Complying with 2 successive day-to-day environment-friendly candle lights, Binance Coin’s (BNB) cost is currently near a degree that can identify its following significant step. On September 1, the indigenous token of the BNB Chain was close to dropping listed below $500.

The problems highlighted in this evaluation will certainly establish whether the coin will certainly remain to rally or encounter more decreases.

Binance Coin Nears $550 Supply Area

In August, BNB cost developed a rising network on the day-to-day graph. Consequently, the cryptocurrency had the ability to relocate from $464 to $600. Nevertheless, the 15% decline afterwards intimidated its cost activity with a sign recommending one more cost accident like what occurred on August 5.

Bulls handled to avoid more decrease, assisting BNB rebound to $536.40. As the cost comes close to the $550-$ 560 supply area, where vendors exceed purchasers, appearing this area can be tough.

A lot of the moment, striking this area brings about a cost autumn as long as need stays soft. For BNB, damaging past the area stays a burden, as the present purchasing stress may not be significant adequate to drive the cost a lot greater.

Learn More: Finest BNB Pocketbooks to Think About in 2024

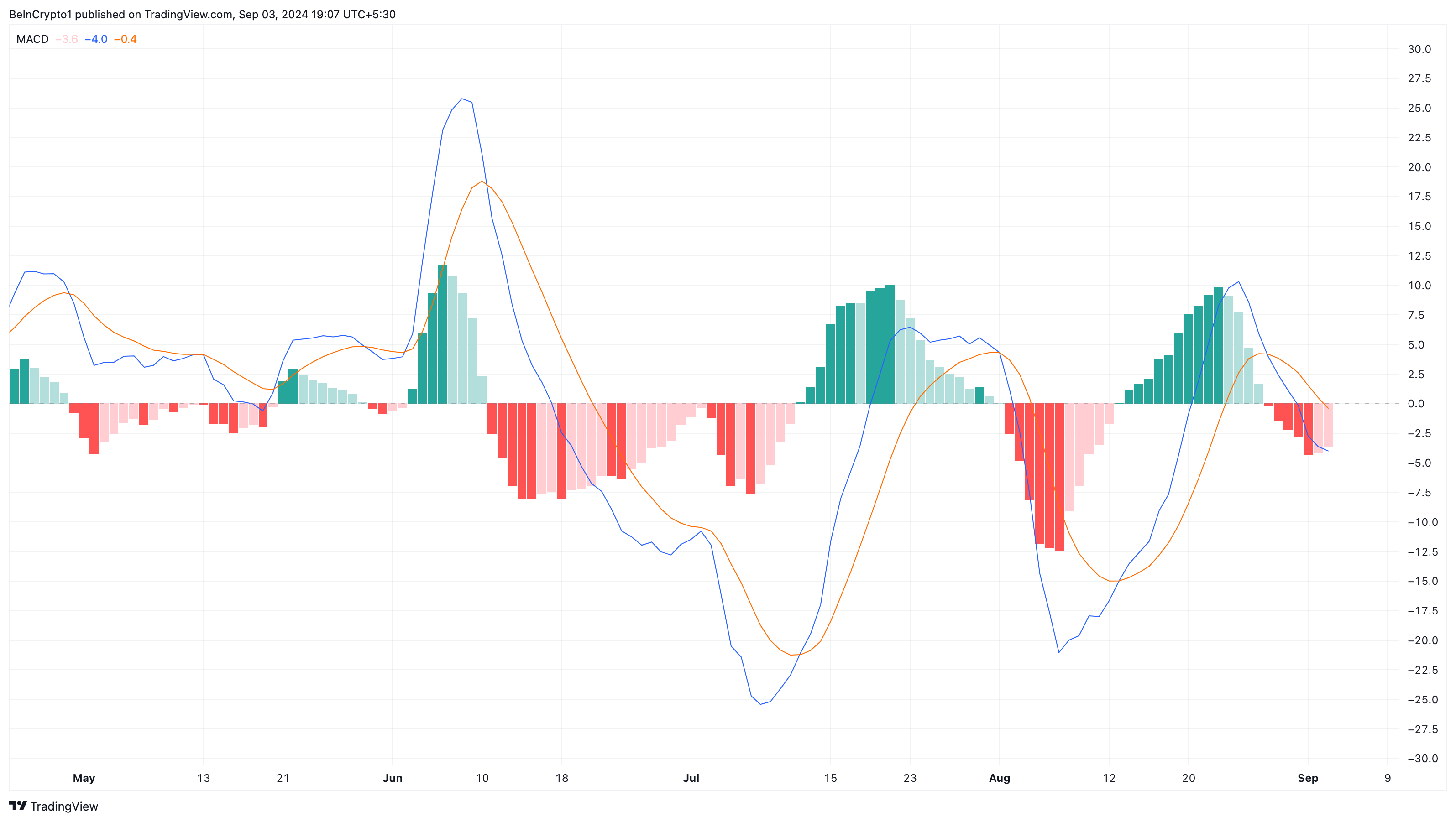

The Relocating Ordinary Merging Aberration (MACD) on the day-to-day graph appears to sustain the predisposition. In non-technical terms, the MACD is a technological oscillator that gauges a cryptocurrency’s energy.

When the analysis declares, energy is favorable, and maybe a very early signal. An unfavorable analysis, on the various other hand, recommends that the energy is bearish. As revealed listed below, the MACD on the BNB/USD day-to-day graph is adverse.

This analysis shows that the BNB’s climbing cost may not last a long period of time. For that reason, damaging over $550 may be an obstacle that may feature no success.

BNB Cost Forecast: Not Yet Time to Strike a New High

From a historic viewpoint, practically each time BNB falls short to damage above $560, the cost at some point goes down listed below $520– sometimes, $500.

For that reason, if previous efficiencies affect future patterns, climbing up towards $600 may not come true in the short-term The graph listed below additionally reveals that the $546.30 area is a noteworthy sight.

Therefore, bears may additionally try to stand up to an additional benefit as the coin comes close to the area. If this takes place, BNB’s cost may reduce to $500 for the very first time in practically a month.

Learn More: Binance Coin (BNB) Cost Forecast 2024/2025/2030

On the benefit, the cryptocurrency’s cost can go beyond the overhanging resistance, possibly striking $589.80 if the more comprehensive market problem maintains a current recuperation.

Please Note

According to the Depend on Job standards, this cost evaluation post is for educational objectives just and need to not be taken into consideration monetary or financial investment suggestions. BeInCrypto is devoted to precise, honest coverage, yet market problems undergo transform without notification. Constantly perform your very own study and talk to a specialist prior to making any type of monetary choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.