling supplies we track reported a blended Q2. En masse, earnings missed out on experts’ agreement quotes by 0.9%.

Rising cost of living advanced in the direction of the Fed’s 2% objective at the end of 2023, bring about solid securities market efficiency. On the various other hand, 2024 has actually been a bumpier adventure as the marketplace switches over in between positive outlook and pessimism around price cuts and rising cost of living, and gas and fluid handling supplies have actually had a harsh stretch. Generally, share costs are down 5.2% because the most up to date profits outcomes.

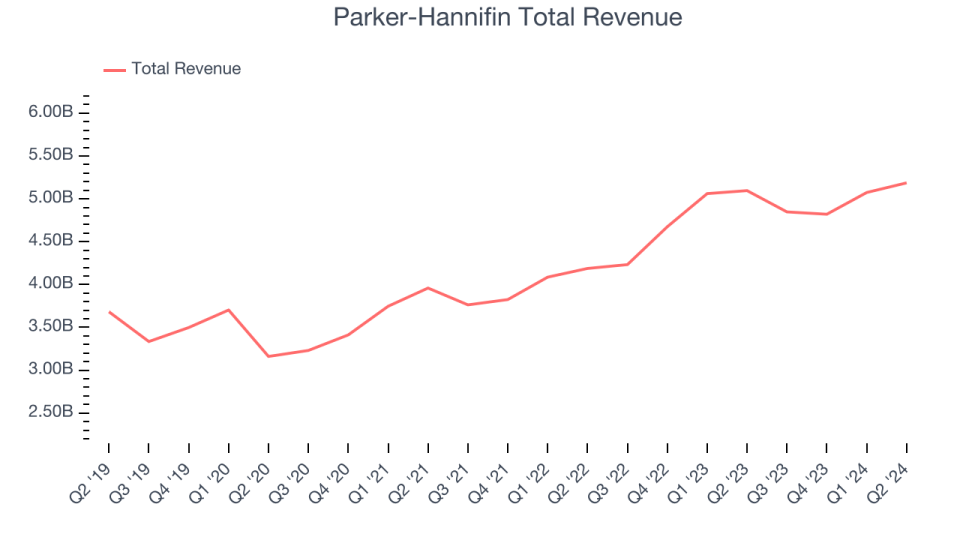

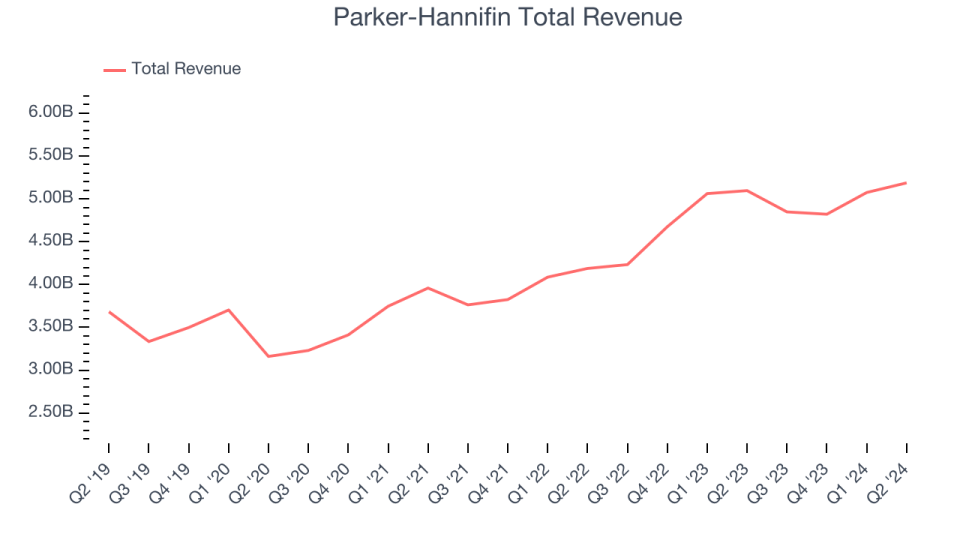

Parker-Hannifin (NYSE: PH)

Established In 1917, Parker Hannifin (NYSE: PH) is a supplier of activity and control systems for a variety of mobile, commercial and aerospace markets.

Parker-Hannifin reported earnings of $5.19 billion, up 1.8% year on year. This print surpassed experts’ assumptions by 2%. In general, it was a solid quarter for the business with an outstanding beat of experts’ natural profits quotes and a suitable beat of experts’ profits quotes.

” We provided an extremely solid 4th quarter topping one more year of document efficiency,” claimed Chairman and Ceo, Jenny Parmentier.

Surprisingly, the supply is up 12% because reporting and presently trades at $575.35.

