Concrete and waste monitoring firm Concrete Pumping (NASDAQ: BBCP) disappointed experts’ assumptions in Q2 CY2024, with profits down 9.2% year on year to $109.6 million. The firm’s full-year profits advice of $425 million at the axis additionally was available in 7.1% listed below experts’ price quotes. It made a GAAP earnings of $0.13 per share, below its earnings of $0.18 per share in the exact same quarter in 2015.

Is currently the moment to purchase Concrete Pumping? Find out in our full research report.

Concrete Pumping (BBCP) Q2 CY2024 Emphasizes:

-

Earnings: $109.6 million vs expert price quotes of $125.5 million (12.6% miss out on)

-

EPS: $0.13 vs expert assumptions of $0.19 (31% miss out on)

-

The firm dropped its profits advice for the complete year to $425 million at the axis from $460 million, a 7.6% decline

-

EBITDA advice for the complete year is $110.5 million at the axis, listed below expert price quotes of $120.9 million

-

Gross Margin (GAAP): 40.6%, in accordance with the exact same quarter in 2015

-

EBITDA Margin: 28.9%, in accordance with the exact same quarter in 2015

-

Totally Free Capital Margin: 24%, up from 22.1% in the exact same quarter in 2015

-

Market Capitalization: $332.8 million

” In the 3rd quarter, proceeded natural development in our united state Concrete Waste Monitoring organization was balanced out by a collection of aspects that influenced volume-driven decreases in our united state Concrete Pumping section,” claimed CPH chief executive officer Bruce Youthful.

Going public using SPAC in 2018, Concrete Pumping (NASDAQ: BBCP) is a supplier of concrete pumping and waste monitoring solutions in the USA and the UK.

Building and Upkeep Provider

Building and upkeep solutions business not just flaunt technological expertise in specialized locations however additionally might hold unique licenses and authorizations. Those that operate in even more controlled locations can take pleasure in a lot more foreseeable profits streams – as an example, emergency exit requirement to be checked every 5 years–. Much more just recently, solutions to deal with power effectiveness and labor schedule are additionally developing step-by-step need. Yet like the wider industrials field, building and construction and upkeep solutions business go to the impulse of financial cycles as exterior aspects like rates of interest can substantially influence the brand-new building and construction that drives step-by-step need for these business’ offerings.

