Completion of a revenues period can be a fun time to find brand-new supplies and examine exactly how firms are managing the existing company setting. Allow’s have a look at exactly how Expeditors (NYSE: EXPD) et cetera of the air cargo and logistics supplies got on in Q2.

The development of ecommerce and international profession remains to drive need for expedited delivery solutions, offering possibilities for air cargo firms. The sector remains to purchase sophisticated innovations such as automated arranging systems and real-time monitoring services to improve functional effectiveness. In spite of the benefits of rate and international reach, air cargo and logistics firms are still at the impulse of financial cycles. Customer investing, for instance, can significantly affect the need for these firms’ offerings while gas expenses can affect earnings margins.

The 7 air cargo and logistics supplies we track reported a combined Q2. En masse, incomes missed out on experts’ agreement price quotes by 0.8%.

Supplies– particularly those trading at greater multiples– had a solid end of 2023, however this year has actually seen durations of volatility. Combined signals concerning rising cost of living have actually brought about unpredictability around price cuts. Nevertheless, air cargo and logistics supplies have actually held stable among all this with share costs up 4.8% typically because the current profits outcomes.

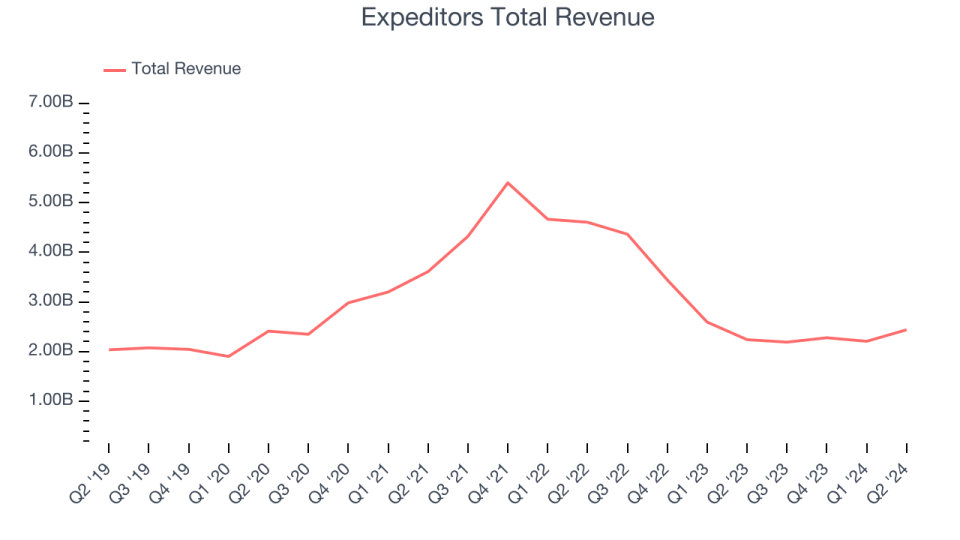

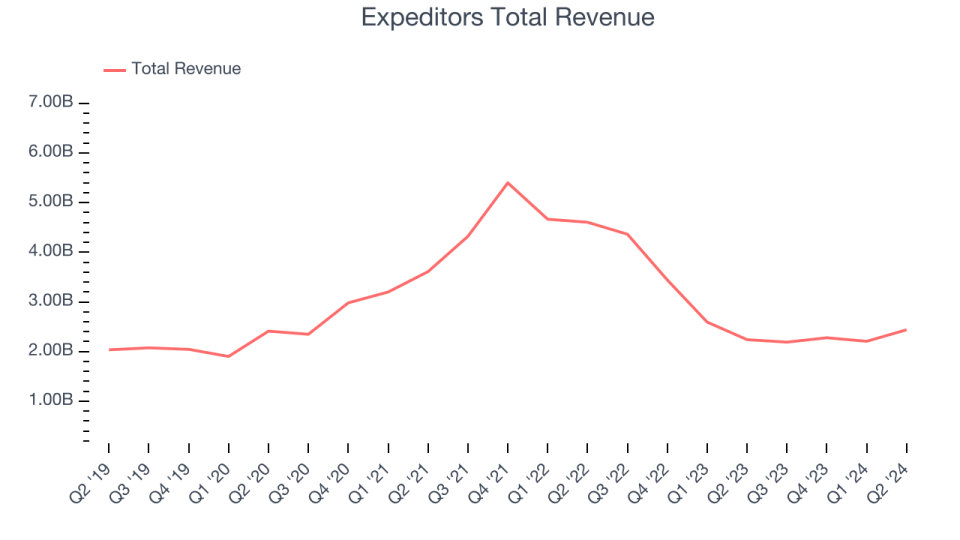

Ideal Q2: Expeditors (NYSE: EXPD)

Expeditors (NYSE: EXPD) uses air and sea products in addition to broker agent solutions.

Expeditors reported incomes of $2.44 billion, up 8.9% year on year. This print surpassed experts’ assumptions by 5.4%. In general, it was a solid quarter for the firm with an excellent beat of experts’ Airfreight profits price quotes.

” We remained to adjust well to an additional unpredictable quarter for our sector, which has actually been influenced by the quick modifications and inequalities in buy versus sell prices, especially on exports out of Asia,” claimed Jeffrey S. Musser, Head Of State and President.

Remarkably, the supply is up 1.6% because reporting and presently trades at $123.36.

Is currently the moment to get Expeditors? Access our full analysis of the earnings results here, it’s free.

