Dogecoin’s (DOGE) current initiative to damage over the top line of its dropping wedge pattern was consulted with resistance from bears. The enhanced marketing stress pressed DOGE’s rate listed below its 20-day rapid relocating standard (EMA).

As purchasing stress reduces, Dogecoin might remain to relocate within this down network awhile much longer.

Dogecoin Vendors Protect Against Rally Above Upper Trendline

Analyses from DOGE’s one-day graph reveal that the meme coin has actually been trading within a dropping wedge pattern given that March. This pattern is created by 2 downward-sloping fad lines, where the top line serves as resistance and the reduced as assistance.

While the wedge relocates downward, it’s usually thought about a favorable pattern since, when finished, rates frequently damage over the top trendline, suggesting that customers have actually subdued vendors.

Nonetheless, DOGE’s dropping wedge has actually tightened over the previous couple of months, the failure to maintain a rally over the top fad line recommends considerable marketing stress at that degree. Its current rate decline listed below its 20-day EMA signals that bearish task controls the meme coin’s market as purchasing task plunges.

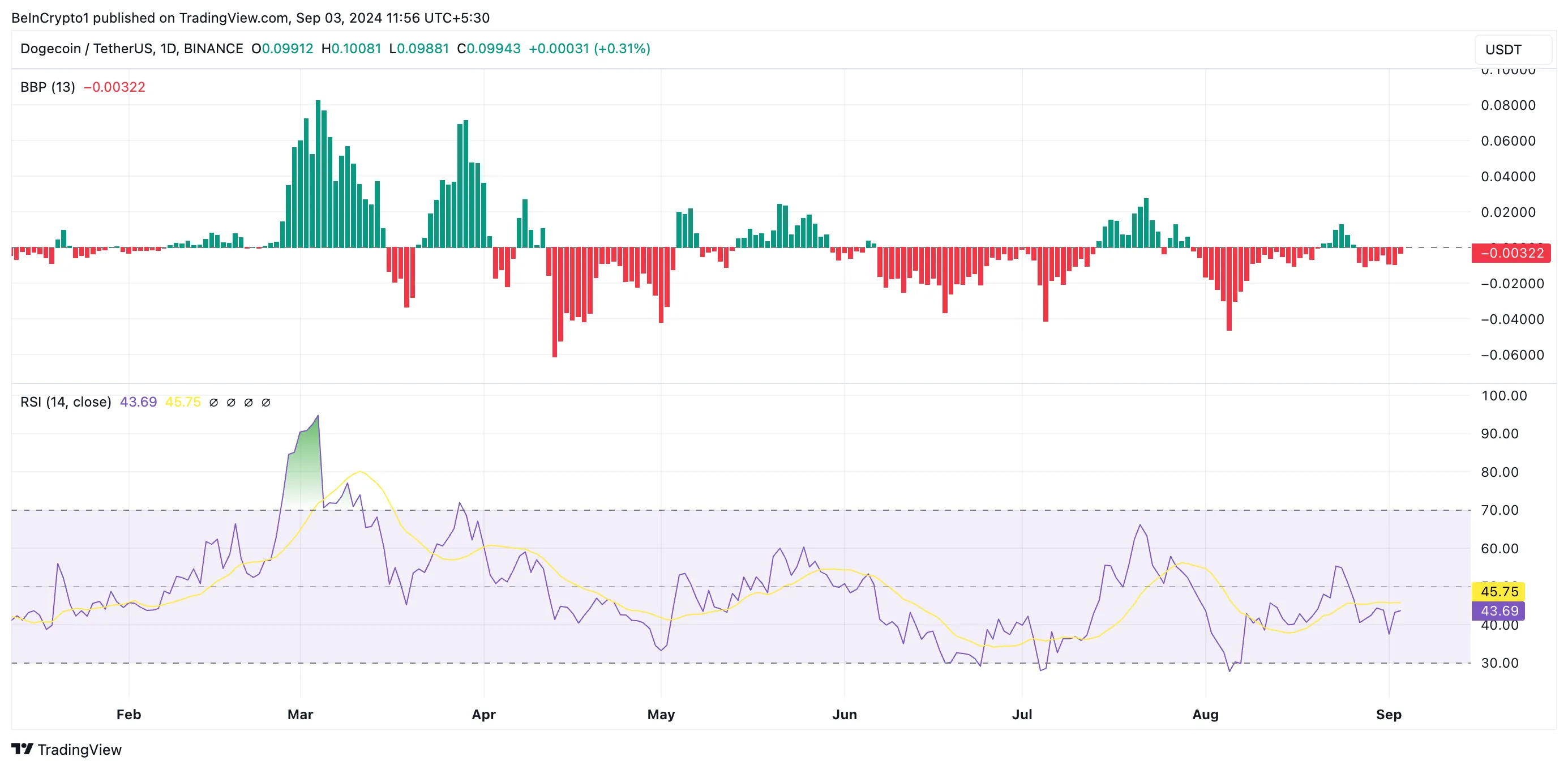

DOGE’s Elder-Ray Index sustains the bearish expectation, with an existing worth of -0.0032, suggesting that vendors are controling the marketplace. In addition, DOGE’s Family member Stamina Index (RSI) is listed below the neutral 50 mark, standing at 43.74, more signaling that marketing task outweighs purchasing in the DOGE market.

These indications highlight the solid bearish view, recommending that a rally over the top trendline of the dropping wedge pattern might be not likely in the close to term.

Learn More: Dogecoin (DOGE) Rate Forecast 2024/2025/2030

DOGE Rate Forecast: Futures Investors Stay Hopeful

In spite of DOGE’s rate difficulties, its futures investors have actually primarily required lengthy settings, as revealed by its constantly favorable financing prices. Financing prices maintain the rate of continuous futures agreements lined up with the area rate.

When they declare, there are a lot more lengthy settings than brief ones. This indicates that even more investors are opening up settings for a cost rally than those holding the coin in hopes of a decrease.

If DOGE witnesses a rise sought after that presses it over its 20-day EMA and past the top trendline of its dropping wedge pattern, it will certainly trade hands at $0.11. If the uptrend proceeds, it will rally towards $0.13.

Learn More: Dogecoin (DOGE) vs Shiba Inu (SHIB): What’s the Distinction?

Nonetheless, if marketing stress remains to place, the leading meme coin will certainly review its August 5 reduced of $0.08.

Please Note

According to the Depend on Task standards, this rate evaluation write-up is for informative functions just and ought to not be thought about monetary or financial investment suggestions. BeInCrypto is dedicated to exact, impartial coverage, yet market problems undergo transform without notification. Constantly perform your very own research study and speak with an expert prior to making any kind of monetary choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.