Sales Development

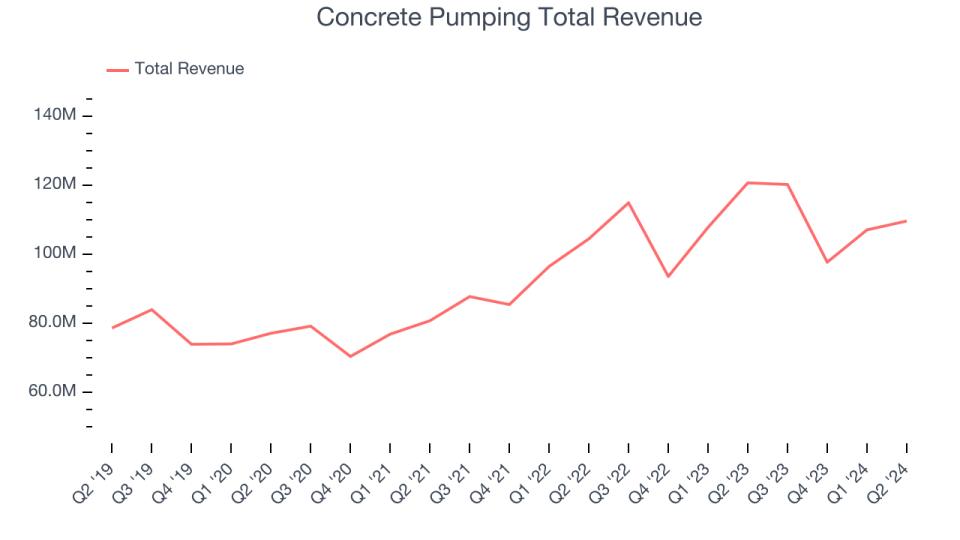

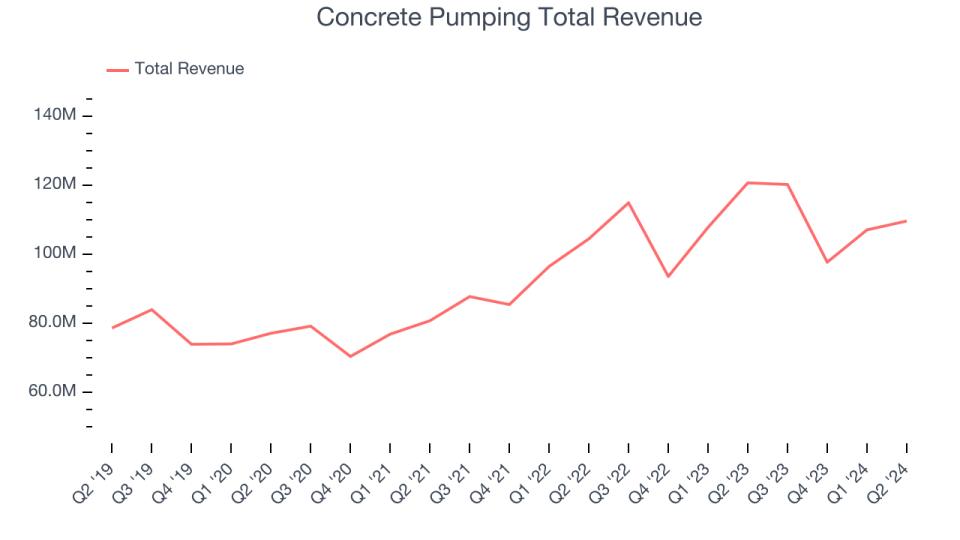

Checking out a business’s lasting efficiency can offer ideas regarding its organization top quality. Any kind of organization can install an excellent quarter or 2, however the most effective constantly expand over the long run. Over the last 5 years, Concrete Pumping expanded its sales at a strong 10.3% worsened yearly development price. This reveals it achieved success in broadening, a valuable beginning factor for our evaluation.

We at StockStory put one of the most focus on lasting development, however within industrials, a half-decade historic sight might miss out on cycles, market fads, or a business taking advantage of stimulants such as a brand-new agreement win or an effective product. Concrete Pumping’s annualized profits development of 7.8% over the last 2 years is listed below its five-year pattern, however we still believe the outcomes were commendable.

This quarter, Concrete Pumping missed out on Wall surface Road’s price quotes and reported an instead unexciting 9.2% year-on-year profits decrease, producing $109.6 numerous profits. Looking in advance, Wall surface Road anticipates sales to expand 8.5% over the following year, a velocity from this quarter.

Unless you have actually been living under a rock, it needs to be noticeable now that generative AI is mosting likely to have a substantial effect on just how huge firms work. While Nvidia and AMD are trading near all-time highs, we like a lesser-known (however still rewarding) semiconductor supply taking advantage of the increase of AI. Click here to access our free report on our favorite semiconductor growth story.

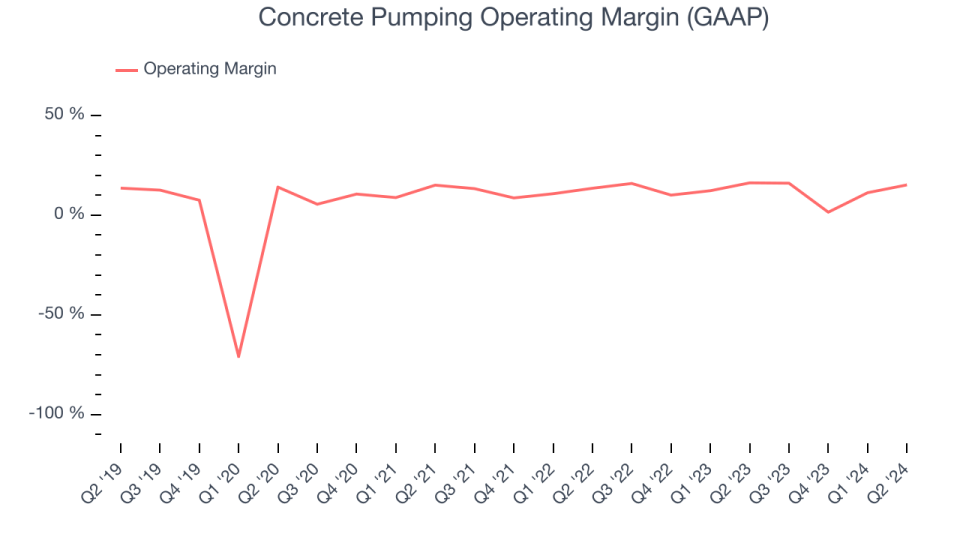

Operating Margin

Operating margin is an essential action of success. Think about it as earnings– the lower line– leaving out the influence of tax obligations and rate of interest on financial debt, which are much less linked to organization principles.