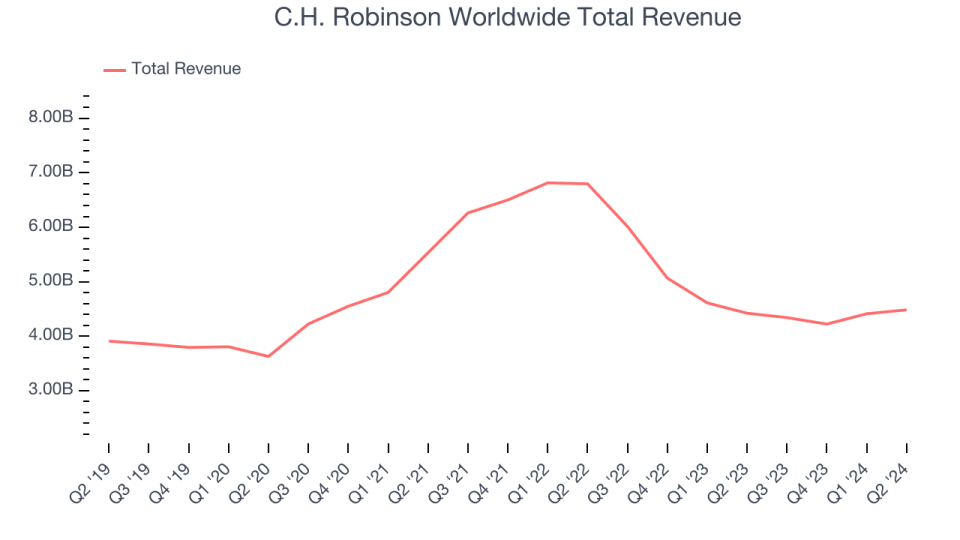

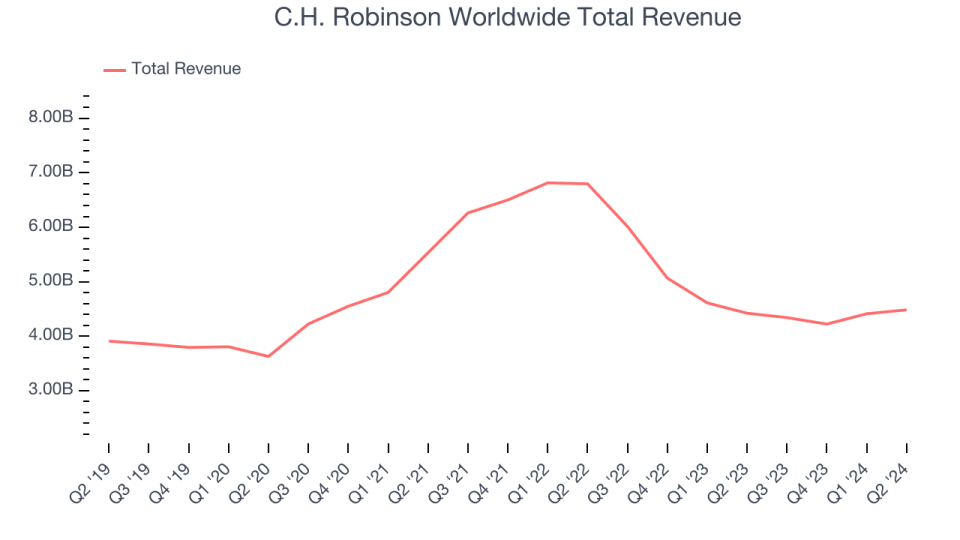

C.H. Robinson Worldwide (NASDAQ: CHRW)

Participating in agreements with 10s of hundreds of transport firms, C.H. Robinson (NASDAQ: CHRW) uses products transport and logistics solutions.

C.H. Robinson Worldwide reported incomes of $4.48 billion, up 1.4% year on year, in accordance with experts’ assumptions. It was a strong quarter for the firm with an excellent beat of experts’ profits price quotes.

The marketplace appears pleased with the outcomes as the supply is up 13.7% because coverage. It presently trades at $101.23.

Is currently the moment to get C.H. Robinson Worldwide? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Center Team (NASDAQ: HUBG)

Begun with $10,000, Center Team (NASDAQ: HUBG) is a service provider of intermodal, vehicle broker agent, and logistics solutions, helping with transport services for companies worldwide.

Center Team reported incomes of $986.5 million, down 5.2% year on year, disappointing experts’ assumptions by 9.7%. It was a weak quarter for the firm with full-year profits assistance missing out on experts’ assumptions and a miss out on of experts’ quantity price quotes.

Center Team uploaded the weakest efficiency versus expert price quotes and weakest full-year assistance upgrade in the team. The supply is level because the outcomes and presently trades at $45.91.

Read our full analysis of Hub Group’s results here.

GXO Logistics (NYSE: GXO)

