For several weeks, Ethereum’s (ETH) rate has actually been looking at a go back to $3,000. However, that has actually not occurred as a result of a number of denials and an instead silent more comprehensive market.

Nonetheless, the underwhelming rate activity is not the only difficulty encountering the blockchain, rated as the second-most useful crypto job. This on-chain evaluation highlights the various other components and what might end up being of ETH rate in the short-term.

Ethereum Incomes Down, Some Whales Out

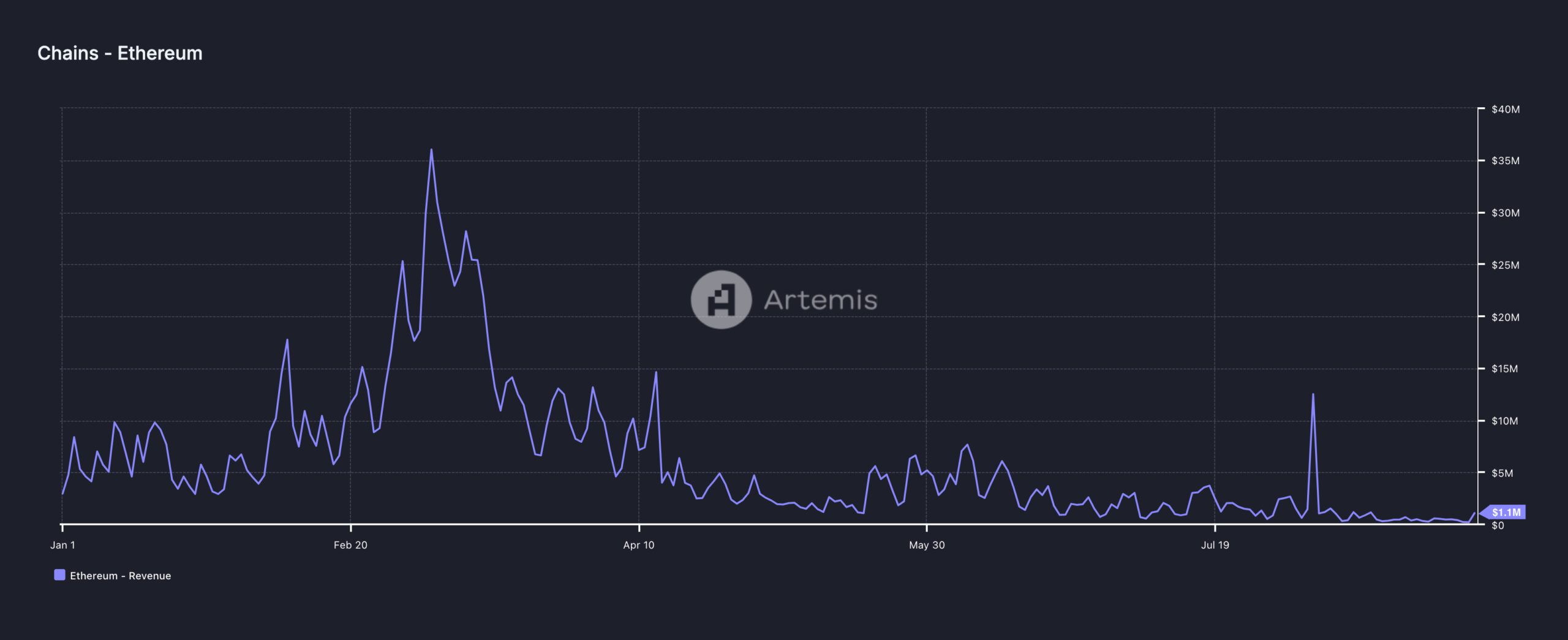

According to Artemis information, Ethereum’s earnings has actually dived to its floor this year. This significant decrease is a plain comparison to the worth in March. Throughout that duration, the blockchain’s earnings rose to $36 million.

Since this writing, the exact same statistics is $1.10 million and dangers dropping listed below the seven-figure worth. The sharp decrease might be credited to the March 13 Dencun upgrade.

The upgrade, tailored at lowering deal charges, made certain that customers no more need to pay ludicrous comissions. Besides the reality that charges are a vital component of Ethereum’s earnings, the large loss in need for ETH likewise added to it.

Find Out More: Exactly how to Purchase Ethereum ETFs?