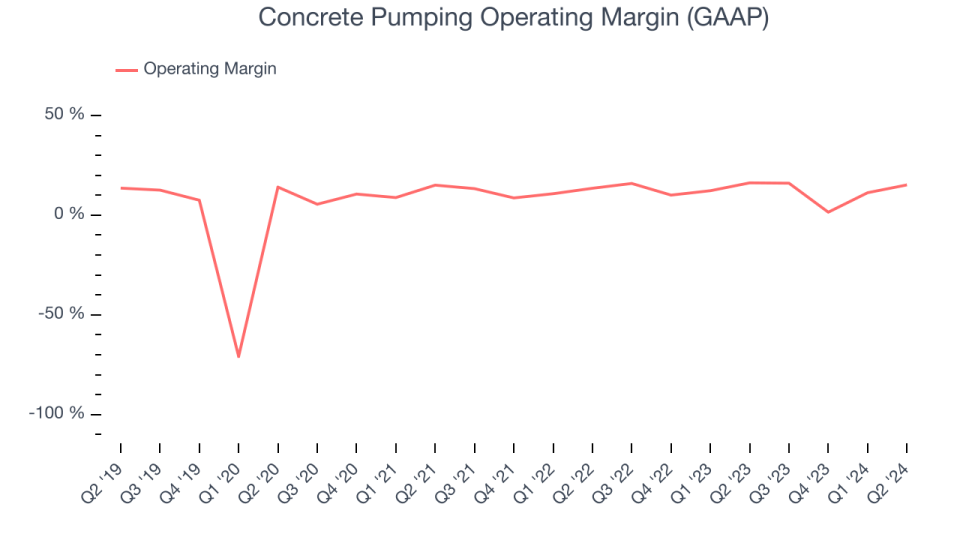

Concrete Pumping has actually done a respectable task handling its expenditures over the last 5 years. The firm has actually generated a typical operating margin of 8.5%, more than the wider industrials field.

Examining the pattern in its success, Concrete Pumping’s yearly operating margin increased by 19.6 portion factors over the last 5 years, as its sales development offered it tremendous operating utilize.

This quarter, Concrete Pumping created an operating earnings margin of 15.2%, down 1 portion factors year on year. Because Concrete Pumping’s operating margin reduced greater than its gross margin, we can presume the firm was just recently much less effective due to the fact that expenditures such as sales, advertising, R&D, and management expenses raised.

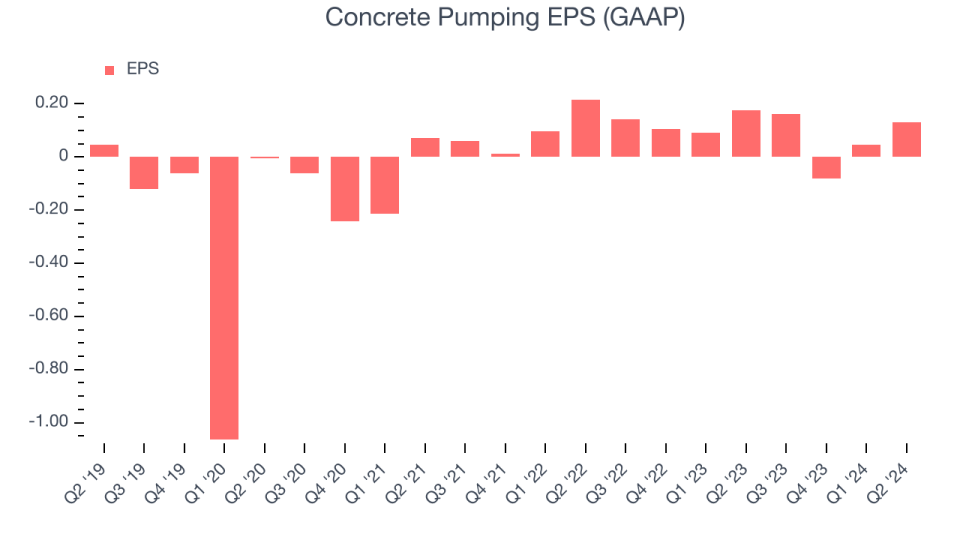

EPS

Examining lasting profits fads informs us regarding a business’s historic development, however the lasting modification in its revenues per share (EPS) indicate the success of that development– as an example, a business might inflate its sales with too much investing on advertising and marketing and promos.

Concrete Pumping’s full-year EPS turned from adverse to favorable over the last 5 years. This is motivating and reveals it goes to a defining moment in its life.

Like with profits, we additionally evaluate EPS over an extra current duration due to the fact that it can offer understanding right into an arising style or growth for business. Unfortunately for Concrete Pumping, its EPS decreased by 18.2% every year over the last 2 years while its profits expanded 7.8%. Nevertheless, its operating margin in fact broadened throughout this duration, informing us non-fundamental aspects impacted its supreme revenues.

In Q2, Concrete Pumping reported EPS at $0.13, below $0.18 in the exact same quarter in 2015. This print missed out on experts’ price quotes, however we care a lot more regarding lasting EPS development than temporary activities. Over the following year, Wall surface Road anticipates Concrete Pumping to expand its revenues. Experts are predicting its EPS of $0.26 in the in 2015 to climb up by 156% to $0.66.

Trick Takeaways from Concrete Pumping’s Q2 Outcomes

We battled to discover numerous solid positives in these outcomes. Earnings and EPS both missed out on. Its full-year profits advice was reduced and additionally missed out on assumptions. In general, this was a weak quarter. The supply traded down 12.9% to $5 instantly complying with the outcomes.

Concrete Pumping may have had a difficult quarter, however does that in fact produce a chance to spend today? When making that choice, it is necessary to consider its appraisal, organization top qualities, in addition to what has actually occurred in the most up to date quarter. We cover that in our actionable full research report which you can read here, it’s free.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.