With remarkable clients such as Nike and Apple, GXO (NYSE: GXO) handles outsourced supply chains and warehousing for numerous firms.

GXO Logistics reported incomes of $2.85 billion, up 18.9% year on year, going beyond experts’ assumptions by 6%. Taking a go back, it was an excellent quarter for the firm with a good beat of experts’ operating margin price quotes.

GXO Logistics attained the largest expert approximates beat and fastest profits development amongst its peers. The supply is down 1.7% because reporting and presently trades at $48.48.

Read our full, actionable report on GXO Logistics here, it’s free.

FedEx (NYSE: FDX)

Infamously taking its last $5,000 to a Las Las vega blackjack table to maintain the firm afloat, FedEx (NYSE: FDX) is a service provider of parcel and freight distribution solutions

FedEx reported incomes of $22.11 billion, level year on year, in accordance with experts’ assumptions. In general, it was an excellent quarter for the firm with a good beat of experts’ operating margin price quotes.

The supply is up 14.4% because reporting and presently trades at $293.37.

Read our full, actionable report on FedEx here, it’s free.

Sign Up With Paid Supply Financier Research Study

Aid us make StockStory a lot more useful to financiers like on your own. Join our paid individual research study session and obtain a $50 Amazon present card for your viewpoints. Sign up here.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.