Ethereum’s profits has actually gone down dramatically over the previous numerous months as competitors from Layer-2 (L2) scaling options has actually raised.

The March Dencun Upgrade was an essential growth for the Ethereum blockchain, specifically in decreasing purchase costs. Nonetheless, this upgrade came with an expense.

Ethereum Earnings Sinks Amidst Layer-2 Boom

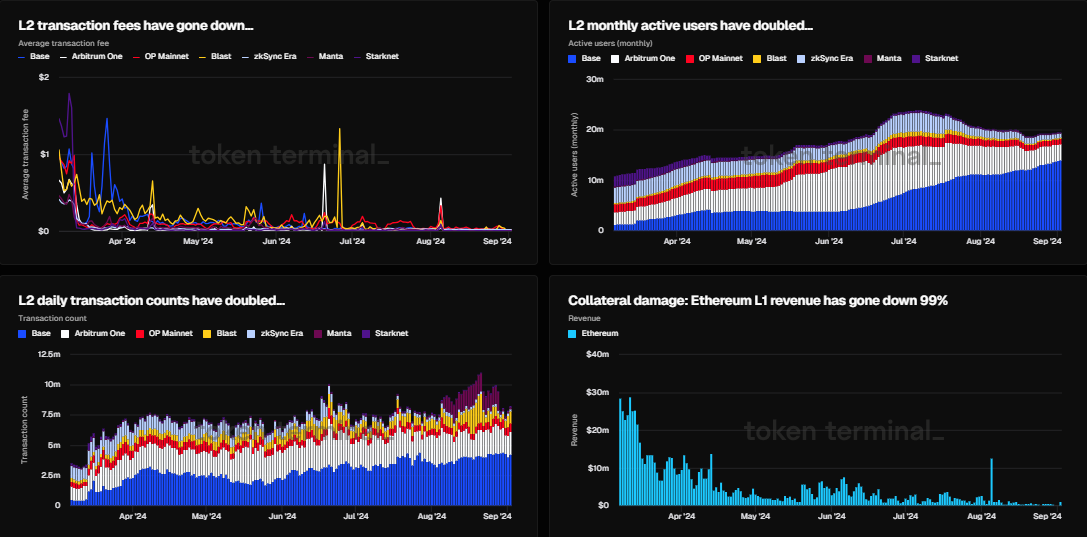

Ethereum’s profits has actually dived by 99% given that the Dencun upgrade on March 13, according toToken Terminal data The upgrade decreased purchase costs for Layer-2 (L2) options, increasing day-to-day purchase matters and month-to-month energetic customers.

Enhanced competitors among over 70 active L2 solutions and 21 Layer-3 (L3) jobs has actually even more attracted customers far from Ethereum’s mainnet, triggering Ethereum’s network profits to go down considerably from $35.5 million on March 5 to $566,000 by late August.

Rob Viglione, Chief Executive Officer of Horizen Labs, thinks Ethereum is transitioning from a main purchase system to an essential negotiation and safety and security layer for Layer 2 networks. While this change might trigger temporary interruptions, it might eventually strengthen Ethereum’s duty.

” We might see market loan consolidation amongst L2s, with a couple of leading gamers arising. Some could check out different information accessibility options, possibly tough Ethereum’s placement. Although, it’s most likely that L2s with solid, one-of-a-kind use-cases will certainly still remain in need for many years to find. Ethereum’s profits design is readied to change from private purchase costs to creating profits as the negotiation layer for L2 networks. This shift settings Ethereum as vital facilities for a varied blockchain community,” Viglione informed BeInCrypto.

Find Out More: What Is the Ethereum Cancun-Deneb (Dencun) Upgrade?

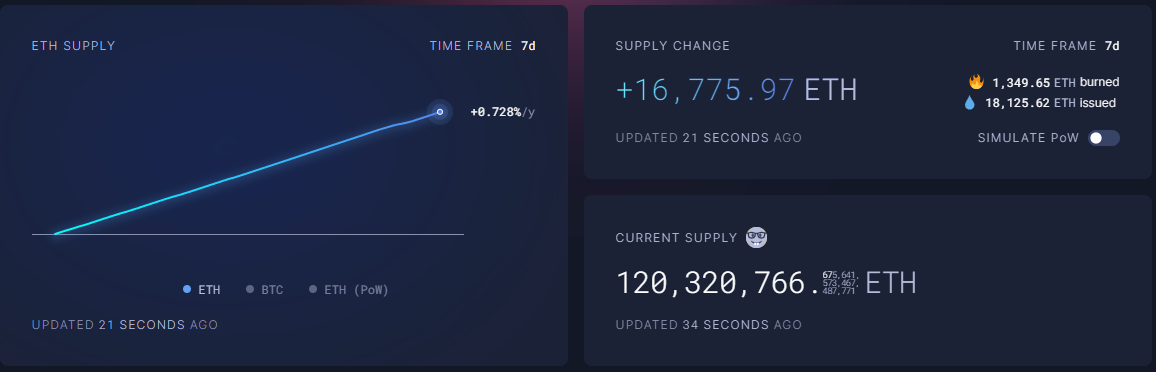

The Dencun Upgrade on Ethereum effectively decreased purchase prices however has actually had unintentional repercussions for token owners. Reduced costs have actually restricted need for ETH, which would usually be utilized to clear up network purchases.

This decreased need has actually raised ETH’s supply, threatening the deflationary impacts initially planned by Ethereum’s EIP-1559. Therefore, Ethereum has actually gone back to being an inflationary money, consistently releasing even more symbols than it sheds. According to ultrasound.money information, greater than 16,775 ETH symbols have actually been included in Ethereum’s general supply given that mid-April.

” We wrap up that, at the present price of network task, Ethereum will certainly not be deflationary once again. The story of ‘ultrasound’ cash has possibly passed away or would certainly require a lot greater network task to find back to life,” CryptoQuant experts claimed in a current report.

Find Out More: A Deeper Look into the Ethereum Network

In spite of decreased costs and worries over Ethereum’s fading deflationary capacity, some hypothesize that both Layer 1 and Layer 2 networks get on the verge of economic collapse, with capitalists potentially losing up to 80% of their worth. Nonetheless, Ethereum founder Vitalik Buterin differs, insisting that the network has actually expanded more powerful, also in the middle of these difficulties.

Please Note

In adherence to the Count on Task standards, BeInCrypto is dedicated to honest, clear coverage. This newspaper article intends to give exact, prompt info. Nonetheless, visitors are suggested to validate realities separately and seek advice from an expert prior to making any kind of choices based upon this material. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.