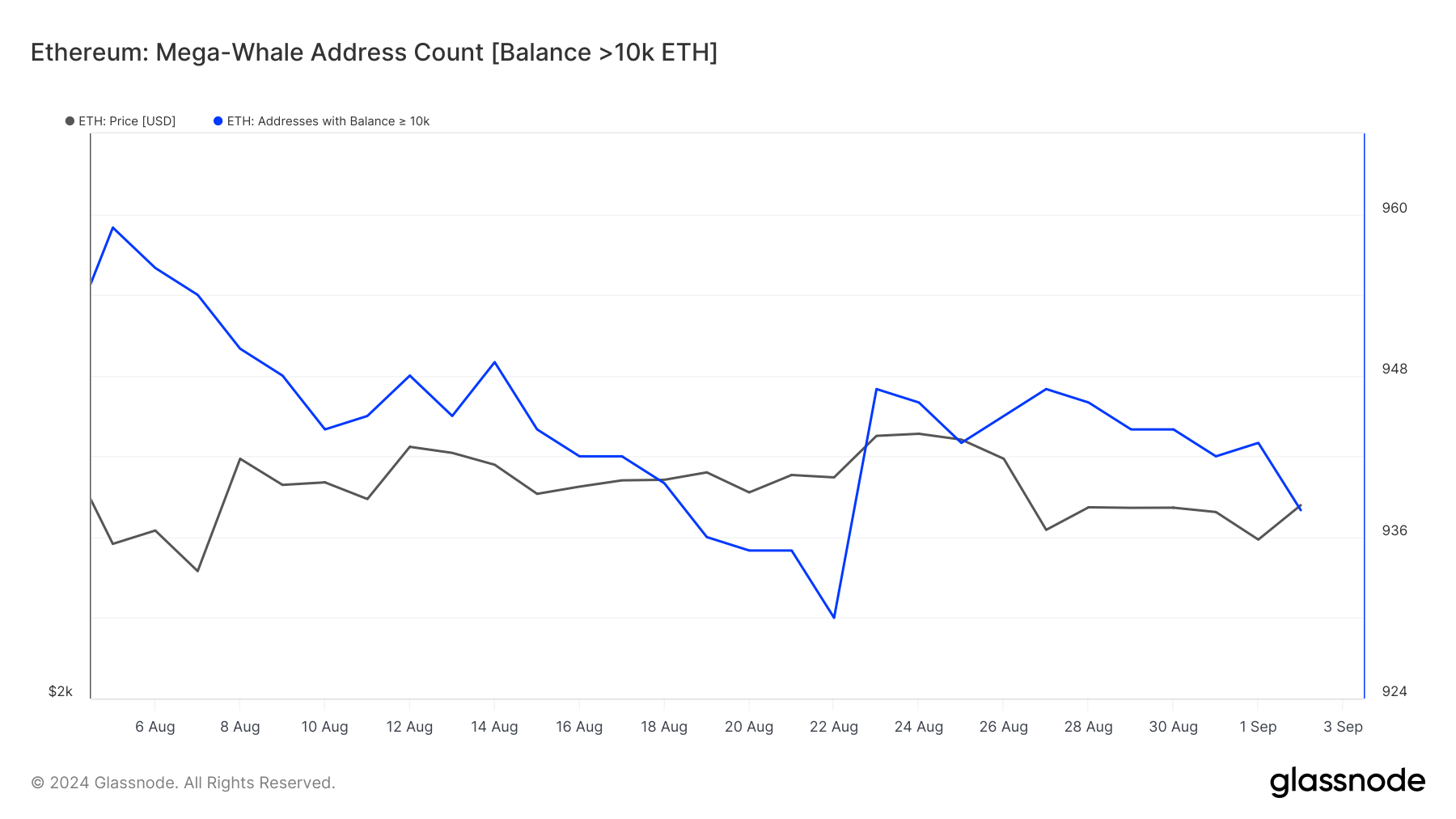

In Addition. ETH’s rate could remain to battle. For example, BeInCrypto took a look at the equilibrium of the Mega-Whale ETH addresses making use of on-chain information from Glassnode. These addresses, holding over 10,000 ETH each, play a vital function in rate motions.

When the equilibrium of these huge owners rises, it commonly indicates a prospective rate increase. Nonetheless, if their equilibrium lowers, it might suggest an impending rate decline. On August 23, the variety of addresses holding 10,000 ETH or even more stood at 947.

Already, this number has actually gone down to 938, suggesting that these whales have actually marketed roughly 90,000 ETH in the previous 2 weeks. If this pattern proceeds, ETH’s rate might quickly drop listed below $2,500.

ETH Rate Forecast: Not Mosting likely to $3,000 At Any Time Quickly

Evaluation of Ethereum’s everyday graph discloses that the cryptocurrency’s rate has actually been unstable. ETH has actually consistently attempted to damage the $2,800 mark, however each effort has actually met being rejected.

This battle is mainly as a result of inadequate purchasing quantity. If this pattern proceeds, ETH’s rate might go down listed below $2,500.

Contributing to the bearish overview, ETH’s rate is presently listed below the 20-day Exponential Relocating Typical (EMA), a vital indication of pattern instructions. When a cryptocurrency professions over the EMA, it usually indicates a favorable pattern.

Nonetheless, ETH’s existing placement listed below the 20-day EMA recommends it is vulnerable to more bearish stress. In a very bearish circumstance, the rate might be up to $2,496 or perhaps $2,341.

Find Out More: Ethereum (ETH) Rate Forecast 2024/2025/2030

In spite of these issues, the projection might alter if ETH sees a substantial rise in quantity and purchasing stress. Under these problems, the rate might climb to $2,794.

Please Note

According to the Depend on Job standards, this rate evaluation short article is for educational objectives just and ought to not be thought about economic or financial investment guidance. BeInCrypto is dedicated to exact, honest coverage, however market problems undergo alter without notification. Constantly perform your very own study and speak with an expert prior to making any kind of economic choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.