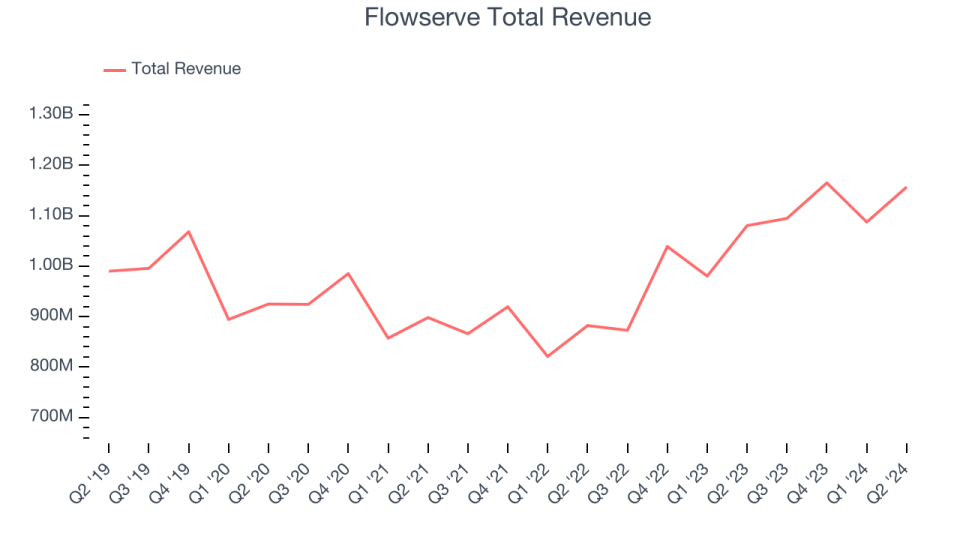

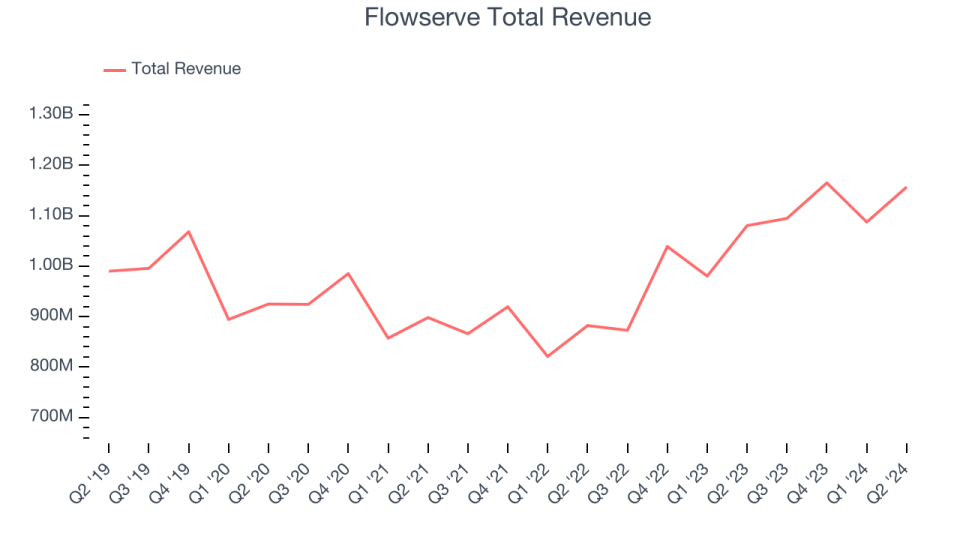

Finest Q2: Flowserve (NYSE: FLS)

Production the biggest pump ever before constructed for nuclear power generation, Flowserve (NYSE: FLS) makes and markets circulation control devices for numerous sectors.

Flowserve reported earnings of $1.16 billion, up 7.1% year on year, surpassing experts’ assumptions by 2.4%. It was a phenomenal quarter for the business with an outstanding beat of experts’ operating margin quotes and a strong beat of experts’ profits quotes.

Flowserve provided the most significant expert approximates defeat amongst its peers. Although it had a great quarter contrasted its peers, the marketplace appears dissatisfied with the outcomes as the supply is down 2% because coverage. It presently trades at $49.88.

Is currently the moment to acquire Flowserve? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Gorman-Rupp (NYSE: GRC)

Powering liquid characteristics because 1934, Gorman-Rupp (NYSE: GRC) has actually developed from its Ohio beginnings right into a worldwide maker and vendor of pumps and pump systems.

Gorman-Rupp reported earnings of $169.5 million, level year on year, disappointing experts’ assumptions by 3.8%. It was a weak quarter for the business with a miss out on of experts’ profits quotes.

As anticipated, the supply is down 3.6% because the outcomes and presently trades at $39.15.

Read our full analysis of Gorman-Rupp’s results here.

ITT (NYSE: ITT)

Playing an important function in the advancement of the very first transatlantic tv transmission in 1956, ITT (NYSE: ITT) offers activity and liquid handling devices for numerous sectors

ITT reported earnings of $905.9 million, up 8.6% year on year, disappointing experts’ assumptions by 1.1%. Income apart, it was a blended quarter for the business with a suitable beat of experts’ natural profits quotes yet underwhelming profits assistance for the complete year.

The supply is down 1.6% because reporting and presently trades at $139.22.

Read our full, actionable report on ITT here, it’s free.

Helios (NYSE: HLIO)

Based on the concept of dealing with others as one wishes to be dealt with, Helios (NYSE: HLIO) styles, makes, and markets activity and digital control parts for numerous fields.

Helios reported earnings of $219.9 million, down 3.4% year on year, exceeding experts’ assumptions by 1.9%. Taking a go back, it was a strong quarter for the business with an outstanding beat of experts’ operating margin quotes.

Helios had the weakest full-year assistance upgrade amongst its peers. The supply is up 1% because reporting and presently trades at $41.97.

Read our full, actionable report on Helios here, it’s free.

Sign Up With Paid Supply Financier Study

Aid us make StockStory much more useful to capitalists like on your own. Join our paid customer study session and obtain a $50 Amazon present card for your viewpoints. Sign up here.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.